Best Foreign MNC Stocks to Invest in India

Introduction

Investing in the stock market has become an essential pathway to achieving financial freedom in today's world. However, it's crucial to adhere to basic investment principles, as venturing into the market without a solid understanding can lead to substantial risks.

With the advancements in technology, the world has evolved into a global marketplace. Now, you have the opportunity not only to purchase products from other countries but also to invest in the stocks of foreign companies. This expansion provides access to a wider range of investment opportunities.

In some instances, a local market may become stagnant or exhibit excessive volatility. When faced with such challenges, investing in the markets of other booming countries or in the stocks of large multinational corporations (MNCs) can be a strategic move. This approach allows you to diversify your portfolio by tapping into international markets that offer significant growth potential, thus enhancing your overall investment strategy.

Top 3 Best Foreign MNC Stocks Listed in India

|

Company Name |

Market Cap (in Cr) |

P/E Ratio |

Div Yield (%) |

|

8.27KCr |

38.68 |

2.01 |

|

|

57.05KCr |

47.5 |

1.53 |

|

|

2.44LCr |

- |

1.16 |

Overview of Top 3 Foreign MNC Stocks Listed in India

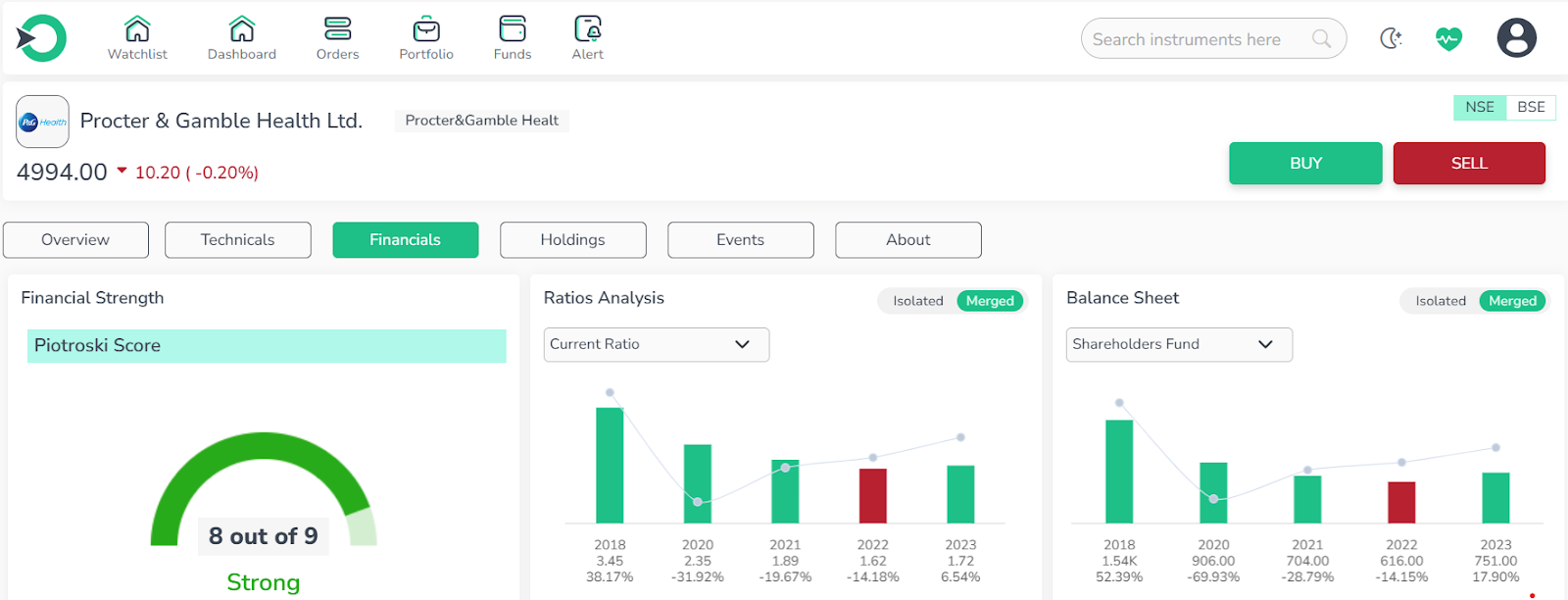

1.P&G Health Limited

Procter & Gamble Health Limited, based in India, specializes in producing pharmaceutical products. The company focuses on the manufacture and marketing of over-the-counter medications, as well as a variety of vitamins, minerals, and dietary supplements aimed at promoting a healthy lifestyle.

-

The stock appears to be overvalued compared to the market average.

-

Growth is low, trailing behind the market in financial metrics.

-

Profitability is high, indicating strong efficiency and profit margins.

-

The entry point is average; the stock is overpriced but not excessively so, staying out of the overbought zone.

Considering the analysis, Procter & Gamble Health Limited stands out as a leading foreign MNC stock listed in India. Despite being overvalued compared to the market average, the company demonstrates solid profitability and efficiency. While its growth metrics lag behind, its current valuation and performance position it as a noteworthy investment option for those seeking exposure to robust multinational corporations in the Indian market.

2. Abbott India Limited

Headquartered in Mumbai, Abbott India Limited is a publicly listed subsidiary of Abbott Laboratories. The company specializes in providing trusted pharmaceuticals across various therapeutic categories including women's health, gastroenterology, cardiology, metabolic disorders, and primary care. Abbott India is known for its commitment to delivering high-quality medicines in these specialized areas.

-

The stock has a high valuation and appears overvalued relative to the market average.

-

Growth is low, with financial performance lagging behind the market.

-

Profitability is high, demonstrating strong efficiency and profit margins.

-

The entry point is average; while the stock is overpriced, it is not in the overbought territory.

Abbott India Limited stands out as a top foreign MNC stock listed in India. Despite its high valuation and lower growth compared to the market, the company demonstrates strong profitability and efficiency. While the stock is overpriced, it remains within a reasonable entry point, making it a promising investment option in the Indian market.

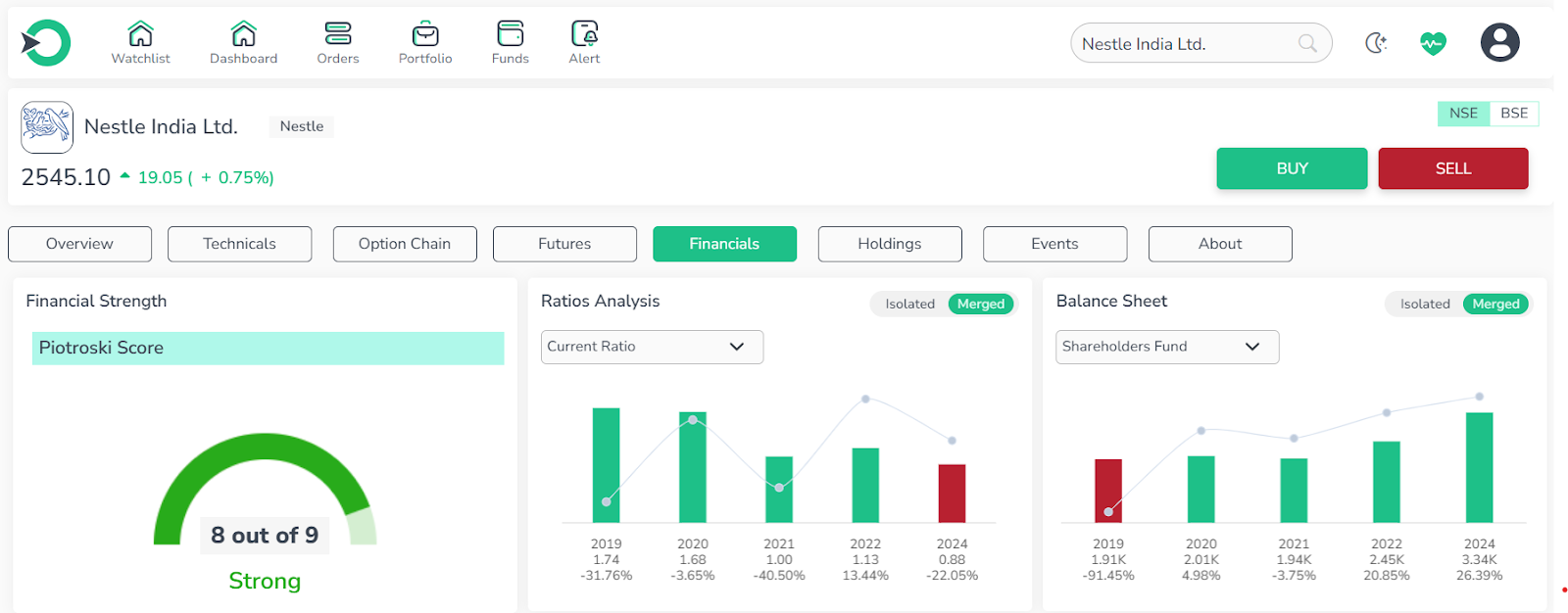

3. Nestle India Limited

Nestlé India Limited, headquartered in Gurgaon, Haryana, is the Indian subsidiary of the Swiss multinational company Nestlé. The company specializes in a wide range of products including food, beverages, chocolates, and confectioneries.

-

The stock is valued high and appears overvalued compared to the market average.

-

Growth is low, trailing behind in financial performance compared to the market.

-

Profitability is high, indicating strong efficiency and profitability.

-

The entry point is average, with the stock not reaching the overbought zone.

Nestlé India Ltd. stands out as a top foreign MNC stock listed in India. Despite its high valuation and slower growth compared to the market, the company demonstrates robust profitability and efficiency. With its stable entry point and strong market presence in food, beverages, chocolates, and confectioneries, Nestlé India Ltd. presents a compelling investment opportunity for those seeking stability and potential growth in the Indian market.

Comparison of Top 3 Foreign MNC Stocks

|

Metric |

Procter & Gamble Health Ltd |

Abbott India Limited |

Nestlé India Limited |

|

Revenue Growth (5-year CAGR) |

-5.05% |

10.13% |

10.75% |

|

Net Income Growth (5-year CAGR) |

-22.83% |

18.80% |

13.29% |

|

Market Share Change |

Decreased from 0.8% to 0.38% |

Increased from 1.68% to 1.7% |

Increased from 14.41% to 14.88% |

|

Debt to Equity Ratio |

- |

4.40% |

- |

|

Current Ratio |

- |

318.24% |

- |

|

Free Cash Flow Growth (5-year CAGR) |

- |

46.25% |

- |

Among the three companies, Abbott India Limited stands out with consistent growth in revenue and net income, surpassing industry averages. Nestlé India Limited also demonstrates strong revenue growth and an increase in market share, albeit slightly below industry net income growth. Procter & Gamble Health Ltd., however, faces challenges with declining revenue, net income, and market share over the past five years, performing below industry benchmarks in these critical metrics. Abbott India Limited emerges as a top performer in this comparative analysis, showing resilience and strong financial health in the Indian market.

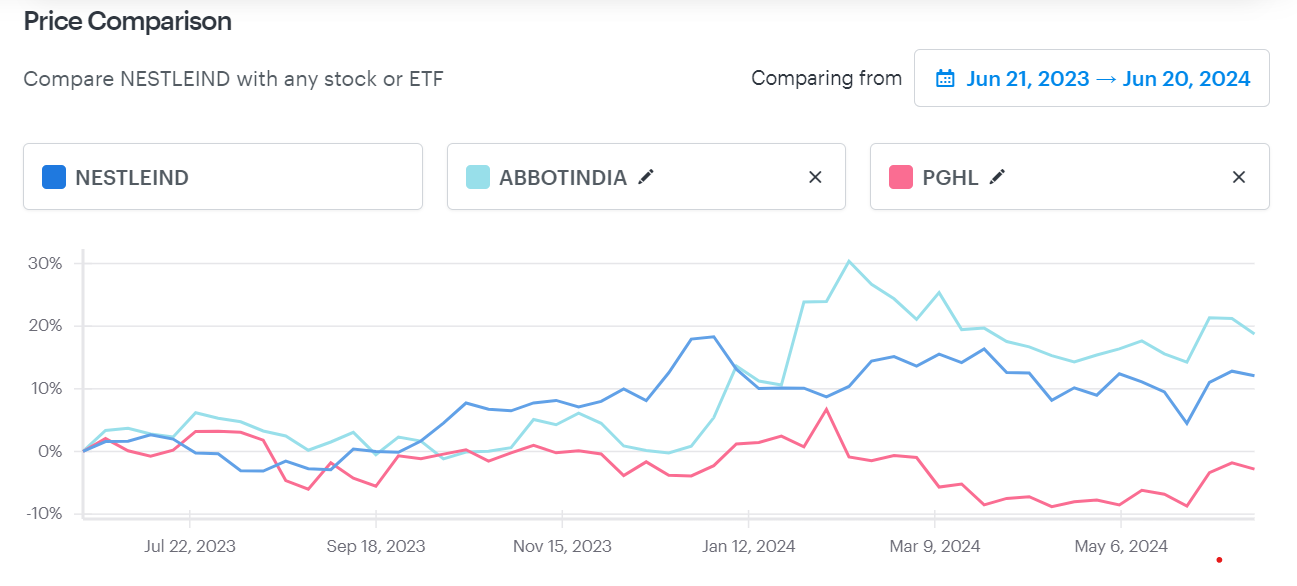

Snapshot of Price Comparision of Top Foreign MNC Stocks

How Can You Invest in Foreign Stocks?

Indian residents can invest in foreign stocks primarily through two routes: Overseas Direct Investment (ODI) and Overseas Portfolio Investment (OPI). This guide focuses on OPI, offering a detailed exploration of its advantages, disadvantages, regulatory requirements, and tax obligations.

-

Liberalized Remittance Scheme (LRS) as the Foundation

The Liberalized Remittance Scheme (LRS) allows Indian residents to remit up to $250,000 per financial year (April to March) for permissible investments, including both ODI and OPI. The LRS framework now clearly defines "Overseas Portfolio Investment" and sets the annual investment limit.

-

Investment in Shares of Listed Foreign Entities

Indian investors can buy shares in foreign companies listed on international stock exchanges, with the condition that their stake does not exceed 10% or grant them control. This enables investments in global giants like Amazon, Apple, Microsoft, and Tesla.

-

Exploring International Mutual Funds

For those hesitant about direct stock investments, international mutual funds offer a viable alternative. These funds invest in international equities, offering exposure to global markets while staying within the LRS limit and avoiding extra reporting requirements.

-

Investing in Listed Debt Instruments

Indian residents can also invest in foreign-listed bonds, including those issued by governments or corporations, to generate a steady income. Like equities, these investments fall under the LRS limit and require no additional reporting under the new regulations.

-

Special Cases: Inheritance and Gift

Indian residents acquiring foreign securities through inheritance or as gifts are not subject to the LRS limit. These cases do not require additional reporting, providing a flexible and straightforward approach to handling inherited or gifted foreign assets.

-

Unlocking Investment Potential in the International Financial Services Centre (IFSC)

Investments in entities within the IFSC, including equity and fund units, fall under the LRS limit and do not require additional reporting.

-

Navigating Sweat Equity Shares

Foreign entities may issue sweat equity shares to employees, allowing Indian residents to acquire up to 10% of the entity’s equity capital. These acquisitions fall under the LRS limit and offer a way for residents to gain ownership in foreign companies.

-

Employee Stock Ownership Plans (ESOPs)

Indian residents working for foreign companies can participate in ESOPs and Employee Benefits Schemes. The acquisition of shares or interests under these plans is capped at 10% of the company’s paid-up capital, with a requirement to report in Form OPI within 60 days.

Conclusion

In today's globalized economy, investing in foreign multinational corporation (MNC) stocks listed on Indian exchanges presents lucrative opportunities for investors. Companies like Abbott India Limited, Procter & Gamble Health Ltd., and Nestlé India Limited exemplify strong financial health, profitability, and market presence despite varying challenges and valuation considerations. These stocks not only offer diversification but also potential growth in sectors ranging from pharmaceuticals to consumer goods. With India's robust economic prospects and the ease of investing through platforms like the Liberalized Remittance Scheme (LRS), these foreign MNC stocks stand poised as compelling choices for investors seeking stable returns and long-term growth in the Indian market.

Diversify your investment portfolio with top-performing foreign MNC stocks like Abbott India, Procter & Gamble Health, and Nestlé India on Enrich Money trading platform, tapping into stable growth opportunities in India's dynamic market.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.

Related Stocks

Frequently Asked Questions

-

Can a Foreign Company be listed on the Indian Stock Market?

Yes, a foreign company can list on the Indian stock market through instruments like Indian Depository Receipts (IDRs). This enables foreign companies to secure funding and offer shares to Indian investors.

-

Why should I consider investing in foreign MNC stocks listed in India?

Investing in foreign MNC stocks listed in India provides diversification benefits by accessing global markets without the complexities of direct international investments. These stocks often bring stable growth, strong profitability, and exposure to sectors with significant growth potential.

-

What are the key benefits of investing in Abbott India, Procter & Gamble Health, and Nestlé India?

Abbott India, Procter & Gamble Health, and Nestlé India are renowned for their robust financial health, high profitability, and substantial market presence in India. They offer stability, potential growth, and exposure to sectors like pharmaceuticals, healthcare, and consumer goods.

-

How can Indian residents invest in foreign MNC stocks listed on Indian exchanges?

Indian residents can invest in foreign MNC stocks through Overseas Portfolio Investment (OPI), where they can buy shares of these companies listed on Indian stock exchanges. This route provides a convenient way to diversify portfolios with global giants.

-

What are the risks associated with investing in foreign MNC stocks in India?

Like any investment, foreign MNC stocks in India carry risks such as currency fluctuations, geopolitical factors, regulatory changes, and market volatility.