Investing in Cybersecurity: Comparing the Top 3 Indian Stocks for 2025

Introduction

In our increasingly digital world, cybersecurity has emerged as a top priority for individuals, corporations, and government bodies.With the rising threat of data breaches, cyberattacks, and digital espionage, the importance of implementing strong cybersecurity measures has never been greater than it is today.. This growing demand is fueling rapid expansion in the cybersecurity sector, positioning it as one of the most promising areas for investment. In India, several companies are leading the charge, delivering cutting-edge technologies and services that safeguard digital infrastructure. This article explores the top cybersecurity stocks in India, comparing their performance, market presence, and role in strengthening the nation’s digital resilience. As dependency on technology deepens, these firms not only offer essential protection but also present compelling investment opportunities.

Understanding Cybersecurity Stocks

Cybersecurity stocks refer to the equity shares of companies dedicated to safeguarding digital infrastructure—ranging from computer systems and networks to sensitive data—from malicious attacks. As digital transformation accelerates across industries, the demand for strong cybersecurity has surged, bringing increased attention to these stocks.

With cyber threats becoming more frequent and sophisticated, many businesses are ramping up their security efforts. This shift has positioned cybersecurity firms for significant growth, making their stocks an appealing choice for investors seeking exposure to one of the most vital and fast-evolving areas within the tech sector.

Top 5 Cybersecurity Stocks Worth Investing In

The following table highlights a selection of cybersecurity stocks ranked by their average net profit margin over the past five years.

|

Company |

5-Year Avg. Net Profit Margin (%) |

|

20.75 |

|

|

17.26 |

|

|

12.75 |

|

|

-33.6 |

|

|

-39.57 |

Overview of Top Three Cybersecurity Stocks

Sasken Technologies Ltd

Founded in 1989, Sasken is a leading provider of Product Engineering and Digital Transformation services, offering end-to-end R&D solutions from concept to deployment.

Sasken Technologies is considered a promising cybersecurity stock for 2025 due to its zero debt, a return on equity (ROE) of 11.41%, and a dividend yield of 1.71% with a payout of Rs. 25.It also reflects a solid current ratio of 1.20, suggesting good short-term liquidity.The company maintains a strong earnings profile with an EPS of Rs. 32.24. However, there are concerns—its price-to-earnings (PE) ratio stands at 45.74, suggesting overvaluation. Additionally, the company posted negative sales growth of -4.66%, a low return on assets (ROA) of 10.01%, and an operating margin of just 6.08%, which may limit its profitability potential.

In short, Sasken Technologies stands out as one of the top cybersecurity stocks to watch in 2025, backed by solid financial indicators and a strong market presence. With a current share price of Rs. 1,474.60 and a zero debt-to-equity ratio, Sasken shows financial discipline and low risk. Despite a slightly high PE ratio of 45.74 and modest revenue growth, it maintains a decent Return on Equity (11.41%) and consistent dividend payouts. These factors position Sasken as a compelling choice for investors seeking exposure to India’s growing cybersecurity sector.

Quick Heal Technologies Ltd

Quick Heal Technologies focuses on creating cybersecurity software solutions that cater to clients in both the Indian and international markets.

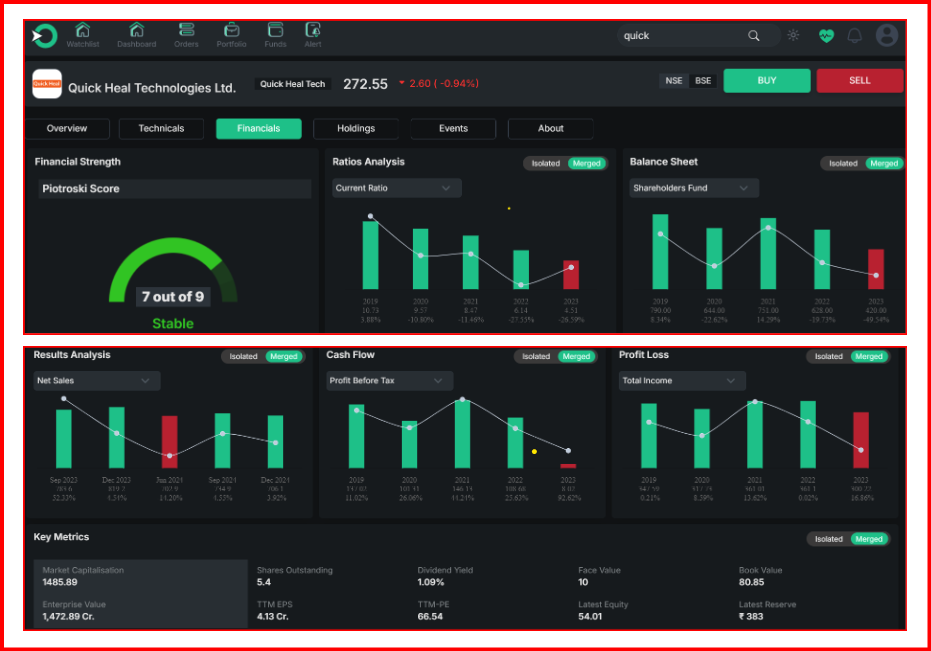

Quick Heal Technologies, currently trading at Rs. 272.55, is a prominent player in the cybersecurity software domain. Its strong financial structure is reflected in a zero debt-to-equity ratio, indicating a debt-free balance sheet, and a current ratio of 4.95, showcasing excellent short-term liquidity. The company also provides a dividend yield of 1.10%, with a payout of ?3, making it attractive to investors seeking regular income.

However, there are a few concerns. The PE ratio is currently at 66.07, indicating that the stock might be priced higher than its earnings would justify. Its Return on Assets (ROA) is 4.80% and Return on Equity (ROE) is 5.75%, both relatively modest figures that indicate limited profitability. The company has reported a revenue growth of 4.90% and an operating margin of 5.96%, reflecting underwhelming efficiency and growth potential. The Earnings Per Share (EPS) is Rs. 4.13, which remains moderate.

Despite moderate growth metrics, Quick Heal Technologies stands out as one of the top cybersecurity stocks in India due to its solid balance sheet, consistent dividends, and market presence.

Expleo Solutions Ltd

Expleo Solutions Ltd is an Indian IT services company that specializes in providing software testing, validation, and verification solutions, particularly to clients in the global BFSI sector.`

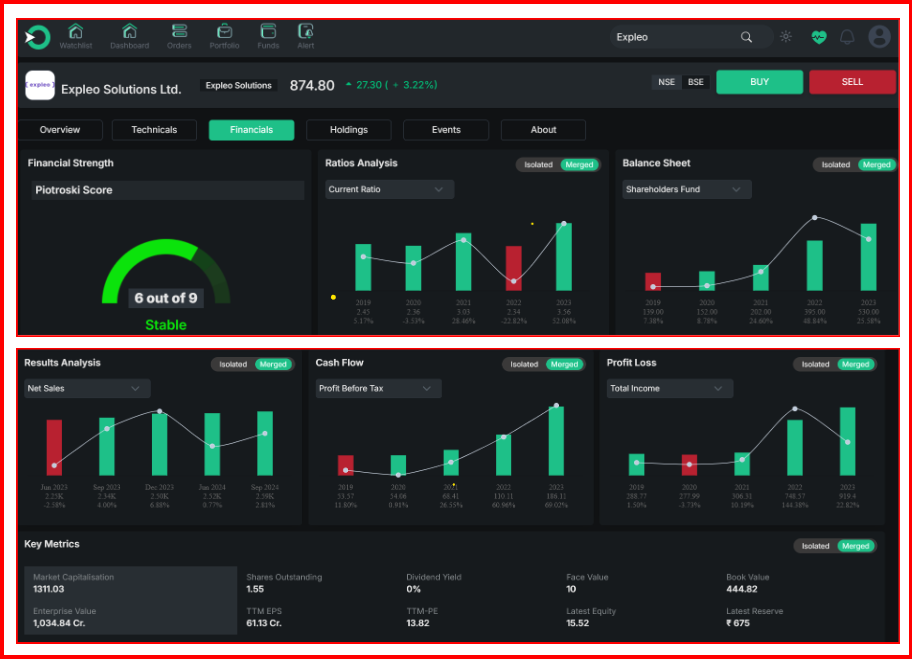

Expleo Solutions reflects strong financial performance with a notable Return on Equity (ROE) of 15.93%, highlighting its efficiency in generating profits. Its current ratio of 5.18 reflects excellent liquidity, while a zero debt-to-equity ratio shows it operates without financial leverage, reducing risk. The operating margin of 14.51% highlights solid cost management, and an EPS of Rs 51.50 suggests healthy per-share earnings.

Despite its strengths, Expleo Solutions has a relatively high PE ratio of 15.84, signaling potential overvaluation. Its ROA of 12.22% points to less-than-optimal asset use. The sales growth of 6.82% is modest, and the dividend yield of 0% may not appeal to income-focused investors.

Expleo Solutions stands out for its strong profitability, debt-free structure, and solid operational efficiency. While growth and dividend returns are limited, its financial stability makes it a promising pick among cybersecurity stocks for long-term investors.

Cybersecurity Stocks – 5-Year Financial Comparison

|

Parameter |

Sasken Technologies Ltd |

Quick Heal Technologies Ltd |

Expleo Solutions Ltd |

|

Revenue Growth (5-Year CAGR) |

-2.81% (vs industry avg 14.21%) |

-2.07% (vs industry avg 11.49%) |

27.48% (vs industry avg 14.21%) |

|

Market Share (5-Year Change) |

1.68% → 0.73% |

0.07% → 0.04% |

0.88% → 1.49% |

|

Net Income Growth (5-Year CAGR) |

-2.73% (vs industry avg 16.51%) |

-23.39% (vs industry avg 9.27%) |

20.10% (vs industry avg 16.51%) |

|

Debt-to-Equity Ratio (5-Year Avg) |

0.46% (vs industry avg 13.36%) |

Not provided |

3.24% (vs industry avg 13.36%) |

|

Current Ratio (5-Year Avg) |

200.62% (vs industry avg 231.24%) |

675.02% (vs industry avg 220.78%) |

381.42% (vs industry avg 231.24%) |

|

Free Cash Flow Growth (5-Year CAGR) |

36.31% (vs industry avg 22.92%) |

-26.79% (vs industry avg 14.14%) |

6.27% (vs industry avg 22.92%) |

Essential Considerations for Investing in Cybersecurity Stocks in India

Investing in cybersecurity stocks demands a solid grasp of the key market dynamics driving the industry’s growth and transformation. The growing demand for digital protection, driven by rising cyber threats and regulatory pressures, makes this sector a promising opportunity.

Keeping an eye on market trends helps identify companies focused on high-demand areas like cloud security and AI-driven solutions. Evaluating a firm's financial health—including revenue growth and debt levels—ensures you're backing a stable, scalable business.

Technological innovation is vital, as companies that invest in R&D stay competitive by offering advanced threat protection. Strategic partnerships with tech leaders or government bodies enhance a company's market reach and trust. Lastly, strong regulatory compliance boosts client confidence and reduces legal risks, both of which support long-term success.

Who Should Invest in Cybersecurity Stocks?

Cybersecurity stocks are ideal for tech-savvy investors seeking exposure to a rapidly growing industry. With the rise of cyber threats, these stocks also appeal to those looking to protect digital assets. Businesses, governments, and organizations aiming to secure their infrastructure can benefit from these investments. Additionally, long-term investors focused on growth and diversification in an interconnected world should consider adding cybersecurity companies to their portfolios.

Benefits of Investing in Cybersecurity Stocks

Investing in cybersecurity stocks offers several key benefits. The increasing sophistication of cyber threats drives growth potential for cybersecurity companies. The industry's ongoing long-term growth is fueled by digital transformation.

Cybersecurity firms lead in innovation, offering advanced solutions in threat detection and data protection. Investing in these stocks allows for diversification, spreading risk across sectors. Additionally, the sector’s potential for mergers and acquisitions and tightening data privacy regulations enhances their growth potential.

How To Invest In Cybersecurity Stocks?

To invest in cybersecurity stocks, start by exploring companies offering cutting-edge security solutions, assessing their financial strength, and tracking evolving market trends.Begin by setting up an account with a brokerage such as Enrich Money, offering access to a diverse selection of stocks. To mitigate risk while capitalizing on the expanding cybersecurity market, diversify your portfolio by including both established industry leaders and emerging companies.

How Market Trends Influence Cybersecurity Stocks

Market trends play a crucial role in shaping the demand for cybersecurity stocks. As cyber threats grow, organizations focus more on security solutions, boosting revenue for cybersecurity firms.

Trends like remote work and cloud adoption create new risks, driving further investment in cybersecurity technologies. Companies that adapt to these changes often experience strong growth.

Moreover, shifting regulatory frameworks and heightened awareness around data privacy are reinforcing the cybersecurity market’s growth. Investors focused on long-term gains recognize cybersecurity as a key sector for their portfolios.

Performance of Cybersecurity Stocks in Unstable Markets

In unpredictable market conditions, investors frequently evaluate how well cybersecurity stocks can withstand fluctuations. With the growing dependence on digital infrastructure and rising cyber threats, many see cybersecurity companies as relatively stable.

During market fluctuations, these stocks can either prosper or face challenges, depending on factors like investor sentiment, company performance, and broader market trends. Understanding these dynamics allows investors to make better decisions regarding their portfolio allocations in uncertain times.

Risks of Investing in Cybersecurity Stocks

Investing in cybersecurity stocks carries several risks. The rapid evolution of cyber threats can render existing solutions obsolete, leading to potential losses if investors don’t stay updated with technological advancements.

The competitive market is another risk, as numerous players may drive down margins, impacting profitability. Regulatory changes can also increase costs and disrupt operations, affecting business models.

Technological obsolescence poses a threat if companies fail to innovate, leading to a loss of clients and market share. Additionally, reputation damage from a data breach can severely impact stock prices and long-term growth. Lastly, economic sensitivity means cybersecurity spending can be cut during downturns, affecting revenue.

Conclusion

India’s cybersecurity sector is gaining momentum as the digital landscape expands and cyber threats become more complex. Among the leading contenders, Sasken Technologies, Quick Heal Technologies, and Expleo Solutions stand out with strong fundamentals and strategic positioning. While each has its own strengths and limitations, they collectively highlight the sector’s immense potential for long-term growth and innovation. As digital security becomes a necessity across industries, investing in the right cybersecurity stocks could be a strategic move for forward-looking investors.

Start your investment journey with confidence on the Enrich Money platform. Discover leading cybersecurity stocks and enhance your trading strategy with Enrich Money today.

Frequently Asked Questions

-

What are cybersecurity stocks?

Cybersecurity stocks are shares of companies that provide digital protection services, like threat detection, data security, and network defense.

-

Why should I consider investing in cybersecurity stocks in India?

India’s rising digital adoption and growing cyber threats are driving strong demand for cybersecurity solutions, making it a promising sector for investors.

-

Are cybersecurity stocks safe during market volatility?

While no investment is risk-free, cybersecurity stocks often show resilience due to the essential nature of digital security in all market conditions.

-

What should I look for before investing in a cybersecurity stock?

Focus on the company’s financial health, innovation in security solutions, market presence, and how well it adapts to evolving cyber risks.

-

How can I invest in top cybersecurity stocks easily?

You can start investing in India’s top cybersecurity stocks through Enrich Money, a smart platform offering tools, insights, and access to leading tech-driven shares.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.