E-Commerce Stocks in India to Invest in 2025: A Comprehensive Guide

E-commerce, the digital marketplace for buying and selling goods, is witnessing explosive growth in India. With widespread internet access and increasing smartphone penetration, online shopping has become a norm across the country. India’s e-commerce market, valued at $125 billion in 2024, is on track to triple and reach an impressive $345 billion by 2030.

What’s driving this surge? A significant push is coming from tier 2 and tier 3 cities, which contributed 56% to e-commerce activity in FY24—a number expected to climb to 64% by 2030. Boosting the sector’s outlook, the 2025 Union Budget has proposed making annual incomes up to Rs. 12 lakh tax-exempt starting FY26—a move expected to increase disposable income and drive higher consumer spending in the online retail space.

With this booming landscape, let’s explore some of the top e-commerce stocks in India that are well-positioned to benefit from this upward trend.

What Are E-Commerce Stocks?

E-commerce stocks are shares of companies that operate within the online retail and digital commerce space. These businesses range from direct-to-consumer retailers and online marketplaces to tech-driven platforms that power online transactions—each playing a vital role in India’s fast-evolving digital economy.

By investing in e-commerce stocks, individuals can tap into the rapid growth of online shopping. As more consumers turn to digital platforms for convenience and variety, these stocks offer strong potential for returns. However, like any sector, they carry risks influenced by market trends, competition, and changing consumer behavior.

Features of Top E-Commerce Stocks in India

The features of top e-commerce stocks in India include strong financial growth, wide market reach, and continuous tech innovation. These companies show consistent revenue growth, often fueled by their ability to serve both urban and rural markets.

They invest in advanced technologies like AI and data analytics to improve user experience and streamline operations. A diverse product range across categories and strategic partnerships with logistics and fintech players also set them apart.

Together, these features make them well-positioned to benefit from India’s booming digital economy.

Government Policies and Economic Trends: Their Impact on Top E-Commerce Stocks in India

The performance of top e-commerce stocks in India is deeply influenced by both government policies and broader economic conditions. Regulatory frameworks such as foreign direct investment (FDI) rules shape how major players like Amazon and Flipkart operate in the country. At the same time, evolving data privacy and protection laws compel companies to strengthen data security and compliance, increasing operational costs but also building consumer trust—an essential asset in the digital marketplace.

Taxation policies, including the Goods and Services Tax (GST) and e-commerce-specific levies, further affect the profitability of these companies. While stringent regulations can tighten margins, favourable policy shifts often enhance investor confidence and support stock price growth.

In addition to regulatory influence, economic cycles play a key role in shaping stock performance. During downturns, e-commerce companies dealing in discretionary goods may face declining sales due to reduced consumer spending. However, those focused on essential categories—such as groceries and household necessities—can see stable or even rising demand. Companies that adapt quickly to changing consumption patterns are more likely to sustain growth and protect shareholder value, even in challenging market environments.

The Role of E-Commerce Stocks in Driving India’s Economic Growth

E-commerce stocks are becoming a key contributor to India’s GDP, driving the country’s digital transformation and fueling retail growth. As internet access and mobile usage continue to rise, more consumers are embracing online shopping, creating a ripple effect across various sectors and generating significant economic activity.

E-commerce growth is spilling over into industries far beyond traditional retail.It also positively impacts industries like logistics, digital payments, and technology, which further strengthens India’s economic landscape. With its continued expansion, e-commerce is playing an essential role in shaping a modern, digital economy in India.

Leading E-Commerce Stocks in India Ranked by Market Capitalisation

|

Stock Name |

Market Cap (Rs. Cr) |

|

2.13LCr |

|

|

78.44KCr |

|

|

56.10KCr |

|

|

Brainbees Solutions Ltd |

16.63KCr |

|

13.89KCr |

|

|

7.84KCr |

|

|

3.69KCr |

|

|

Sat Kartar Shopping Ltd |

244 Cr. |

|

Enfuse Solutions Ltd |

213 Cr |

|

Macobs Technologies Ltd |

163 Cr |

Detailed Overview of Top E-Commerce Stocks in India by Market Cap

-

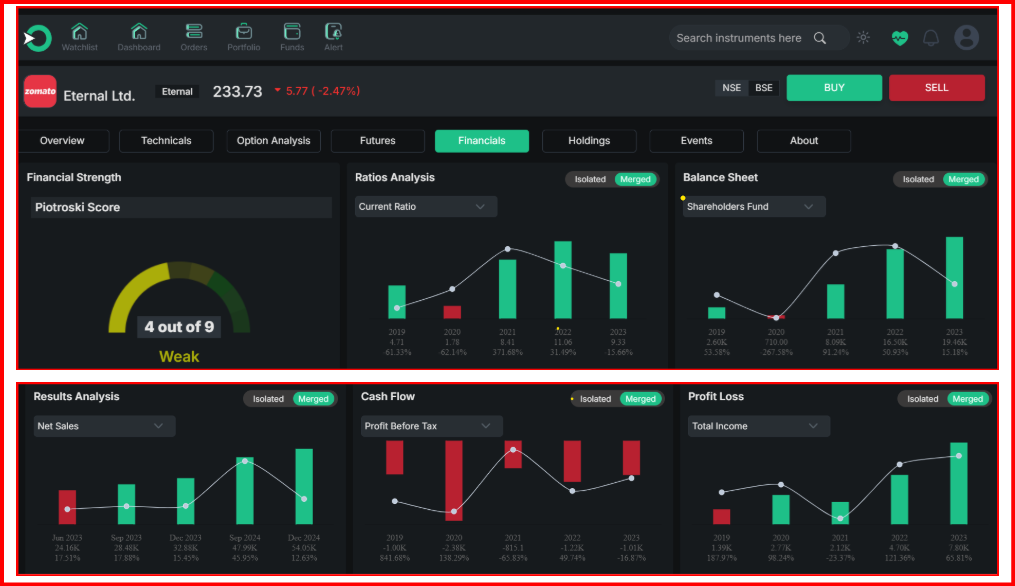

Eternal Ltd

Eternal Ltd is a prominent player in India’s fast-growing e-commerce sector, offering a wide range of digital retail solutions. Known for its rapid expansion and tech-driven operations, the company is steadily gaining investor attention.

It has posted a robust profit growth of 52.51% and revenue growth of 56.92% over the past three years. The company is virtually debt-free, with an excellent interest coverage ratio of 77.22 and a strong current ratio of 2.54, reflecting solid liquidity. An efficient cash conversion cycle of 3.61 days, a low PEG ratio of 0.11, and high operating leverage of 8.90 further strengthen its financial position.

On the downside, Eternal Ltd shows a poor ROE of -0.76% and ROCE of -0.55% over the last three years. It also has a low tax rate of 0.07% and a weak EBITDA margin of -32.98% over five years. Valuation-wise, the stock trades at a high PE of 115.35 and EV/EBITDA of 96.66.

In summary, Eternal Ltd combines strong growth and operational efficiency, though improving its profitability and valuation metrics will be key for long-term investor confidence.

-

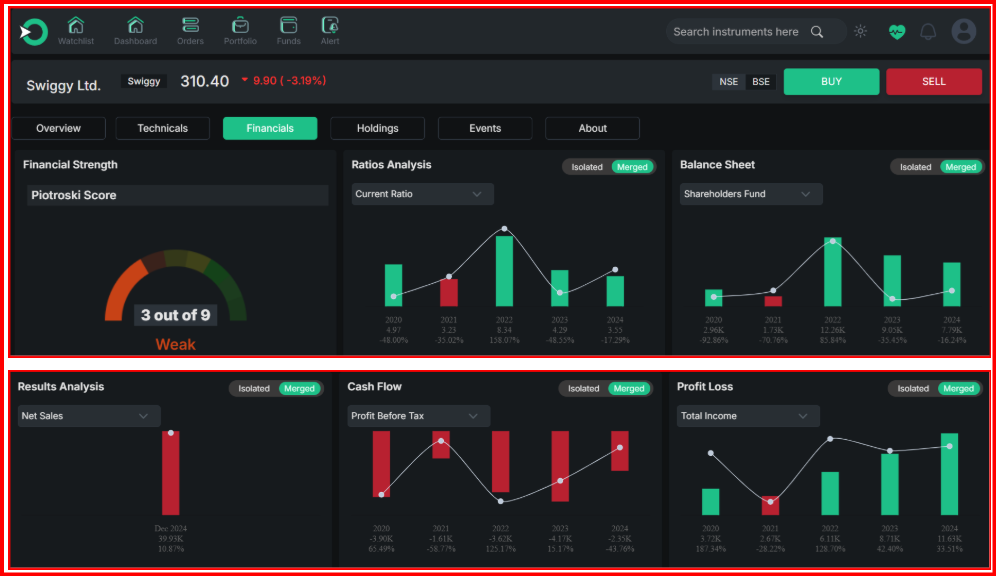

Swiggy Ltd

Swiggy Ltd is a leading name in India’s online food delivery and quick commerce space, playing a crucial role in transforming urban consumer habits. As one of the most recognisable e-commerce brands, the company continues to expand its footprint across major cities.

Swiggy has shown a strong revenue growth of 46.95% over the past three years, indicating increasing demand for its services. It is virtually debt-free, with a solid current ratio of 3.55, reflecting strong short-term liquidity. Notably, the company operates with an exceptionally efficient cash conversion cycle of -4,035.17 days, which highlights its ability to collect revenue well before payments are due.

However, Swiggy faces notable financial challenges. It has recorded a poor profit growth of -17.44% in the last three years and shows a ROE of 0% and ROCE of -34.38%, indicating inefficiencies in capital usage. The company also reports negative cash flow from operations of -1,408.80, a low EBITDA margin of -74.11%, and a negative book value, all pointing to ongoing profitability issues.

In summary, while Swiggy demonstrates strong revenue growth and efficient operations, its weak profitability and negative returns signal a need for substantial financial improvement to assure long-term investor confidence.

-

FSN E-Commerce Ventures Ltd

FSN E-Commerce Ventures Ltd, the parent company of the popular beauty and lifestyle platform Nykaa, is one of India’s most recognized e-commerce brands. With a focus on curated product offerings and a tech-driven retail experience, the company has carved a niche in the online personal care and fashion segments.

Over the past three years, FSN has delivered impressive profit growth of 47.91% and revenue growth of 20.94%, backed by efficient operations.The company has negligible debt and a strong 4.09 current ratio, reflecting healthy liquidity. A high promoter holding of 52.16% further reflects strong backing and confidence from its leadership.

However, the company’s financials show areas of concern. It has a modest ROE of 7.16%, contingent liabilities of Rs. 814.66 Cr, and negative operational cash flow of Rs. -31.19 Cr. Additionally, its tax rate is unusually low at -30.12%, and its EBITDA margin stands at -7.59% over the past five years. From a valuation standpoint, the stock appears expensive, trading at a PE of 329.30 and EV/EBITDA of 376.52.

In conclusion, FSN E-Commerce Ventures Ltd combines strong growth and operational stability with a dominant market presence, but investors should be cautious of its valuation and profitability metrics.

Financial Overview of Leading E-Commerce Stocks: Eternal Ltd, Swiggy Ltd, and Nykaa (FY24 & 9MFY25)

|

Particulars (Rs. crores / %) |

Eternal Ltd |

Swiggy Ltd |

FSN E-Commerce Ventures |

|

Market Capitalisation (Apr 11, 2025) |

Rs. 2,09,509 Cr |

Rs. 76,414 Cr |

Rs. 51,452 Cr |

|

Sales – FY24 |

Rs. 12,114 Cr |

Rs. 11,247 Cr |

Rs. 6,386 Cr |

|

Profit After Tax – FY24 |

Rs. 351 Cr |

Rs. -2,350 Cr |

Rs. 40 Cr |

|

Sales – 9MFY25 |

Rs. 14,410 Cr |

Rs. 10,816 Cr |

Rs. 5,888 Cr |

|

Profit After Tax – 9MFY25 |

Rs. 488 Cr |

Rs. -2,036 Cr |

Rs. 53 Cr |

|

Return on Equity (ROE) |

1.12% |

N/A |

2.44% |

|

1-Year Stock Return |

7.36% |

N/A |

-0.81% |

Factors to Consider When Investing in E-Commerce Stocks in India

Key factors to consider when investing in e-commerce stocks in India include the sector’s growth potential, a company’s financial strength, and its competitive edge. Strong revenue, profit margins, and cash flow signal long-term stability.

Investors should also assess how well the company adopts new technologies like AI and automation to enhance operations. Understanding regulations around FDI and data privacy is equally important, as is evaluating the stock’s valuation to avoid overpaying.

How to Invest in E-Commerce Company Stocks in India?

To invest in e-commerce company stocks in India, begin by researching the financial performance and growth potential of leading e-commerce firms. Next, register with a trusted platform like Enrich Money, known for its seamless interface and powerful trading tools. Open your trading and demat account, complete the KYC process, and you're ready to start building your e-commerce stock portfolio with ease.

Advantages of Investing in E-Commerce Stocks

Investing in e-commerce stocks offers strong growth potential, driven by the global shift towards online shopping. These companies benefit from access to international markets, advanced technologies like AI and big data, and consumer demand for convenience. Additionally, e-commerce businesses generate diverse revenue streams from sales, advertising, and subscriptions, providing stability and reducing risk for investors. With these advantages, e-commerce stocks offer attractive long-term investment opportunities.

Risks of Investing in E-Commerce Stocks

Investing in e-commerce stocks comes with risks like market volatility, as companies are sensitive to economic shifts, consumer behavior changes, and competition. Regulatory challenges, such as evolving policies on data privacy and taxation, can affect operations and profitability.Fierce competition may result in price wars, ultimately tightening profit margins. Technological disruptions require constant innovation, and failing to keep up can harm business models. Supply chain issues, caused by events like natural disasters or geopolitical tensions, can lead to delays and higher costs. Additionally, cybersecurity threats pose significant risks, with breaches potentially damaging consumer trust and causing financial losses.

Conclusion:

India’s e-commerce sector is on a strong upward trajectory, fueled by digital adoption, government support, and rising consumer demand. The stocks highlighted here represent key players positioned to benefit from this growth in 2025 and beyond. For investors, e-commerce stocks offer a compelling opportunity to tap into the future of retail and digital innovation in India.

Frequently Asked Questions

-

What Are E-Commerce Stocks?

E-commerce stocks are shares of companies that engage in online retail and digital trade, enabling the buying and selling of goods and services through the internet. These companies include online marketplaces, retailers, and technology platforms supporting digital commerce. Investing in e-commerce stocks allows investors to benefit from the growing trend of online shopping.

-

Is It Safe To Invest In E-Commerce Stocks?

While e-commerce stocks offer high growth potential, they come with risks such as market volatility, regulatory changes, and competition. Investors should evaluate their risk tolerance before investing in these stocks.

-

How To Invest In E-Commerce Stocks?

To invest in e-commerce stocks, research companies with strong market presence and growth prospects. Use a reliable brokerage platform like Enrich Money for trading.

-

Is E-commerce in India Profitable?

E-commerce in India is becoming more profitable, fueled by the growing use of the internet and rising consumer demand.While profitability varies by business model, the overall sector continues to see strong growth despite challenges like competition and regulations.

-

What Is The Future Of Indian E-Commerce?

The future of Indian e-commerce looks promising, with continuous growth fueled by rising internet penetration, mobile usage, and digital payments. Innovations like AI, improved logistics, and supportive government policies will further boost the sector's economic contribution.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.