Top 3 Silver Stocks in India to Watch for 2025

Introduction

Silver, a precious metal valued for its rarity, has seen a growing demand in India among investors seeking portfolio diversification. Silver stocks typically include companies that are directly involved in activities such as silver mining, refining, or production. Silver stock prices in India are influenced by factors such as global demand and supply dynamics as well as prevailing economic conditions. Investing in leading silver stocks presents a promising chance to benefit from the sector's growth potential. This blog will feature India's top silver stocks, discussing their significance and investment potential.

Understanding Silver Stocks

Investing in silver stocks allows you to gain exposure to companies involved in the silver industry. There are two main types: physical silver shares, representing partial ownership of actual silver, and Silver mining. In India, silver stock prices are influenced by supply, demand, and various economic factors affecting the silver market. While investing in silver shares can provide exposure to potential capital gains if silver prices rise, it also carries risks if prices fall.

To mitigate risks, investors should thoroughly research companies before purchasing silver mining or physical silver shares. Investing in leading silver stocks in India, when approached with a thorough evaluation, can offer a valuable opportunity for diversifying your portfolio.

Top Three Silver Stocks to Watch in 2025 in India

Here’s a List of the top silver stocks in India, including their share prices and market capitalizations:

|

Company |

Share Price (in INR) |

Market Capitalisation (in Billion INR) |

|

160.88 |

1.75KCr |

|

|

454 |

1.69LCr |

|

|

668 |

2.73LCr |

Overview of Top 3 Silver Stocks to Watch in 2025

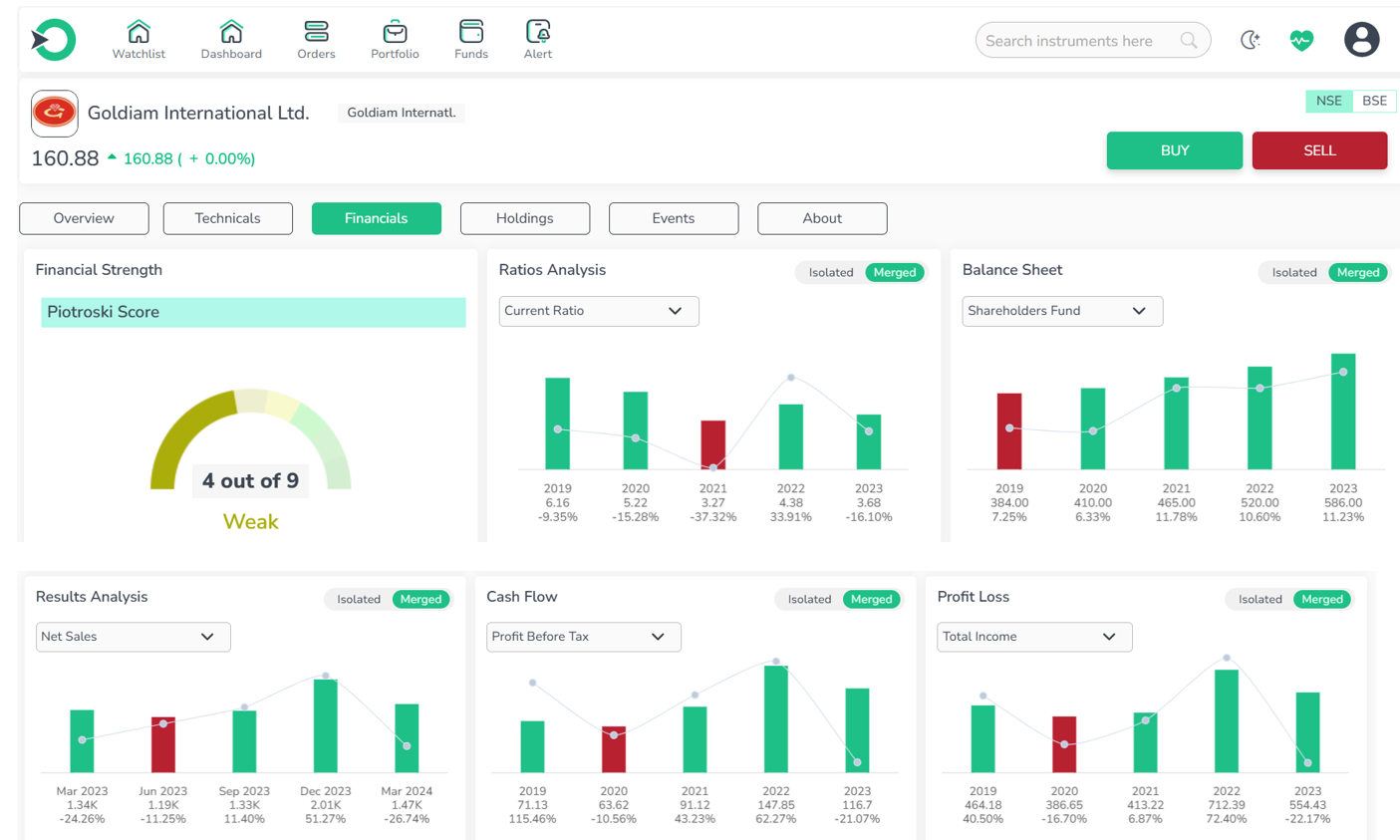

1. Goldiam International Ltd

Goldiam International Limited focuses on manufacturing and selling diamond-studded jewelry made from gold and silver in the Indian market.The company operates through two distinct segments: Jewelry Manufacturing Activity and Investment Activity.

-

Performance: The average price return has been moderate, lacking significant excitement.

-

Valuation: The stock seems overvalued compared to the market average.

-

Growth: Financial growth metrics indicate the company is trailing behind the market.

-

Profitability: There are clear indicators of profitability and operational efficiency.

-

Entry Point: The current stock price suggests it is underpriced and not in the overbought zone, potentially making it a good entry opportunity.

Goldiam International Ltd. shows promising performance metrics, including moderate price returns and strong profitability indicators. Despite its higher valuation relative to market averages, its current underpriced status presents an appealing entry opportunity for investors looking at silver stocks.

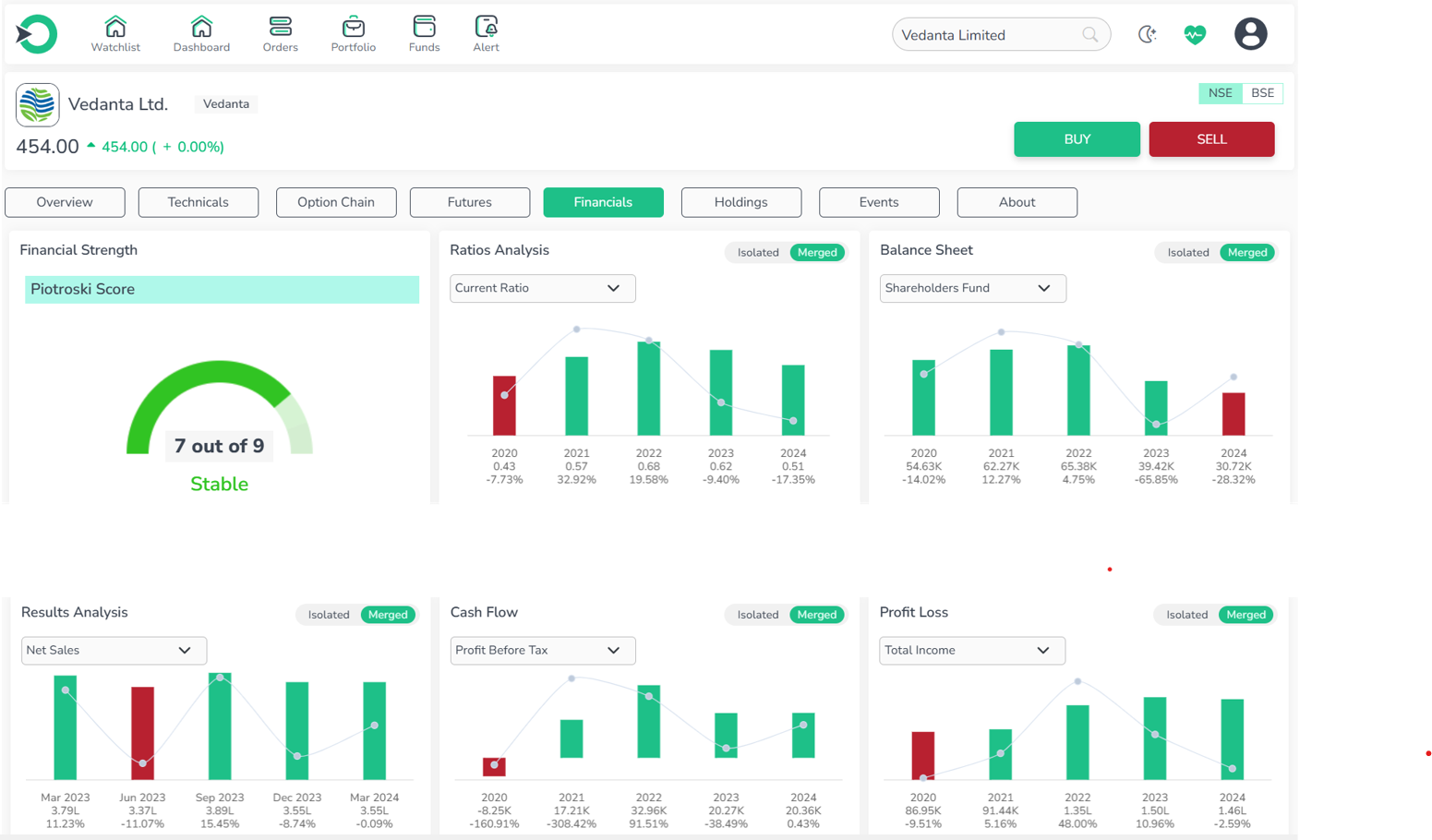

2. Vedanta Resources Ltd

Vedanta Limited is an India-based company engaged in a diverse range of natural resource operations.The company is involved in the exploration, development, extraction, production, processing, and sale of diverse commodities such as oil and gas, zinc, lead, silver, copper, aluminum, iron ore, steel, pig iron, and metallurgical coke.

-

Performance: The company has performed poorly, ranking among the low performers in its sector.

-

Valuation: Vedanta Limited appears to be overvalued compared to the market average.

-

Growth: Financial growth metrics indicate that the company is trailing behind the market.

-

Profitability: There are positive signs of profitability and operational efficiency within the company.

-

Entry Point: The current stock price suggests it is underpriced and not in the overbought zone, potentially offering a favorable entry point for investors.

Vedanta Limited stands out as a leading contender in the silver stocks sector, demonstrating strong indicators of profitability and operational efficiency. Despite its current overvaluation relative to the market average, its potential as a top performer and favorable entry point make it an attractive choice for investors interested in silver stocks.

3. Hindustan Zinc Ltd

Hindustan Zinc Limited is involved in mineral exploration, extraction, and processing activities throughout India, Asia, and on a global scale.The company operates through segments including Zinc, Lead, Silver & Others, and Wind Energy.

-

Performance: The price return has been average, without any notable excitement.

-

Valuation: Hindustan Zinc Limited appears overvalued compared to the market average.

-

Growth: Financial growth metrics indicate that the company is lagging behind the market.

-

Profitability: There are positive indicators of profitability and operational efficiency.

-

Entry Point: The current stock price suggests it is overpriced and in the overbought zone, presenting a less favorable entry point for investors.

Hindustan Zinc Limited stands out as a prominent player in the silver stock sector, displaying strong profitability and operational efficiency. Despite its current overvaluation and less favorable entry point, its reputation and production capabilities position it as a significant contender in the silver market.

Comparison of Top leading Silver Stocks

|

Metric |

Goldiam International Ltd |

Vedanta Resources Ltd |

Hindustan Zinc Ltd |

|

Revenue Growth (%) |

10.89 |

8.12 |

8.05 |

|

Net Income Growth (%) |

33.15 |

0.44 |

2.53 |

|

Market Share (%) |

0.13 |

85.43 to 85.57 |

88.77 to 89.93 |

|

Debt to Equity Ratio (%) |

2.87 |

93.94 |

26.3 |

|

Current Ratio (%) |

503.93 |

87.56 |

305.45 |

Comparision Analysis:

Goldiam International Ltd has shown robust revenue and net income growth rates exceeding industry averages. It maintains a low debt to equity ratio and exceptionally high current ratio, indicating strong financial health and liquidity.

Vedanta Resources Ltd has seen moderate revenue growth but faces challenges with fluctuating net income and a high debt to equity ratio. Market share remained relatively stable.

Hindustan Zinc Ltd demonstrates consistent revenue growth, with moderate net income growth and a balanced debt to equity ratio. The company maintains a healthy current ratio, reflecting stable financial management despite minor fluctuations in market share.

Price comparision Snapshot:

Key Factors Influencing Silver Stocks

-

Silver Prices: Silver stock prices in India often rise with increases in silver prices due to higher demand.

-

Economic Conditions: Inflation tends to boost silver stocks as investors seek a hedge while rising interest rates can negatively affect silver equities by increasing business costs.

-

Government Policies and Geopolitical Events: Trade disputes and other geopolitical events that disrupt supply chains can reduce silver supply, driving up prices and related stock values.

-

Market Monitoring: Regularly tracking silver price trends, economic forecasts, political news, and demand drivers helps in making informed investment decisions in silver stocks.

Understanding these factors can help identify attractive entry and exit points for silver stocks that fit your investment goals and risk tolerance.

How to Invest in Silver Stocks

Investing in silver stocks is straightforward. You can open a Demat account to purchase individual stocks of silver-related companies or opt for mutual funds and ETFs that focus on silver mining and refining. Some funds exclusively deal in silver stocks, while others include a mix of silver and various assets.

When investing, it’s essential to align with your financial goals. Diversifying across multiple silver stocks or price points can help spread your risk. It’s also advisable to monitor market trends and news related to silver prices in India to identify the best times to buy or sell. With careful planning, silver stocks can be a valuable addition to your investment portfolio.

Investing in Silver Stocks with Enrich Money

Investing in silver stocks with Enrich Money is simple. Start by researching silver mining companies and market trends using the platform’s data tools. Analyze financial health and growth prospects with Enrich Money’s analytics. Diversify your portfolio by investing in multiple silver stocks to spread risk. Use real-time monitoring to stay updated on market changes and silver prices. Regularly review and adjust your portfolio with Enrich Money’s tracking tools to optimize returns.

Investing in Silver Shares: Risks and Rewards

Here is a detailed overview of the risks and benefits associated with investing in silver stocks in India:

|

Risks of Silver Shares |

Benefits of Silver Shares |

|

Silver share prices in India can be highly volatile, leading to fluctuations in the overall silver stock market. |

Silver is often viewed as a safeguard against inflation and economic instability. |

|

Operational challenges or management issues can negatively impact a silver company's value. |

The value of silver shares has the potential to appreciate over time. |

|

Regulatory changes, including taxes and laws, can affect silver companies. |

Silver shares offer high liquidity, making them easy to buy and sell. |

Conclusion

Investing in the top silver stocks in India can be a lucrative opportunity, but it requires careful research and a diversified approach. Factors such as company performance, economic conditions, and global demand significantly influence silver share prices. Potential benefits include capital appreciation, although risks such as operational challenges and price volatility must be considered.

Before investing in silver shares, it is crucial for investors to assess factors like mining operations, financial stability, and dividend yields. Platforms like Enrich Money trading platform simplify the process with user-friendly trading, research tools, and screening capabilities. This enables even novice investors to strategically enhance their portfolios by understanding market dynamics and leveraging a straightforward investment platform to acquire fundamentally strong silver stocks.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.

Frequently Asked Questions

-

What are the ways to invest in silver stocks in India?

To invest in silver stocks in India, open a Demat account with a registered stockbroker and use Enrich Money to research and purchase shares of silver mining companies listed on the platform. This allows you to participate in the silver market efficiently and manage your investments with ease.

-

What factors impact silver stock prices?

The prices of silver stocks are shaped by global supply and demand dynamics, economic trends, government regulations, geopolitical developments, and the operational performance of silver mining and refining firms. These factors collectively determine the fluctuations in silver-stock prices in the market.

-

Are silver stocks a worthwhile investment?

Investing in silver stocks can offer benefits like portfolio diversification and potential capital growth. However, it's important to consider associated risks such as price volatility and specific risks related to individual companies.

-

How can I mitigate risks when investing in silver stocks?

To minimize risks when investing in silver stocks, diversify your portfolio, conduct comprehensive research, stay updated on market trends, and consider investing in silver ETFs or mutual funds.

-

What advantages can investing in silver stocks potentially offer?

Investing in silver stocks offers advantages such as potential capital growth, protection against inflation, liquidity, and exposure to the silver market without the need for physical ownership of the metal.