The Top Hotel Stocks to Invest in India's 2024 Boom

Introduction

The hotel industry of India rises up as the key component promoting the country’s positive financial drive. Over the years, it has evolved drastically into a brand that universally adheres to the change in consumer trends.

This transformation receives momentum from an integration of advanced technologies like the application of the internet for booking and using services, the growth of demand for the thirds kind of lodging facilities: heritage and boutique.

The Top Hotel Stocks to Invest in India's 2024

Indian Hotels Company Limited (IHCL):

December 2024

IHCL laid out a bold expansion plan, with an aim to double its portfolio size to more than 700 hotels by 2030. IHCL set aside Rs.5,000 crore to fund this expansion, with heavy emphasis on India while retaining choice international projects.

January 2025

The company witnessed a 29% growth in net profit in the third quarter of FY25 to Rs.582.32 crore. The revenue also experienced an identical 29% growth.

February 2025

IHCL continued its growth momentum with the announcement of its fifth hotel in Mumbai. The company reiterated its vision to cross 700 properties by 2030, with at least 10% of them overseas. Topline for the quarter increased by 29% to Rs.25.9 billion, while the EBITDA margins continued to be above 39%.

Chalet Hotels Ltd:

January 2025

Chalet Hotels Ltd achieved its all-time quarterly revenue in Q3 FY25, up 22% at Rs.460 crore. The Average Daily Rate (ADR) rose 18% to Rs.12,944. Leasing operations were also expanded by increasing its rental portfolio by 0.4 million square feet.

Overview of India's Hotel Industry

India’s hotel industry has seen a major overhauling in terms of rationalisation in the last few years. Service delivery has adopted different forms necessary for specifics like leisure, workcation, and staycation to diversify the ways customers can improve their hotels. The sector is already dependent on the tourist industry for survival hence government intervention is critical in expanding the market.

Grouping it into four major categories of independent or unbranded hotels, other accommodations, new generation of hotels, and lastly the branded or full-fledged chain of hotels, the total scenario shows a marked diversification. Independent or unbranded hotels occupy more that 70% of total available rooms; while the branded or traditional segment though dominating the organized segment possesses approximately 5% of total rooms.

In a bid to promote the flow of investment in the hospitality and hotel sector, the Government of India has allowed 100% FDI through the automatic route. Statistical estimations show bright prospects of the Indian hotel industry, the increase is expected to start from the current level of USD 24. It is projected that the global spending on mobile advertising will rise to USD 61 billion in 2024 from USD 31. Total health care expenditure is projected to reach USD 0.1 billion by 2029 with a growth rate of 4%. 73% during this period.

Top Three Hotel Stocks in India in 2024 as per Market Capitalisation

Below is a list detailing the leading hotel stocks in India ranked by market capitalization:

|

S.No. |

Hotel Stocks in India 2024 (as per market capitalisation) |

|

1 |

|

|

2 |

|

|

3 |

Overview of Best Hotel Stocks in India 2024

-

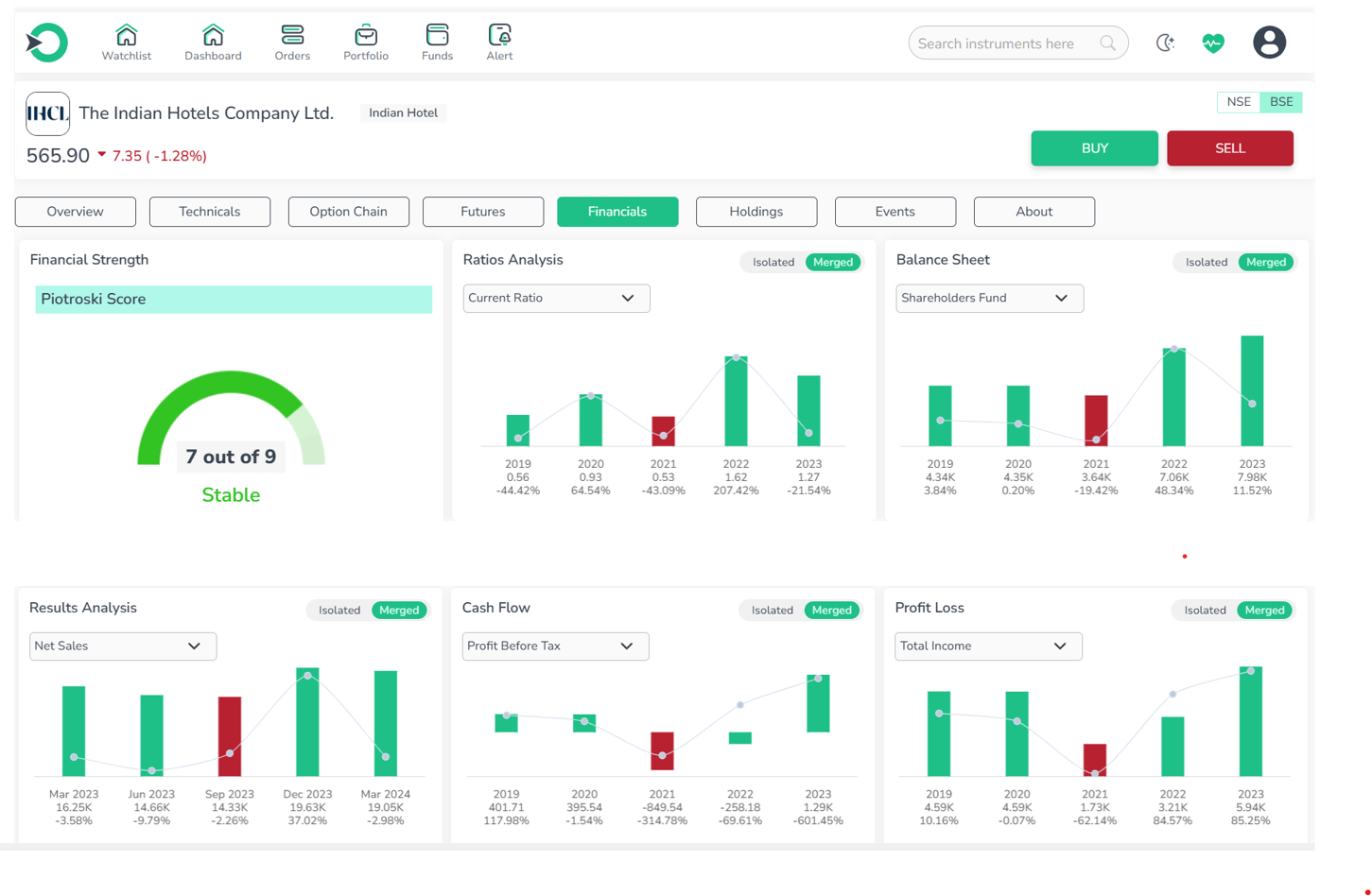

Indian Hotels Company

The Indian Hotels Company Limited or IHCL is an integrated hotel chain in India that owns and provides operations for a range of tartan, resorts, jungle safaris, palaces, spas and in-flight catering. Tata is an Indian based company, and it falls under the Tata Group conglomerate. IHCL was established in 1902 and was started by Jamsetji Tata and has it headquartered in Mumbai with its flagship hotel Taj Mahal Palace Hotel located in Mumbai as well.

-

Price return is average, lacking excitement.

-

Valuation seems overvalued compared to the market average.

-

Growth is low, trailing behind financial market trends.

-

Profitability shows promising signs of efficiency.

-

Entry point indicates the stock is not in the overbought zone.

In the context, evaluating the IHC based on the measures such as its performance, valuation, growth, profitability, and entry point makes it one of the three most attractive stocks in the hotel sector. While its average price return is somewhat low in excitement, there are certainly indications of possible profitability and efficiency. Although it may have some struggles in its growth it still has reasonable valuation. Moreover, the entry point of the stock indicates that it is not particularly in an overbought territory at the moment, which contributes to it being classified as one of the top contenders for the best hotel stocks to invest in.

-

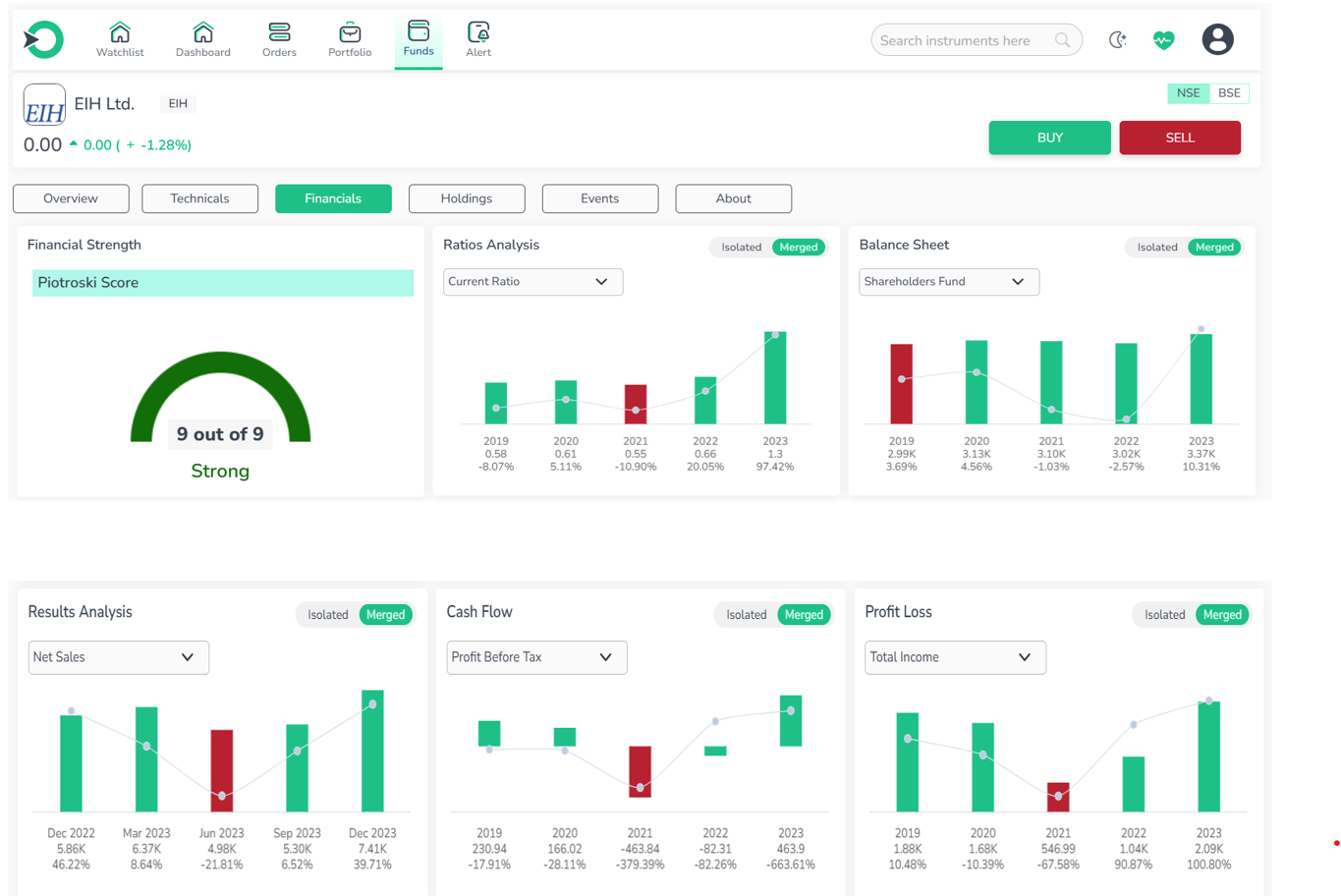

EIH

EIH Limited is subsidiary of The Oberoi Group; it is in the business of managing hotels and cruisers, presently worldwide in five countries it operates under the brand of ‘Oberoi’ which is luxury and ‘Trident’ which is five star. Also, the group offers other services such as flight catering, airport restaurants, travel and tour services, cars rental, project management, corporate air charter, among others, thus exemplifying its broad service offer in hospitality and travel industries.

-

Price return has been average as there has been no significant upward movement in prices over the period under review.

-

It compares to an overvalued camp than the normal market average being used for similar operations.

-

Growth is low, this means that there is a need to up for urge competition from the financial markets.

-

Profitability also signifies high profitability and performance of an organization.

-

Entry point reveals links with Dijkstra’s overpriced benchmark but is not overbought.

Taking into account that it offers overall fair results in regards to prices, is overpriced according to the industry average, has low growth characteristics, and demonstrates good potential for profitability and efficiency, EIH Limited can be stated to be one of the best stocks to consider in the hotel sector. Although its level can be considered as greatly overvalued compared to the historical average, it still is at the middle level in terms of ‘overbuying’ signal with the possible positive continuation of the movement and stable operating in the context of the hotel and restaurant industry.

-

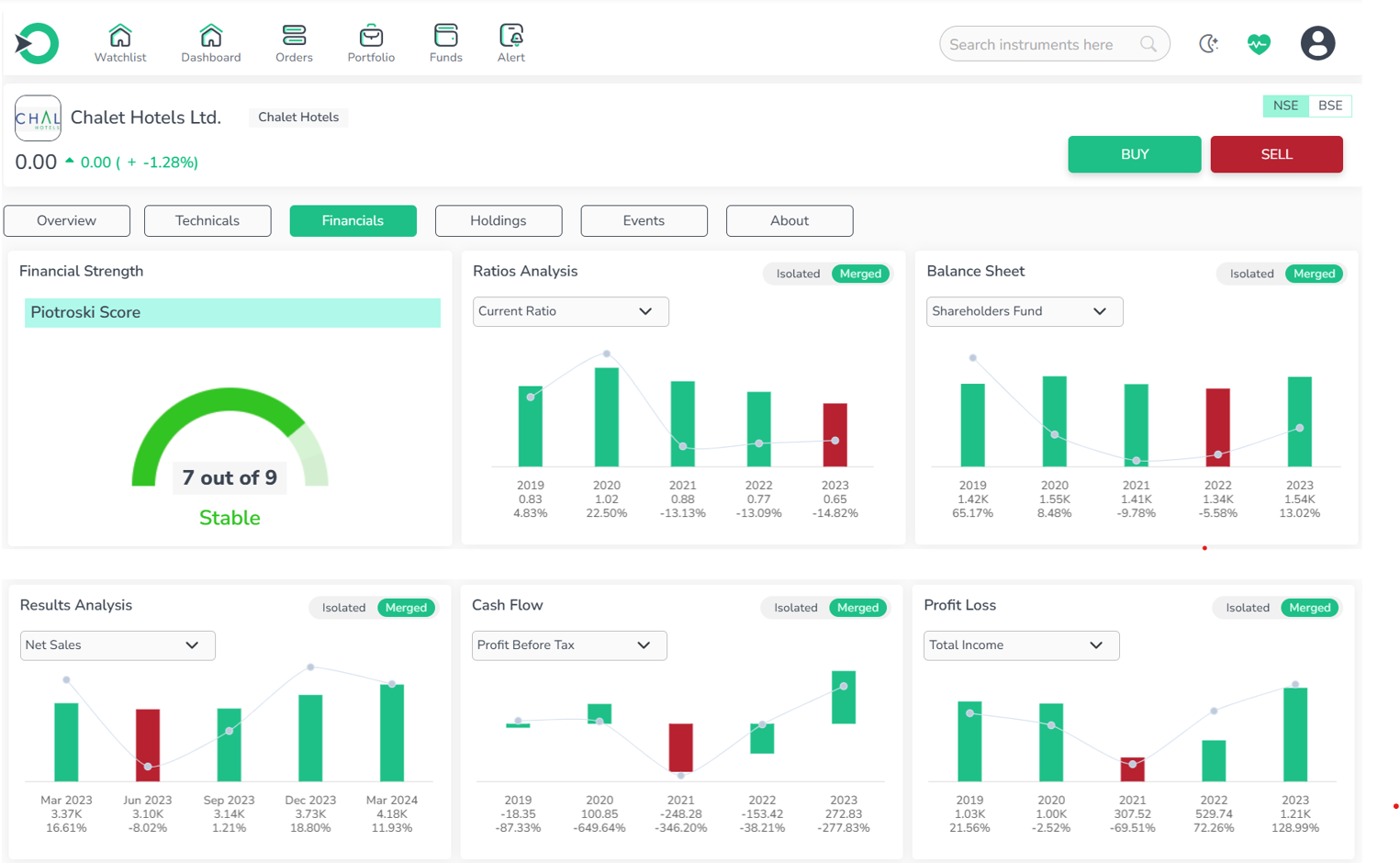

Chalet Hotels

Chalet Hotels Ltd is a part of the K Raheja Corp group and is primarily involved in owning, developing and management of luxurious hotels meant for the high end business travelers in India’s metros. Its strategic business goals are to provide effective, efficient, and profitable business management starting from pre-development stages and continuing through to the final asset management and operation to fully capitalize on every square footage in its portfolio.

-

Price return has generally been low, there has been no ‘thrill’.

-

Valuation Based on P/E looks overvalued than the market average.

-

This growth remains lower compared to the progress in the advancement of financial markets.

-

It mentions good signs of profitability and efficient use of resources in profitability.

-

The entry point acknowledged that the stock is overpriced, but it is not in the overbought range.

Therefore, due to its below-average price return, higher valuations than the market average, poorer growth prospects, and better indications of profitability and efficiency, Chalet Hotels Ltd can be considered one of the best hotel stocks. Although it is considered overpriced, it is still within the mean line not yet in the overbought level so buying opportunity may exist in the context of a stable hospitality industry.

Comparison of Key Metrics for Indian Hotels Company Ltd, EIH, and Chalet Hotel

|

Metric |

Indian Hotels Company Ltd |

EIH |

Chalet Hotel |

|

Revenue Growth (5-year avg) |

7.30% |

4.53% |

7.79% |

|

Market Share (5-year change) |

1.16% |

-1.05% |

0.38% |

|

Debt to Equity Ratio (5-year) |

69.80% |

15.18% |

129.84% |

|

Current Ratio (5-year avg) |

85.72% |

119.73% |

78.19% |

-

Revenue Growth: From the analysis of the financial data of Indian Hotels Company Ltd and Chalet Hotel it could be observed that both companies performed better than the industry average with regards to the relative growth of their revenues of the last 5 years where Chalet Hotels led with 7 % . 79%.

-

Market Share: Darling, Sundaram Fast, Indian Hotels Company and Chalet Hotel were able to increase their market share while EIH marginally declined.

-

Debt to Equity Ratio: From the LER above, it is evident that EIH has comparatively lower debt to equity ratio, making it slightly healthier than Indian Hotels Company Ltd and Chalet Hotel which have relatively higher ratios.

-

Current Ratio: Among all them you could; EIH has the highest current ratio which indicate that its position is better in terms of liquidity compared to the; Indian Hotels Company Ltd and Chalet Hotel. Amongst the three, Chalet Hotel has been identified to have the lowest current ratio in this scenario.

Key Considerations for Investing in Hotel Stocks in India

Before focusing on the potential of hotel stocks in India it is important to have an understanding of determinants that influence their returns. Here are some key points to take into account:

-

Location: Hotel brand needs to be preferred which are located in favorable business locations offering high standard services. This strategic choice hinges on location strengths, and guarantees that there is an emphasis and concentration on service, a move that is bound to increase investment possibilities.

-

Market Trends: With reference to the Indian hospitality industry locate and analyze existing trend. Look closely at some key indicators such as occupancy rates, average daily rate and ,revenue per available room. This is helpful because these trends can be further analyzed or predicted on how they will be in the near to medium term.

-

Financial Performance: Analyze the state of hotel companies with regard to its financial health using tools like revenues, profit margins, balance sheet and assets. Leveraging it, investors can make the right decisions, whereas the fixed income investors get a clear picture about the potential of a company to generate returns.

-

Brand Strength: Assess the likelihood of potential hotel chain investments returning value for the brand. This is manifested in form of a strong and sustainable brand image that enables a firm to dictate prices and enjoy customer loyalty hence improved financial performance.

-

Tourism Trends: Tourism should be mentioned as an unchanging part of the development of hotel industry activity. Discuss the feasibility of domestic and international tourism for the country and its future prognosis of growth. This requires factoring objects such as government patronage for the aerospace industry, travel structures, and trends.

-

Valuation: Explore the key concepts regarding the valuation of hotel enterprises through stocks. P/E, P/S and EV/EBITDA are some of the most critical ratios that investors in the company can compare with industry benchmarks and industry average as shown below. This analysis is helpful in avoiding the trap of buying stocks at their current high prices when they are costly compared to their intrinsic values.

Is Investing in Hotel Stocks Right for You?

Before investing in the hotel stocks, the situation requires meticulous analysis for possible risks and challenges that are always found in this line of business.

One major risk is the cyclical nature of the hotel REITs industry that fluctuates with the movements in the economy. One of the main areas that may be affected during downturns is the travel industry, which means that customers will spend less time traveling and as a result of this, they require less hotel services causing profitability to dip.

Also, natural calamities are expected to break and cause havoc when it comes to properties and unhappy tourists, all of which are a thorn in the side of an industry begging for stability.

Thereby, competition in the hotel sector may result in driving down prices and reducing the margins available to players in this segment which is not healthy for its financial subsequent players in a field.

Another important consideration is regulatory compliance that refers to the ability of a given business to meet all legal requirements for operating in a given country or region. In order to reduce such risks associated with properties, the hotel companies are subjected to legal measure concerning zoning laws, construction standards, environmental wears and labor relations. Legal: This may involve fines and bails, while reputational may extend to cancellation of orders or customer switching to other brands.

One cannot invest directly in hotel stocks without first analyzing factors such as the general business environment, global economic outlooks, competition and laws that govern the industry. It is also important to assess the risk tolerance level and investment goals to decide whether or not hospitality shares are suitable for the desired investment plan. There are many benefits available to those who choose to speak with a financial advisor and invest in stock.

Conclusion

The hotel industry of India offers high economic potential fueled by increasing traveling and tourism, improved per head income levels and favorable bureaucratic conditions. To tap smartly into such an opportunity the investors can diversify into the premier hotel stocks in India for the year 2024. However, no sane decision maker can overlook the economic structures, competition intensity, geographical differences, and legal environments in any given country.

Investors have to undergo profound analysis and research based on firms and important criteria that depict the performance of stocks in hotels. Diversifying the portfolio by including different kinds of stocks of hotels will help minimize jeopardies and maximize the possible revenues.

Frequently Asked Questions

-

How can I invest in the best hotel shares in India?

To invest in hotel stocks in India, simply open a trading account with a stockbroker and purchase shares of hotel industry companies listed on the stock exchange.

-

Is Now a Favorable Time to Invest in Leading Hotel Stocks in India?

Considering the expected recovery of the sector, investing in Indian hotel stocks seems promising, attributed to an anticipated 8.7% CAGR (2022-2028) in the tourism industry, driven by an expanding middle class, increased disposable income, and enhanced tourism infrastructure. Nonetheless, it is prudent to conduct thorough research or seek advice from a financial advisor before making investment decisions.

-

Who Should Consider Investing in Top Hotel Stocks in India?

Investing in top hotel stocks in India may interest long-term, growth-oriented investors with a high-risk appetite who believe in the economic and tourism trends. However, investors should evaluate their risk tolerance and investment goals beforehand.

-

Should I Invest in Established or Emerging Hotel Chains?

Established hotel chains provide stability and brand recognition, while smaller ones may offer higher growth potential alongside increased risk. Assess your investment objectives to determine the most suitable option.

-

How can I diversify my portfolio with hotel stocks?

Invest in hotel companies with diverse geographic presence, spanning luxury and budget markets, and varying business models (ownership vs. management) through Enrich Money's platform to optimize portfolio diversification and potential returns. Leveraging Enrich Money's analytical tools and expert guidance, you can strategically position your investments to capitalize on opportunities within the dynamic hospitality industry.

Related Stock:

Advani Hotels & Resorts (India) Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.