The Top 3 Semiconductor Stocks in India

Introduction

In an era marked by technological breakthroughs like the EV revolution and the widespread adoption of 5G, the semiconductor industry is undergoing remarkable growth and evolution. These advancements have fueled a surge in demand for semiconductors, vital components powering electric vehicles, telecommunications infrastructure, and an array of ubiquitous electronic devices. This burgeoning landscape prompts consideration of investing in premier semiconductor stocks in India, offering promising opportunities for exploration and growth.

The Top 3 Semiconductor Stocks in India 2025

March 2025:

•HCL Tech launched FlexSpace for AI PCs.

•Leader in semiconductor engineering services, as ranked by Everest Group.

•Named to Ethisphere's 2025 World's Most Ethical Companies list for the second year running.

February 2025:

•Joined forces with Children's Minnesota to deploy AI-powered solutions for transforming healthcare operations.

•Opened a global delivery center in Hyderabad, with the presence of the Telangana Chief Minister.

•HCL Foundation partnered with TRIFED for the development and promotion of indigenous craftsmanship and uplifting tribal artisans pan-India.

Bharat Electronics Limited (BEL)

December 2024:

•Entered into an MoU with Mitsubishi Electric and MEMCO Associates

January 2025:

•Released a 52.51% increase in consolidated net profit for Q3 FY24, at Rs.1,310.95 crore, while sales grew 38.65% to Rs.5,770.69 crore.

February 2025:

• Secured new orders of over Rs.500 crore for laser range finders and communications systems. This lifted BEL's order book for FY 24-25 to Rs.8,194 crore.

ABB India Limited

December 2024:

• Financial Performance: Posted a 56% increase in net profit for Q4 2024 to Rs.528.41 crore, while revenue increased 22% to Rs.3,364.93 crore. A final dividend of Rs.33.50 per share was declared.

January 2025:

• Acquisition: Bought Siemens Gamesa's power electronics business.

February 2025

•Yearly Growth: Achieved its highest-ever annual order book of Rs.13,079 crore and revenue of Rs.12,188 crore, reflecting strong growth in all business segments.

What exactly are semiconductor stocks?

They're shares in companies involved in the design, manufacturing, and distribution of semiconductors or chips. These companies play a crucial role in the electronics industry, creating minuscule chips that power a vast array of devices, including smartphones, computers, electric vehicles, and medical equipment.

Investing in semiconductor stocks offers individuals the chance to partake in the technological sector's growth and innovations.

Overview of the Semiconductor Industry in India

The semiconductor industry in India plays a pivotal role in driving technological advancements and economic growth. Currently, India relies entirely on imports for semiconductors, sourcing them predominantly from Taiwan, China, Korea, and Vietnam. This heavy dependence results in a significant import value of approximately $24 billion.

In 2023, the Indian semiconductor industry was valued at USD 34.3 billion and is projected to expand to USD 100.2 billion by 2032.To fortify the semiconductor ecosystem, the Indian government has forged partnerships on a global scale. Notably, on January 18, 2024, India and the European Union finalized an agreement to collaborate on semiconductor research, innovation, and technology development. This partnership seeks to enhance the semiconductor supply chain in both regions, fostering robust cooperation in areas spanning research and innovation, talent development, and the exchange of market insights.

Furthermore, the government's initiatives like the 'Make in India' campaign and the Production Linked Incentive (PLI) scheme offer lucrative incentives to establish semiconductor manufacturing facilities within the country. Additionally, the Design Linked Incentive (DLI) scheme provides crucial support to semiconductor startups, fostering a conducive environment for indigenous innovation and entrepreneurship.

In light of these developments, the semiconductor industry in India is poised for significant expansion and transformation.

Best Semiconductor Stocks in India 2024

|

S.No. |

Best Semiconductor Stocks in India |

Market Capitalisation in INR |

|

1 |

3.61 trillion |

|

|

2 |

1.70 trillion |

|

|

3 |

1.71 trillion |

Comprehensive Analysis of the Top Semiconductor Stocks in India for 2024

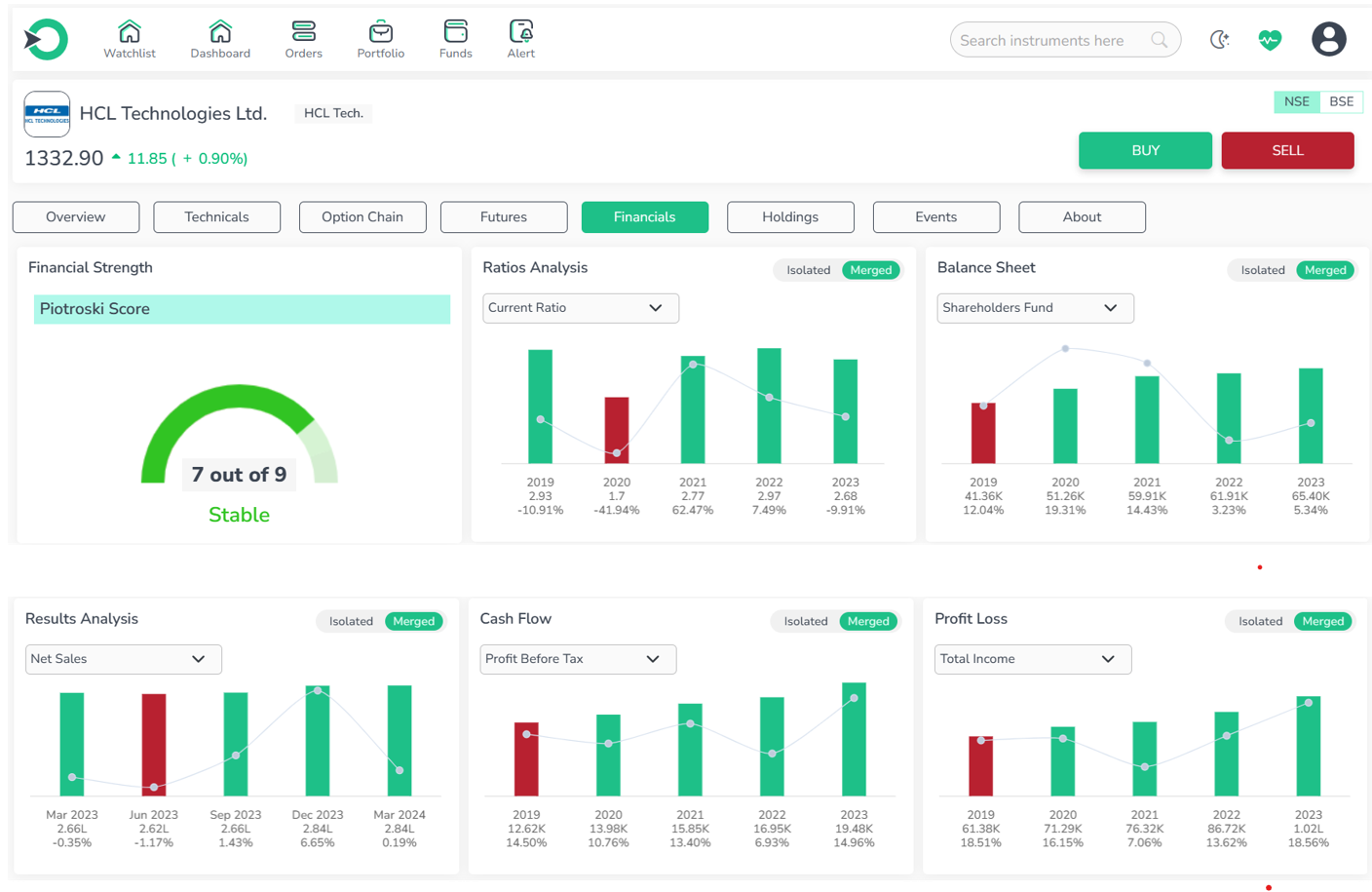

1.HCL Technologies

HCL Technologies Limited provides a variety of services including software development, business process outsourcing, and information technology infrastructure services.

-

Performance: This stock hasn't fared well, ranking among the low performers.

-

Valuation: It appears overvalued compared to the market average.

-

Growth: Lagging behind the market in terms of financial growth.

-

Profitability: Showing promising signs of profitability and efficiency.

-

Entry Point: The stock is relatively overpriced but hasn't reached the overbought zone.

In conclusion, despite its underperformance and overvaluation compared to the market average, the semiconductor stock in question exhibits promising signs of profitability and efficiency. While its growth trajectory lags behind the market, the stock presents an entry point that, although relatively overpriced, has not yet ventured into the overbought zone. Thus, with cautious consideration, it still holds potential as one of the best semiconductor stocks to watch for future development and improvement.

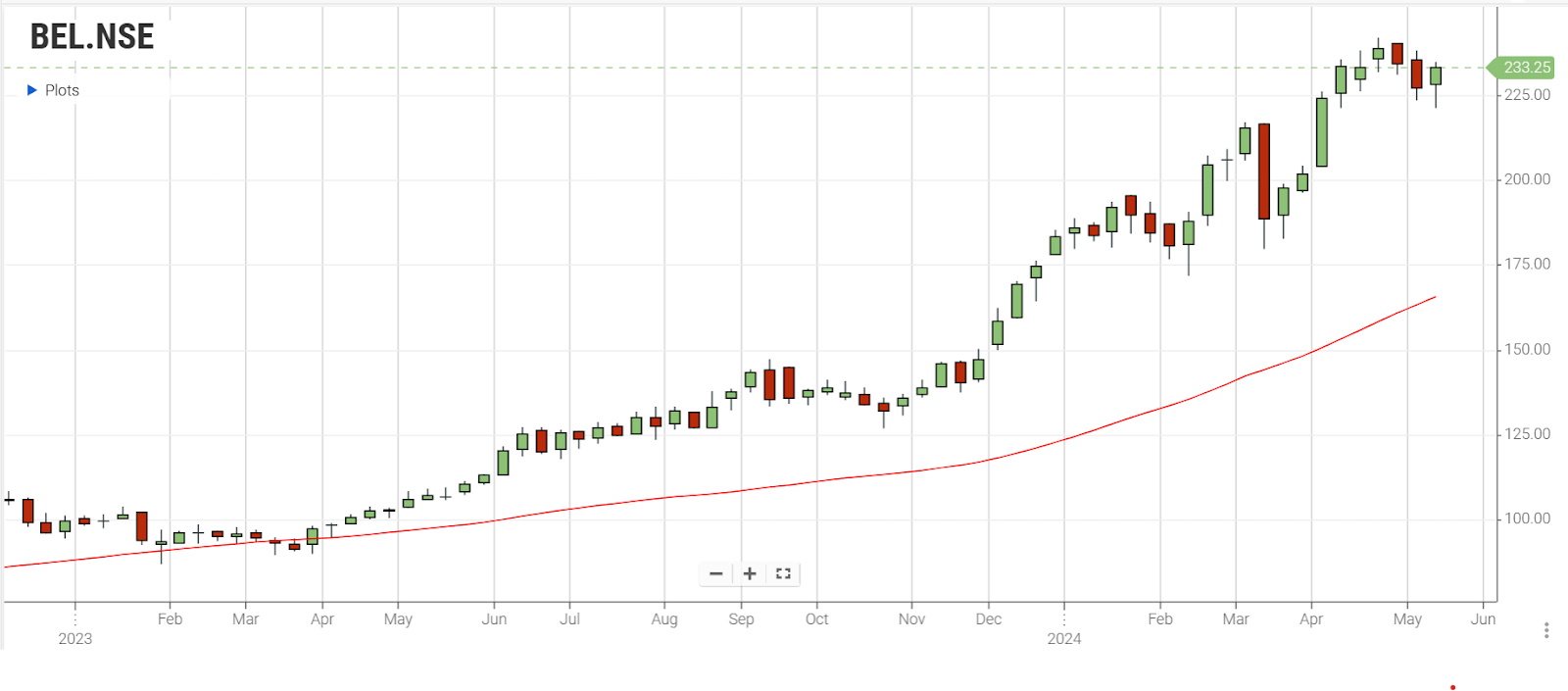

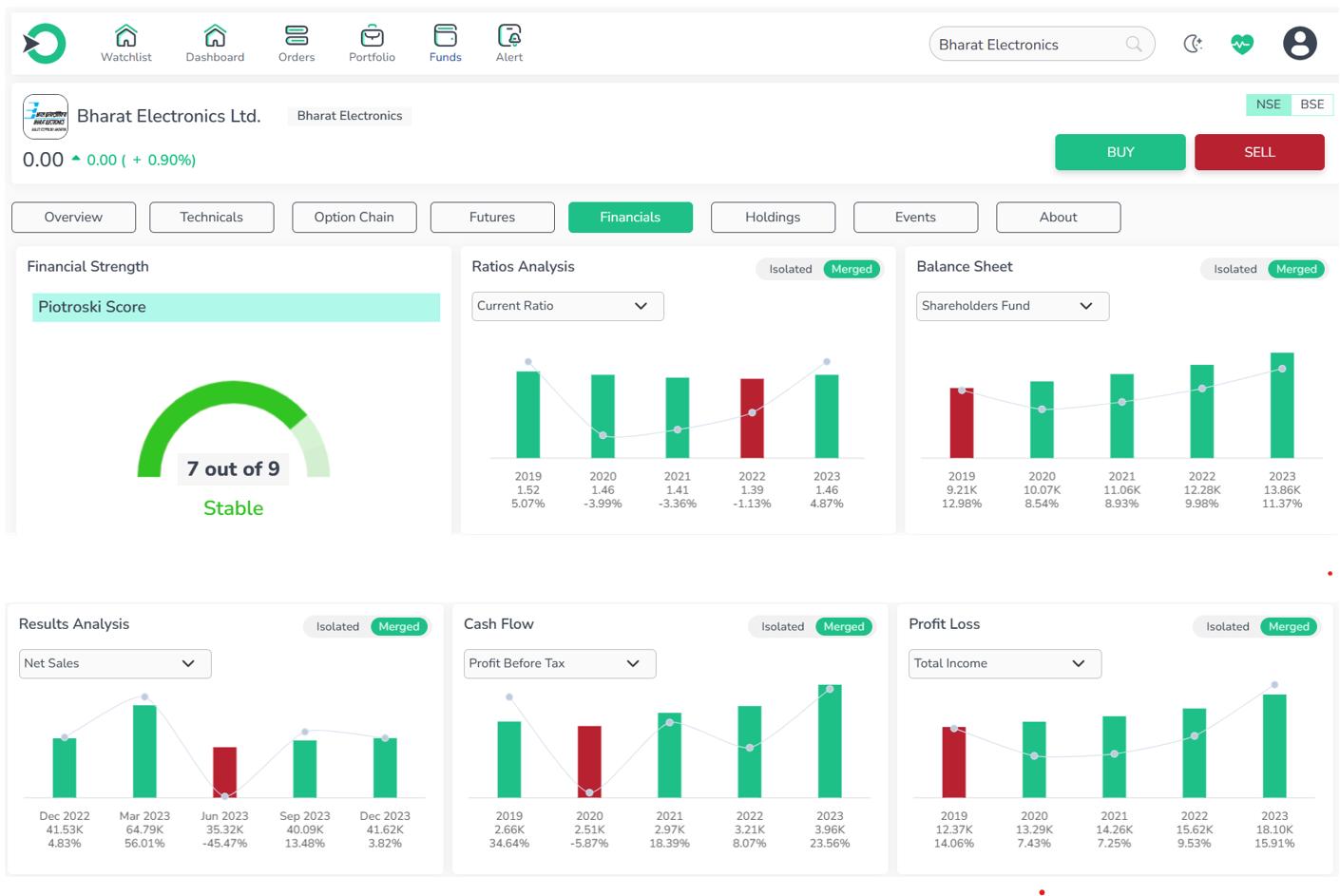

2.Bharat Electronics Limited

Bharat Electronics Limited specializes in the design, manufacture, and supply of electronics products and systems for both defense and nondefense markets. The company's primary offerings encompass a range of products such as weapon systems, radar, and fire control systems.

-

Performance: Price return has been average, with nothing particularly exciting.

-

Valuation: Appears overvalued compared to the market average.

-

Growth: Lagging behind the market in financial growth.

-

Profitability: Signals robust efficiency and strong financial performance.

-

Entry Point: The stock is overpriced but is not in the overbought zone.

In conclusion, despite Bharat Electronics Limited's average performance in terms of price return and its apparent overvaluation compared to the market average, it demonstrates promising signs of profitability and efficiency. However, its growth trajectory lags behind the market, and while the stock may be overpriced, it has not yet reached the overbought zone. Considering these factors, Bharat Electronics Limited emerges as a contender among semiconductor stocks, offering potential opportunities for investors willing to navigate its current valuation and growth challenges.

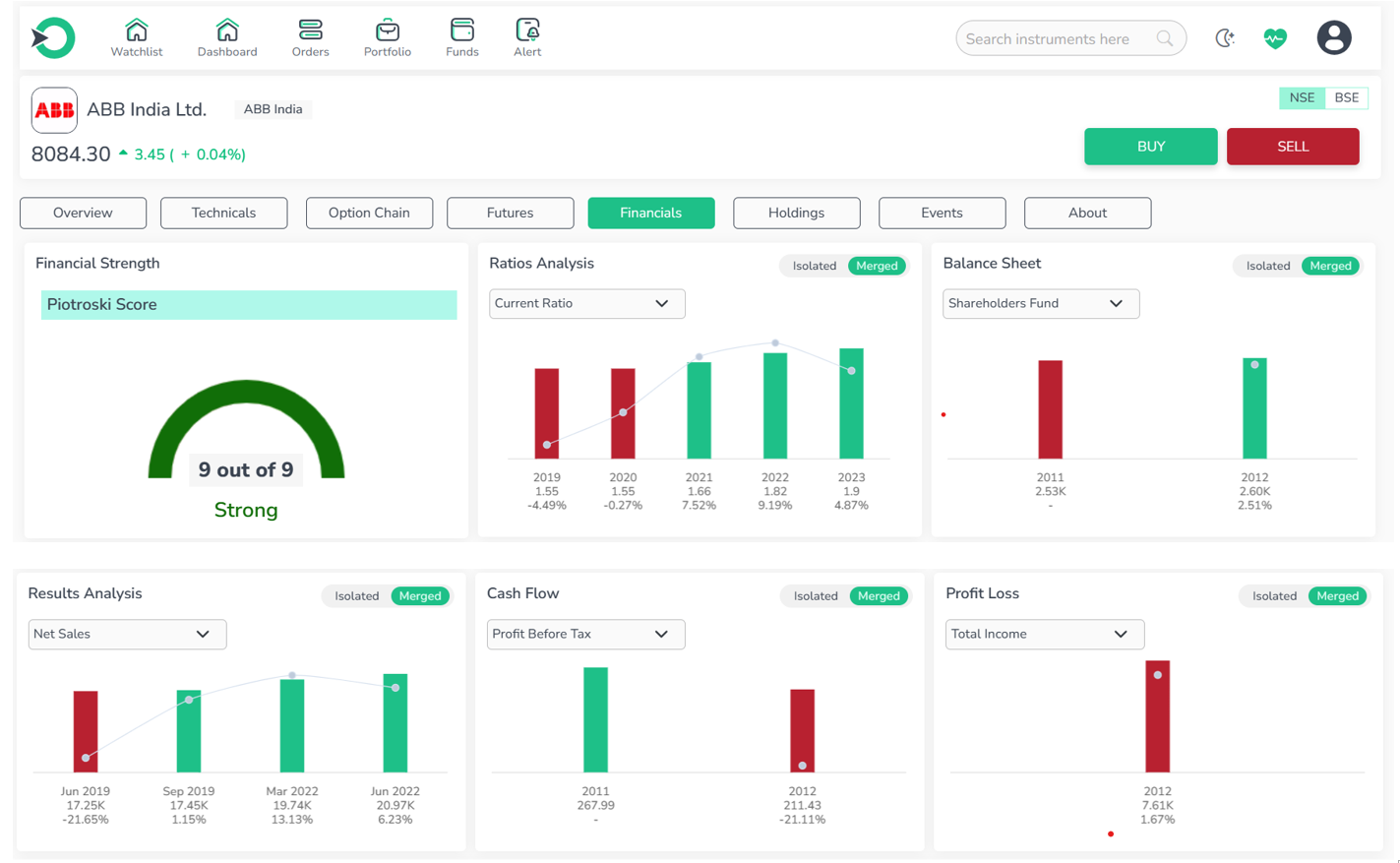

3.ABB India Limited

ABB India Limited is involved in the development and sale of products and system solutions to utilities, industries, channel partners, and original equipment manufacturers in India and abroad. The company operates through segments including Motion, Robotics and Discrete Automation, Electrification, and Process Automation.

-

Performance: Price return has been average, with no remarkable gains.

-

Valuation: Appears overvalued compared to the market average.

-

Growth: Financial growth has been moderate for a few years.

-

Profitability: Signals robust efficiency and strong financial performance.

-

Entry Point: The stock is overpriced but is not in the overbought zone.

In conclusion, ABB India Limited emerges as a potential contender among semiconductor stocks, showcasing signs of strong profitability and efficiency despite its average performance and relatively high valuation. With moderate growth and an average entry point, it presents an opportunity for investors willing to navigate its current valuation challenges.

Comparative Financial Analysis of HCL, Bharat Electronics, and ABB

Here's a table summarizing the key data for the three companies: HCL, Bharat Electronics, and ABB.

|

Metric |

HCL Technologies |

Bharat Electronics Limited |

ABB India Limited |

|

Revenue Growth Rate |

14.70% |

11.20% |

8.86% |

|

Market Share (5-year change) |

1.18% |

-5.28% |

5.16% |

|

Net Income Growth Rate |

11.23% |

15.82% |

19.44% |

|

Debt to Equity Ratio |

10.93% |

0.27% |

0.88% |

|

Current Ratio |

231.42% |

144.79% |

167.55% |

let's analyze the data:

-

Revenue Growth Rate: HCL has the highest revenue growth rate among the three companies at 14.7%, followed by Bharat Electronics at 11.2%, and ABB at 8.86%.

-

Market Share (5-year change): ABB has experienced the highest increase in market share over the last 5 years, with a change of +5.16%. HCL follows with a change of +1.18%, while Bharat Electronics experienced a decrease of -5.28%.

-

Net Income Growth Rate: ABB has the highest net income growth rate at 19.44%, followed by Bharat Electronics at 15.82%, and HCL at 11.23%.

-

Debt to Equity Ratio: Bharat Electronics has the lowest debt to equity ratio at 0.27%, followed by ABB at 0.88%, and HCL with the highest ratio at 10.93%.

-

Current Ratio: HCL has the highest current ratio at 231.42%, followed by ABB at 167.55%, and Bharat Electronics with the lowest ratio at 144.79%.

These metrics provide insights into the financial performance and stability of the three companies over the last 5 years, showcasing their revenue growth, profitability, debt management, and liquidity.

Key Considerations Before Investing in Top Semiconductor Stocks in India

-

Ensure consistent revenue growth and ability to translate sales into profits before investing in semiconductor stocks.

-

Scrutinize financial health through analysis of income statements, balance sheets, and cash flow statements.

-

Stay informed about industry risks and developments, especially regarding government initiatives and ecosystem formation.

-

Recognize the long-term horizon required for returns due to initial heavy investments in research and operations.

-

Exercise caution against blindly following recommendations and seek advice from financial advisors if needed.

Who Should Consider Investing in Semiconductor Stocks in India?

Investing in semiconductor stocks in India is ideal for individuals with a keen interest in technology, long-term investors, and tech enthusiasts alike. Those possessing industry knowledge and a willingness to tolerate risk, while keeping a close eye on global trends, stand to uncover potential opportunities in this sector. However, before diving into investments, conducting thorough research and seeking guidance from a financial advisor are essential steps to ensure informed decision-making.

Conclusion

In conclusion, investing in top semiconductor stocks in India holds promising potential for future growth, driven by robust demand fueled by technological advancements. With diligent research and thoughtful consideration, investing in Indian semiconductor stocks can yield significant long-term returns. As India embarks on a bold path towards semiconductor self-sufficiency, a transformative journey awaits, propelled by innovation and strategic partnerships. The convergence of AI and semiconductor technology opens doors to new possibilities, with Indian companies well-positioned to carve out a niche in the global semiconductor landscape. With an unwavering commitment to excellence and determination, India's semiconductor industry is poised to redefine the boundaries of technological innovation, steering the nation towards unparalleled growth and prosperity.

Frequently Asked Questions

-

Is Investing in Semiconductors a Wise Choice?

Indeed, investing in semiconductors can prove beneficial owing to their indispensable role in technology and the escalating demand for electronic devices. However, it's essential to weigh market fluctuations and competition before committing to investments.

-

Are Semiconductor Stocks Prone to Risks?

Semiconductor stocks entail certain risks due to cyclicality in market trends, potential disruptions in the supply chain, and intense competition. Nevertheless, they also present growth opportunities propelled by technological advancements and the growing demand within the electronics industry.

-

What Does the Future Hold for Semiconductors?

The future of semiconductors is poised for significant advancements, including progress in nanotechnology, AI-driven chip design, 3D stacking, quantum computing, and the adoption of sustainable materials. These innovations aim to foster the creation of faster, more efficient, and environmentally friendly electronic devices.

-

How do semiconductor stocks fit into the broader investment landscape?

Semiconductor stocks occupy a significant position within the investment landscape, serving as a cornerstone for technology-focused portfolios. Given their integral role in powering various electronic devices and facilitating technological advancements, semiconductor stocks offer investors exposure to the rapidly evolving tech sector.

-

What are some key indicators to assess the performance of semiconductor stocks?

When evaluating semiconductor stocks, investors should consider key performance indicators such as revenue growth, market share dynamics, net income growth, debt-to-equity ratio, and current ratio. These metrics provide insights into the financial health, profitability, and stability of semiconductor companies, aiding investors in making informed investment decisions.

Related Stocks

Dixon Technologies (India) Ltd.

CG Power and Industrial Solutions Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.