What is the NSE Option Chain?

Have you ever encountered the term "Option Chain" and found yourself curious about what it actually means? It seems to be used so frequently in market discussions, making it essential to understand its significance. The NSE Option Chain is just one aspect of it, but there are other crucial terms associated with it, such as the strike price and option premium. In this article, we will delve into the NSE Option Chain, explore the concepts of strike price and option premium, and gain a better understanding of the same.

-

CALL OPTION & PUT OPTION

-

NSE OPTION CHAIN

-

DEPICTION OF OPTION CHAIN USING NIFTY OPTION CHAIN

-

MONEYNESS OF OPTION

-

CALCULATION OF MONEYNESS

Before delving into the intricacies of the NSE option chain, it is crucial to understand the fundamental concepts of call and put options. These concepts serve as the building blocks for comprehending how the NSE option chain operates and their significance in the world of financial markets.

CALL OPTION & PUT OPTION

Options are classified into two types: call options and put options. Examples of call and put options can be further divided into two categories: American-style options and European-style options.In India, we use European-style options, which are denoted as "CE" or Call European for call options and "PE"or Put European for put options. Buyers of call options are granted the privilege to purchase the underlying asset, whereas buyers of put options have the right to sell the underlying asset. Importantly, buyers of options have rights but not obligations, meaning they can choose whether to exercise the contract or not.

Every option contract consists of both a buyer and a seller. The seller, also known as the option writer, has the obligation to buy (in the case of call options) or sell (in the case of put options) if the buyer chooses to exercise the contract. The sellers do not have any rights, only obligations.

Buyers of call options expect the market to rise, as they want to buy the asset at a favorable price in the future. Buyers of put options anticipate the market to decline, as they want to sell the asset at a higher price than its potential future value.Conversely, the seller of a call option holds the belief that the market will not experience further upward movements, while the seller of a put option holds the view that the market will not encounter further downward movements.

So from the above it is clear that Call and Put options are advantageous for the buyers, as they grant them the right to buy or sell the asset. Sellers, on the other hand, are obligated to fulfill the contract if the buyer decides to exercise it.

Here comes the importance of “Option premium”.The option buyer pays a non-refundable upfront amount to the option seller,this is called option premium.So these are certain basics about call and put option.Now we can look into NSE option chain analysis.

NSE OPTION CHAIN

The NSE option chain functions as an extensive repository, offering in-depth details regarding the accessible options contracts for a particular underlying stock or index. It offers a structured view of both call and put options, each associated with a particular expiration date. The options are organized and displayed based on their strike prices, allowing traders to easily assess the various choices available.The NSE option chain presents essential statistics, such as premium, open interest, and implied volatility, for each listed option. The premium refers to the current price at which the option can be bought or sold. Open interest indicates the total number of outstanding contracts for a specific option. Implied volatility represents the market's expectation of the underlying asset's future price fluctuations.

By arranging the options data systematically, the NSE option chain enables investors and traders to make informed decisions regarding their trading strategies. Traders can quickly analyze the potential risks and rewards associated with different strike prices and choose the most suitable options to align with their market outlook. Furthermore, the NSE option chain provides additional data, including volume (the number of contracts traded) and other relevant statistics for each strike price. This wealth of information allows traders to gauge the level of interest and activity in various options, which can be valuable in identifying potential trading opportunities.

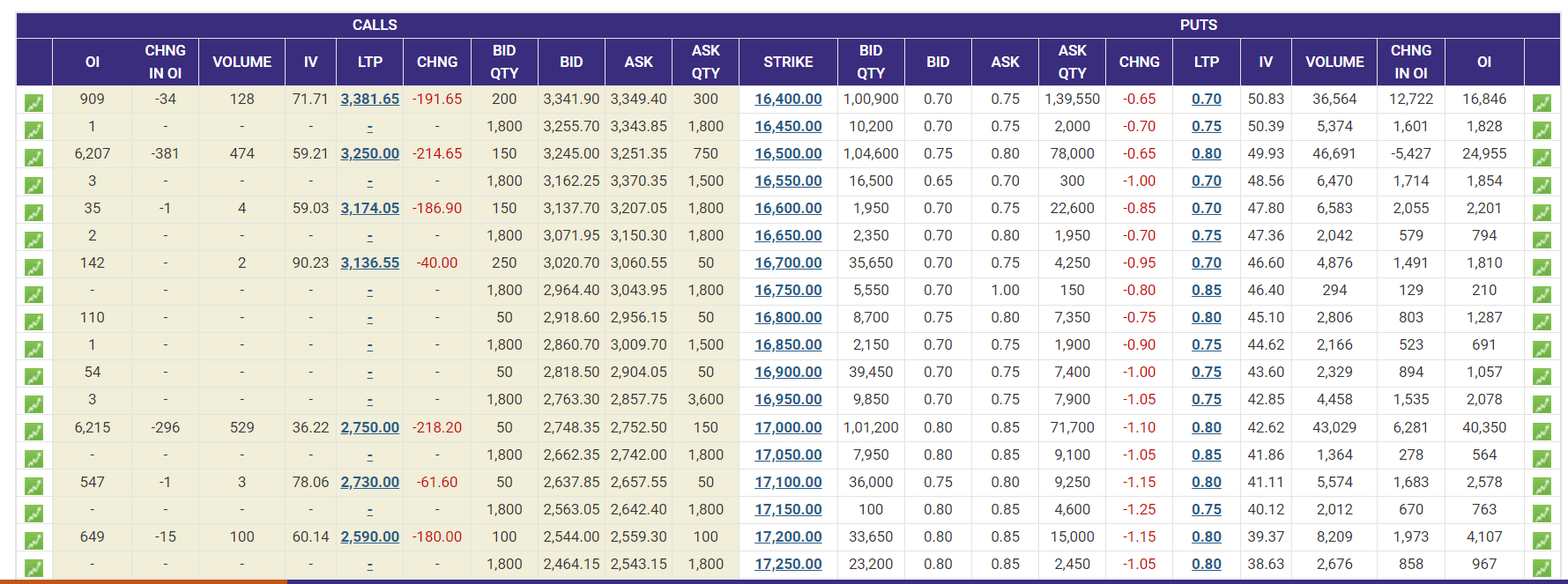

DEPICTION OF OPTION CHAIN USING NIFTY OPTION CHAIN

In the Nifty 50 option chain, the strike price takes center stage, with call data positioned on the left and put data on the right side. This arrangement offers a significant advantage by providing essential data points for both calls and puts of a particular strike in one concise view. Traders can quickly access crucial information such as price changes, volume changes, implied volatility (IV) fluctuations, open interest changes, accumulation, and unwinding. This streamlined presentation allows for easy identification of accumulation build-up and open interest reduction.

Additionally, all in-the-money (ITM) strikes are shaded in yellow, dynamically changing with shifts in the market price and the spot value of the underlying asset. Likewise, the Nifty option chain displays all "Out of the Money (OTM)" strikes in white shading. Here you might be confused about the “In the Money “ concept.Lets discuss what does that mean.

MONEYNESS OF OPTION

Moneyness of an option contract involves categorizing each option (strike) as either In the money (ITM), At the money (ATM), or Out of the money (OTM) and also “Deep in the Money “& “Deep Out of the Money”.This classification aids traders in selecting the most suitable strike to trade based on specific market conditions.

CALCULATION OF MONEYNESS

So for calculating the moneyness of option contracts,it is very important that we should know the concept of “Intrinsic value” .Intrinsic value of an option is the amount of money you would make if you were to exercise the option contract.It can never be negative.It can be either zero or positive number.

Call option Intrinsic value=Spot price -Strike price

Put option Intrinsic value=Strike price-Spot price

The strike which is closest to spot price is “At the Money”.

If Intrinsic value is zero,option strike is called “Out of the Money”

If the Intrinsic value is a non-zero number ,then option strike is considered “In the Money”.

Indeed, the NSE option chain serves as a valuable tool for traders when it comes to selecting the most suitable strike for their trades. One crucial factor to consider is "open interest," which indicates the number of outstanding contracts for a specific strike. Traders often favor strikes with high open interest, as it suggests a higher level of market activity and interest at that particular price level.

The NSE Bank nifty option chain displays various strike prices and expiration dates, along with corresponding premiums, open interest, and trading volumes for both call and put options. Traders and investors refer to the Bank Nifty option chain to analyze market sentiment, gauge potential price movements, and make informed decisions regarding hedging or speculating on the performance of the banking sector.

Moreover, the NSE option chain can provide valuable information about the underlying asset's resistance and support levels. The strike with the highest open interest on the call side can be viewed as a "resistance" level, indicating a price point where selling pressure may be significant. On the other hand, the strike with the highest open interest on the put side can be considered a "support" level, representing a price point where buying interest may be strong.

By analyzing the NSE option chain comprehensively, traders can make well-informed decisions and develop effective strategies based on the underlying market dynamics. Utilizing the data from the NSE option chain can enhance trading precision and increase the probability of successful outcomes.

FAQ

-

What is the NSE option chain?

The NSE option chain functions as an extensive repository, offering in-depth details regarding the accessible options contracts for a particular underlying stock or index.

-

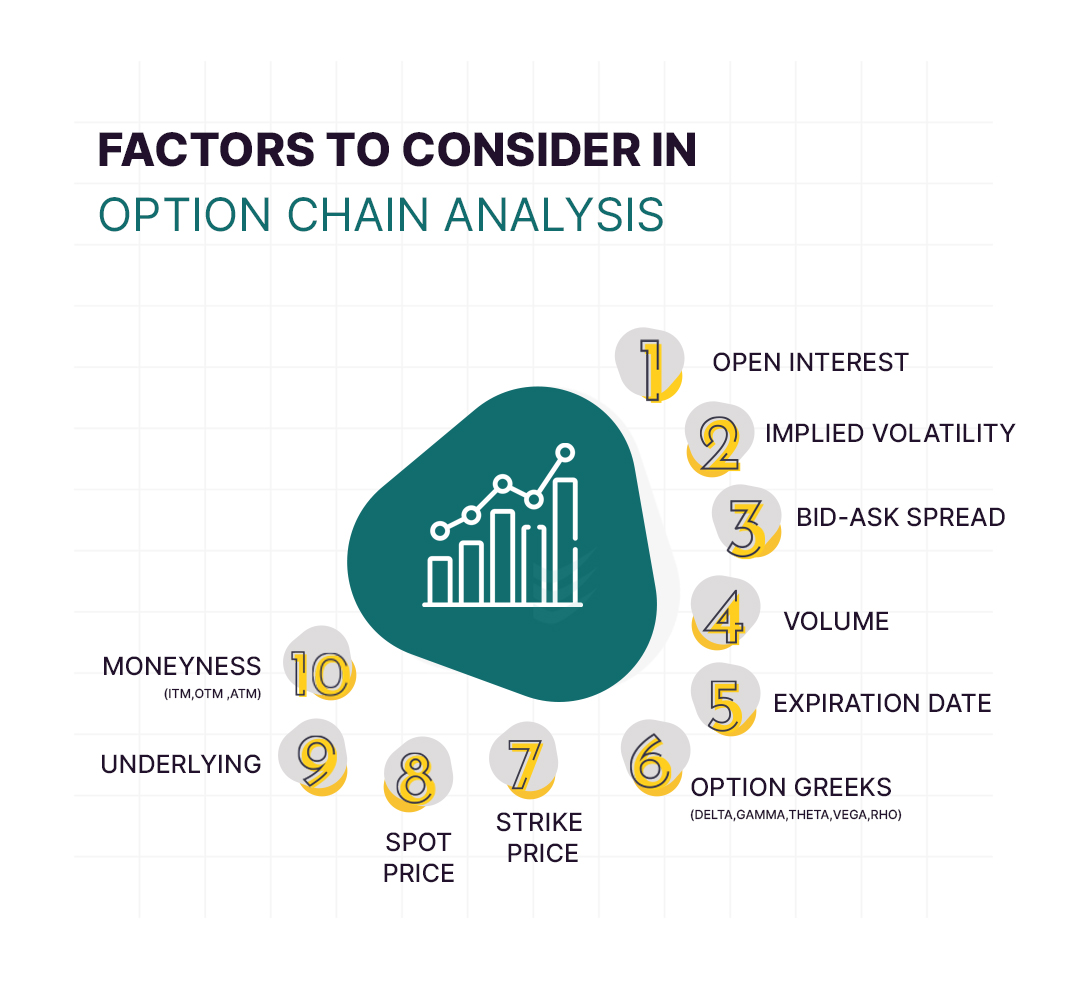

Which are the important factors to consider in NSE option chain data?

Open interest,Implied volatility,Bid-Ask spread,Volume,Expiration date,Strike price,Spot price,Underlying asset,Moneyness and Option greeks are certain factors to be considered.

-

What do you mean by call & put option?

A call option is a financial contract that gives the holder the right to buy an underlying asset at a predetermined price, while a put option gives the holder the right to sell an underlying asset at a predetermined price.

-

What is Intrinsic Value?

Intrinsic value of an option is the amount of money you would make if you were to exercise the option contract.

-

How can we classify Moneyness of option?

Moneyness can be classified into three,namely “In the money”,”Out of the Money” and “At the Money”.