Nifty Top 10 Equal Weight Index launched on 24th June, 2024

Overview

NSE Indices on 24th June,024 launched a new index named ' Nifty Top 10 Equal Weight Index as a part of its Equity Strategic Indices which is considered to be the nation’s first top tier capitalization stocks index. Nifty Top 10 Equal Weight Index is launched by NSE to monitor the performance of Nifty 50 stocks which are in its Top 10. The Nifty 50’s Top 10 stocks are identified based on six months average of market capitalization using free float method.

Why NSE Launches Nifty Indices Time to Time?

The main objective of NSE to launch Nifty Indices is ‘diversification’ which would cater to investors needs who opt for unique investment strategies. The launch of new indices by NSE has been increasing year by year. NSE launched about 36 indices in the year 2013 to 107 indices in 2024. These numbers reflect the NSEs strategy to capitalize on index creation activity. By offering various indices, NSE can license these indices data to Asset Management Companies to launch new index funds, Exchange Traded Funds and other mutual funds, which generates significant revenue in the Indian Economy.

Nifty Top 10 Equal Weight Index

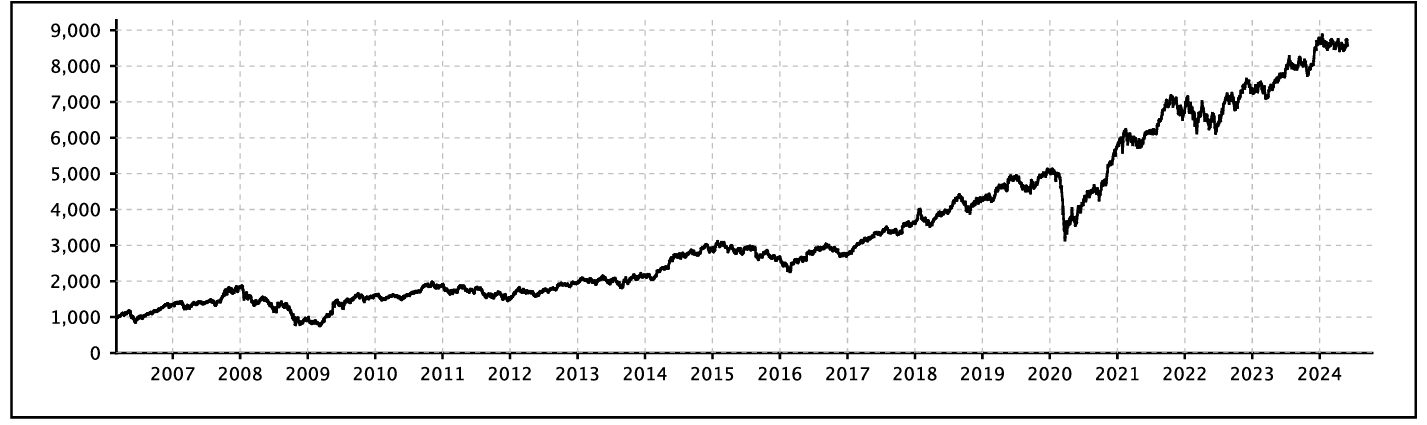

The Nifty Top 10 Equal Weight Index was established with a base date of March 2, 2006, starting at a base value of 1000. This index will be reconstituted on a half yearly basis and the index rebalancing takes place on a quarterly basis.

Eligibility Criteria

-

This Nifty Top 10 Equal Weight index constitutes eligible stocks which are part of Nifty 50 at time of review .

-

Nifty Top 10 Equal Weight Index consist of stocks from financial services, fast moving consumer goods, information technology, construction , oil, gas and consumable foods sectors.

-

Each stock in the Nifty Top 10 Equal Weight Index is assigned an equal weightage.

Sectoral Representation of Nifty Top 10 Equal Weight Index

Financial Services - 41.33%

Fast Moving Consumer Goods - 20.29%

Information Technology – 18.97%

Construction – 9.86%

Oil, Gas & Consumable Fuels – 9.55%

Constituent Stocks

The index consists of 10 stocks.

|

Company Name |

Industry |

Weightage |

|

Financial Services |

11% |

|

|

Financial Services |

10.59% |

|

|

Fast Moving Consumer Goods |

10.36% |

|

|

Financial Services |

10.31% |

|

|

Fast Moving Consumer Goods |

9.93% |

|

|

Construction |

9.86% |

|

|

Oil, Gas & Consumable Fuels |

9.55% |

|

|

Information Technology |

9.52% |

|

|

Information Technology |

9.45% |

|

|

Financial Services |

9.43% |

Source : niftyindices.com

The performance metrics of the Nifty Top 10 Equal Weight Index

Nifty Top 10 Equal Weight Index renders a dividend yield of 1.34. The price earnings ratio is at 21.95 and price to book ratio is at 4.39.

Nifty Top 10 Equal Weight Index renders a CAGR price return of 14.07% since inception. For a period of 5 years, the CAGR price return of the index is 13.32% . For a period of a year , the price return is 12.47%.

While the YTD, price return value is -1.45%.

The correlation between Nifty 50 and Nifty Top 10 Equal Weight Index stands at 0.97.

Source : niftyindices.com

The Nifty Top 10 Equal Weight Index is calculated with base date of 2nd March,2006, and base value of 1000. The above chart compares the performance of Nifty Top 10 Equal Weight index with Nifty 50.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.

Frequently Asked Questions

What is the Nifty Top 10 Equal Weight Index and why was it launched?

The Nifty Top 10 Equal Weight Index was launched by NSE Indices on June 24, 2024, as part of its Equity Strategic Indices. It tracks the performance of the top 10 stocks from the Nifty 50, identified based on their six-month average market capitalization using the free float method. This index aims to provide investors with a focused view on the largest stocks by market capitalization in India.

How can investors participate in the Nifty Top 10 Equal Weight Index?

Investors can participate on the Nifty Top 10 Equal Weight Index through a mutual fund or ETF which tracks the index. Until an index fund or ETF is available for investment, investors can make investment in the underlying stocks of Nifty Top 10 Equal Weight Index through Enrich Money .

Is the Nifty Top 10 Equal Weight Index Fund available for investment?

As of 27th June, 2024, Nifty Top 10 Equal Weight Index fund is not available for investors. Investors can opt for investment in the index constituent stocks by building a diversified portfolio.

Is there an NSE-listed fund specifically for the Nifty Top 10 Equal Weight Index?

As of June 27, 2024, there is no Nifty Top 10 Equal Weight Index fund available for investment. Investors interested in this strategy can consider purchasing the constituent stocks of the index to construct a diversified portfolio reflecting the index's composition.

Why does NSE launch new Nifty indices periodically?

NSE introduces new Nifty indices to cater to diverse investment strategies and investor preferences. This initiative allows for the creation of index funds, ETFs, and other financial products that utilize these indices, contributing to market liquidity and investor choice.