The Best Mutual Funds for Lumpsum Investment in 2024: Strategies for Maximum Returns

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets like stocks, bonds, and other securities. Mutual funds are managed by professional fund managers, they offer a convenient way for individuals to access a range of investments without needing in-depth market expertise. Mutual funds come with varying risk levels, catering to different financial goals and investment strategies.

Lump Sum Investment in Mutual Funds

Lump sum investment in mutual funds involves investing a substantial amount of money at once, rather than in smaller, periodic instalments. It allows investors to take full advantage of market movements from the start, but also exposes them to potential market fluctuations. This approach suits investors with a long-term perspective and a higher risk appetite.

Features of Mutual Funds Lumpsum Investment

The ideal features of mutual funds investment in one time are

Single Transaction: A large amount is invested in one go, rather than multiple instalments.

Immediate Market Exposure: The entire investment is exposed to market movements from the start, which can be beneficial in favourable conditions but riskier in volatility.

Compounding Growth: Offers the potential for long-term wealth accumulation through compounding over time.

Investment Flexibility: Ideal for investors who have a significant sum ready, allowing them to select funds that match their risk tolerance and financial goals.

Cost Efficiency: Fewer transactions may lead to lower overall costs compared to regular investment methods.

No Ongoing Contributions: After the initial investment, there's no need for regular contributions, making it convenient for investors.

Benefits of Mutual Funds Lumpsum Investment

Opportunity for Higher Returns: A single, upfront investment allows full participation in market gains, especially when the market is on an upward trend.

Convenience: It requires no ongoing contributions, making it easier to manage compared to periodic investment plans.

Compounding Advantage: Over the long term, lump sum investments can lead to significant wealth growth due to the compounding effect.

Lower Costs: Fewer transactions can reduce associated costs like transaction fees.

Immediate Market Access: Provides instant exposure to market movements, which can be advantageous if invested during favorable conditions.

Customizable Fund Selection: Investors have the flexibility to choose funds aligned with their financial goals and risk preferences.

Risks Associated with Mutual Funds Lumpsum Investment

Market Timing Risk: Investing a large sum at once means the entire amount is subject to immediate market fluctuations, which can lead to losses if the market declines shortly after the investment.

Increased Exposure to Volatility: A lump sum investment faces full market volatility, making it riskier during periods of economic uncertainty or instability.

Lack of Cost Averaging: Unlike systematic investment plans (SIPs), lump sum investments do not benefit from averaging costs over time, potentially increasing the impact of market downturns.

Reduced Liquidity: Committing a significant amount in one go can limit cash availability for other investments or emergencies.

Risk of Underperformance: If the market does not perform well, the return on the lump sum investment may be lower than anticipated, affecting overall financial goals.

Why Should an Investor invest in Mutual Funds in Lumpsum Amount?

Some reasons why an investor might choose to invest in mutual funds with a lump sum amount:

Higher Return Potential: A lump sum investment allows for immediate exposure to market gains, which can yield significant returns if the market rises.

Long-Term Compounding Benefits: Investing a large sum at once can enhance the effects of compounding, particularly over extended periods, leading to greater wealth accumulation.

Capitalizing on Market Opportunities: If an investor anticipates favorable market conditions, a lump sum can help take full advantage of those trends from the beginning.

Simplified Investment Process: Making a single investment reduces the complexity of managing multiple transactions, making it easier for the investor.

Cost Efficiency: With fewer transactions, overall fees may be lower compared to regular investment approaches, which can enhance net returns.

Flexible Fund Selection: Investors have the opportunity to choose mutual funds that best fit their financial objectives and risk appetite without needing to adjust their investment regularly.

Instant Market Participation: A lump sum investment enables investors to engage with the market immediately, which can be beneficial in a dynamic financial landscape.

Difference between lumpsum investment and SIP investment in Mutual Funds

A comparison between lump sum investment and SIP (Systematic Investment Plan) in mutual funds:

|

Feature |

Lump Sum Investment |

SIP Investment |

|

Investment Method |

Involves investing a large amount in one go. |

Involves regular investments of smaller, fixed amounts over time. |

|

Market Exposure Timing |

Provides immediate exposure to the market. |

Gradual exposure helps reduce the impact of market volatility. |

|

Cost Averaging |

Does not benefit from cost averaging, as the entire amount is invested at once. |

Allows for cost averaging, which can lower the average purchase price over time. |

|

Investment Strategy |

Ideal for those who have a significant sum to invest and can tolerate short-term fluctuations. |

Suitable for investors who prefer a disciplined approach, investing smaller amounts regularly. |

|

Liquidity |

Offers immediate liquidity after the initial investment, but requires a larger upfront commitment. |

Provides flexibility with smaller investments, making it easier to adjust contributions as needed. |

|

Commitment Level |

Requires a substantial initial commitment, which may be a barrier for some investors. |

Lower commitment, allowing for easier management of cash flow and investment amounts. |

|

Long-Term Growth |

Can lead to significant long-term growth through compounding if invested wisely. |

Encourages consistent investing, which can also result in long-term wealth accumulation. |

These distinctions help investors choose between lump sum and SIP methods based on their financial goals and investment preferences.

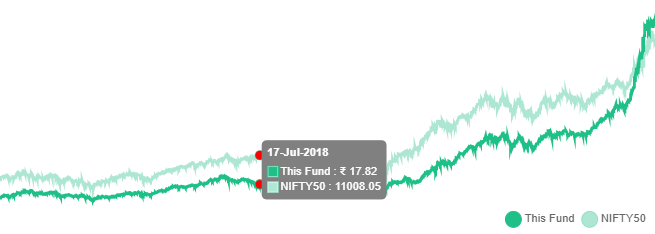

Best Mutual Funds for Lumpsum Investment in 2024

As we look ahead to 2024, mutual funds present a compelling investment opportunity, particularly for those considering lump sum investments. Based on their impressive five-year return percentages, certain mutual funds have emerged as top contenders for investors seeking substantial growth. These funds not only demonstrate strong historical performance but also align well with the evolving market dynamics. Investing a lump sum in these high-performing mutual funds can provide significant wealth accumulation potential. In this article, we will explore the best mutual funds for lump sum investment in 2024, helping investors make informed decisions.

|

Mutual Fund Name |

NAV in Rs. |

AUM (Crores in Rs.) |

Minimum Investment in Rs. |

1 year Return % |

5 years Return % |

Expense Ratio |

|

Nippon India Small Cap Fund - Growth - Direct Plan |

199.46 |

62259.56 |

1000 |

46.36% |

38.22% |

0.66 |

|

Invesco India Infrastructure Fund - Growth - Direct Plan |

79.08 |

166.48 |

1000 |

63.07% |

33.52% |

0.7 |

|

Bandhan Infrastructure Fund - Growth - Direct Plan |

61.88 |

1,905.92 |

1000 |

67.45% |

32.68% |

0.81 |

|

Canara Rob Infrastructure Fund(G)-Direct Plan |

183.49 |

883.22 |

1000 |

68.70% |

32.05% |

0.99 |

|

Canara Rob Infrastructure Fund(G)-Direct Plan |

164.045 |

2908.45 |

1000 |

56.62% |

30.48% |

0.91 |

Among these

Nippon India Small Cap Fund - Growth - Direct Plan,

Invesco India Infrastructure Fund - Growth - Direct Plan and

Bandhan Infrastructure Fund - Growth - Direct Plan

are mutual fund plans with comparatively less expense ratio.

Nippon India Small Cap Fund - Growth - Direct Plan

The Nippon India Small Cap Fund - Growth - Direct Plan focuses on investing in small-cap companies with high growth potential. This fund has shown strong performance in recent years, making it an attractive option for lump sum investments. With a strategy aimed at capitalizing on emerging businesses, it offers the potential for significant returns over the long term. Investors considering a lump sum investment can benefit from the fund's aggressive growth approach in the small-cap segment.

Nippon India Small Cap Fund - Growth - Direct Plan fund has good return potential. The less expense ratio is an added advantage for long term investors as it would provides better return.

Invesco India Infrastructure Fund - Growth - Direct Plan

Invesco India Infrastructure Fund - Growth - Direct Plan focuses on investing in companies within the infrastructure sector, making it a strong choice for lump sum investments. With a growth-oriented approach, it aims to capitalize on the potential of India’s rapidly expanding infrastructure landscape. The fund has shown robust performance over the years, making it appealing for investors seeking long-term capital appreciation. By investing a lump sum, investors can take advantage of the sector's growth prospects and benefit from the fund's strategic management.

Invesco India Infrastructure Fund - Growth - Direct Plan fund also has good return potential. The less expense ratio is an added advantage for long term investors as it would provides better return.

Bandhan Infrastructure Fund - Growth - Direct Plan

Bandhan Infrastructure Fund - Growth - Direct Plan is designed for investors looking to capitalize on the growth potential of the infrastructure sector. This mutual fund aims to generate long-term capital appreciation through a focused investment in equities of infrastructure-related companies. With a direct plan option, investors benefit from lower expense ratios, enhancing overall returns on lump sum investments. Its performance in the context of market trends makes it an attractive choice for those seeking substantial growth in their investment portfolio.

Bandhan Infrastructure Fund - Growth - Direct Plan fund also has good return potential. The less expense ratio is an added advantage for long term investors as it would provides better return.

Conclusion

Investing in mutual funds through a lump sum approach in 2024 offers significant potential for wealth accumulation, particularly in high-performing funds like Nippon India Small Cap Fund and Invesco India Infrastructure Fund. This strategy allows investors to capitalize on immediate market exposure and the power of compounding. While the potential for higher returns is enticing, it's essential to be mindful of the associated risks, such as market volatility and timing. By carefully selecting funds that align with individual financial goals and risk tolerance, investors can enhance their chances of achieving substantial long-term growth in their investment portfolios.

Unlock your investment potential with Enrich Money by diving into mutual fund stocks. Our user-friendly platform lets you open a complimentary Demat account, empowering you to enrich your portfolio with top mutual fund options. With Enrich Money, you can seamlessly tap into this booming sector and take confident steps toward securing your financial future.

Frequently Asked Questions

What are mutual fund lump sum investments?

Mutual fund lump sum investments involve a one-time payment to purchase units of a mutual fund. This strategy is often favored for its potential to generate significant returns over time.

Why should I consider lump sum investments in 2024?

Given the market's positive outlook for 2024, lump sum investments can capitalize on potential growth opportunities. Investing now may yield higher returns as markets recover and expand.

How do I choose the best mutual funds for lump sum investment?

Evaluate mutual funds based on past performance, expense ratios, and fund manager reputation. It's crucial to align your investment goals with the fund’s objectives and risk profile.

What are the risks associated with lump sum investments?

Lump sum investments can be riskier due to market volatility; a poor market entry may impact returns. Diversifying your investment across different funds can help mitigate this risk.

Is it better to invest a lump sum or through SIPs?

While lump sum investments can lead to higher returns in a bullish market, SIPs offer the advantage of averaging costs over time. Your choice should depend on your risk tolerance and market conditions.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.