Multibagger Penny Stocks in 2025: Navigating High-Potential Investments

With the fast-paced advancement of new technologies and upcoming markets, the investment scenario of 2025 is becoming more and more characterized by prospects of Multibagger penny stocks. These inexpensive but high-growth potential stocks fascinate investors looking for exponential returns. Let's dive into why these stocks are attractive and how you can strategically navigate your investment path.

What Are Multibagger Penny Stocks?

Multibagger penny stocks are stocks normally existing in small businesses, priced extremely low—many times in singles, or even cents—that have the potential to grow several folds in value. The term "Multibagger" indicates that an investment is capable of earning returns of three times, ten times, or even more of the initial upfront investment. While such stocks have the capability to turn a small investment into a big profit, they are by nature speculative and call for caution owing to their volatility.

Top Multibagger Penny Stocks in 2025

|

STOCK NAME |

LTP in INR |

Market Capitalization INR in Crores |

52 weeks High |

52 weeks Low |

Dividend Yield |

ROCE |

ROE |

PE ratio |

|

12.10 |

170 |

53 |

9.94 |

0.00% |

66.10% |

98.10% |

0.80 |

|

|

70.60 |

74 |

141 |

42.7 |

3.54% |

78.40% |

87.00% |

1.86 |

|

|

14.20 |

77.8 |

34.7 |

12 |

0.00% |

13.40% |

|

1.21 |

|

|

27.80 |

7260 |

28.9 |

22.1 |

1.08% |

6.50% |

13.80% |

5.57 |

Overview of Multibagger Penny Stocks

These shares are based in niche markets or early-phase businesses that frequently go unnoticed by mass investors. Their appeal lies in the potential for explosive growth after embracing pioneering technologies or fashions. But the embedded risk is huge, and their price volatility can be wild—making proper due diligence not only advisable, but necessary.

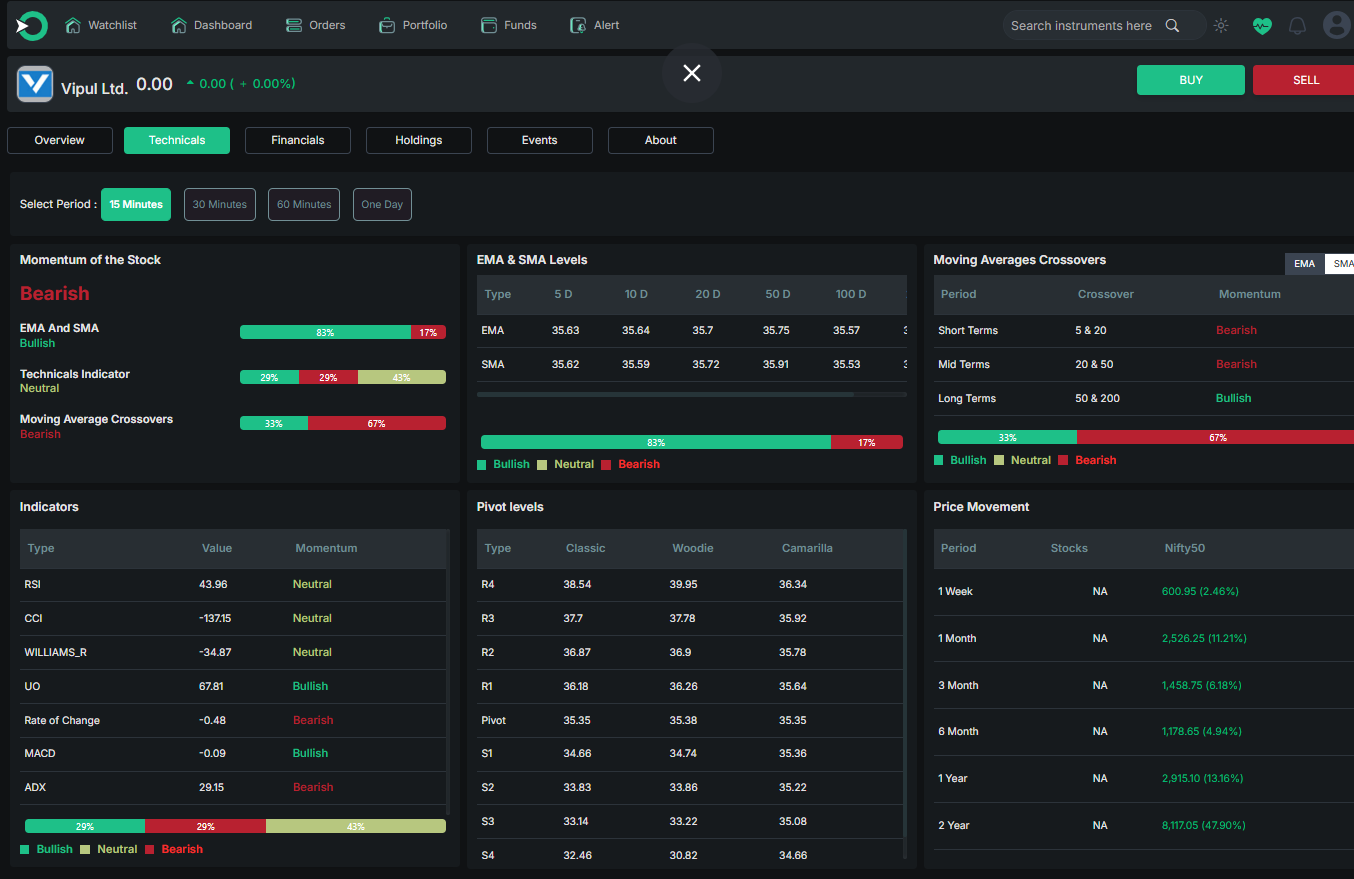

Vipul Limited: Multibagger Potential Assessment

Although Vipul Limited is valued at an incredibly low valuation (P/E of 0.80, P/B of 0.42) that could imply Multibagger potential, huge red flags cannot be overlooked. The precipitous drop in promoter holding from 63.43% to a mere 18.25% in three years indicates a damning vote of no confidence by insiders. Also, 30.7% of the remaining promoter shares are pledged.

The recent performance of the company reflects shocking operational decline with quarterly sales declining 92.83% YoY. Although reported profits look good (186% CAGR in 5 years), they are largely based on "other income" and not core business.

Worrying financial statistics include 439 debtor days and a very poor cash conversion cycle, reflecting underlying business issues. Contingent liabilities of Rs.481 Cr are more than the company's entire market cap (Rs.170 Cr).

Even with positive debt reduction and very high ROCE (66.14%), fundamentals do not justify sustainable growth. The odd mismatch between promoter actions, worsening operations, and accounting ratios indicates this penny stock poses extraordinary risk even though the tempting valuation is there.

Vipul Limited has more warning signs than solid Multibagger signs for 2025. Savvy investors should wait until the May 30th results and more evident operational improvement before considering this high-risk proposition.

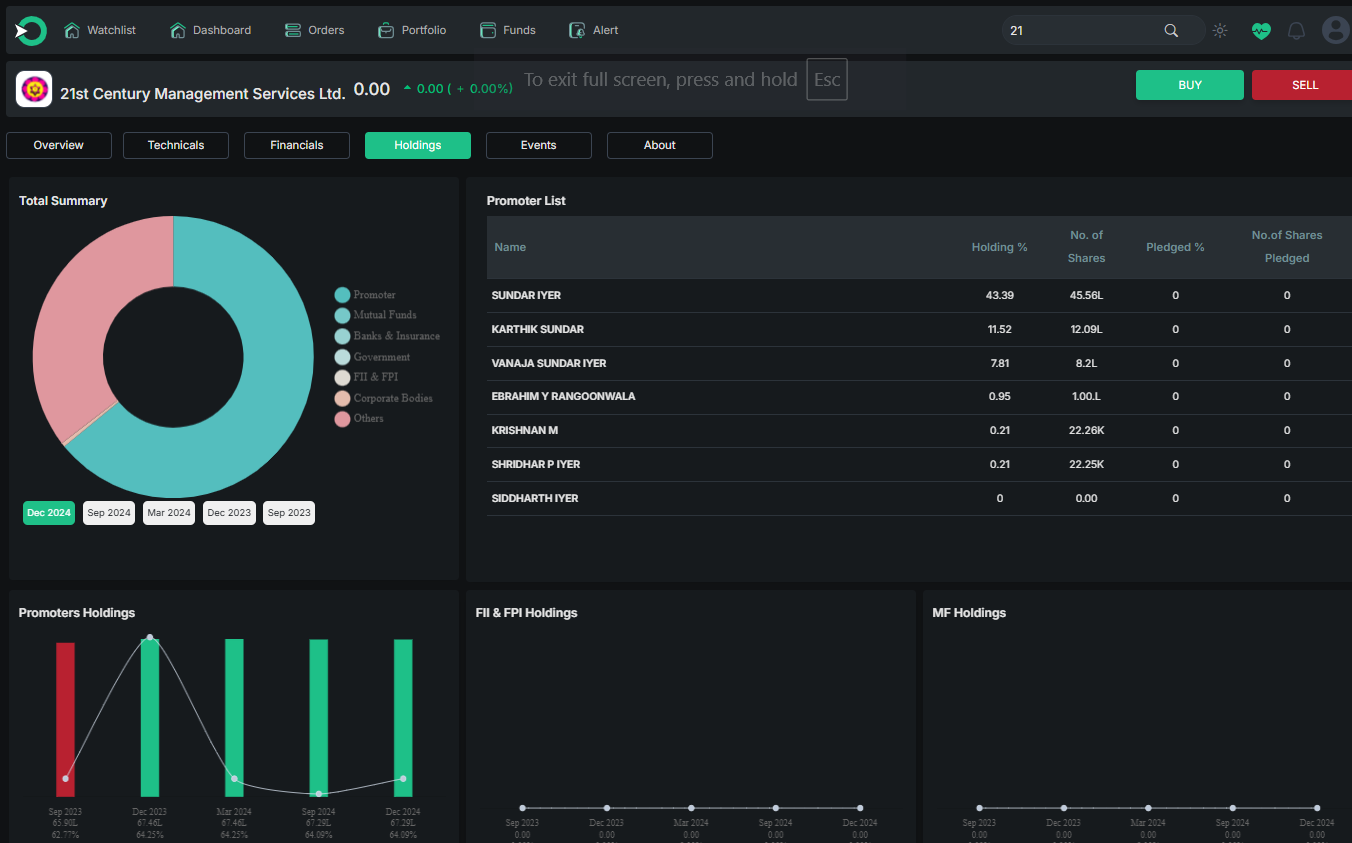

Twenty First Century Management Services: Multibagger Penny Stock Potential Analysis

At Rs.70.6 per share, Twenty First Century Management Services offers a compelling opportunity in the small-cap finance segment. The firm engages in capital markets, dealing on its own surplus capital in equity and derivatives segments.

Albeit its paltry market cap of Rs.74 crores, TFCMS has stunning financials that may indicate Multibagger potential. It’s very low P/E of 1.86 is far below the industry median of 21.96 and indicates tremendous undervaluation. The share is priced at only 0.78 times book value, offering a margin of safety.

Financial performance exhibits stupendous growth path with 5-year CAGR of 49.2% in its profit and 415% TTM profit growth. The business exhibits outstanding capital efficiency with a 78.4% ROCE and an 87% ROE, significantly outstripping industry comps.

A nice 3.54% dividend yield provides passive income attractiveness, while the promoters' high holding of 64.43% reflects management belief. The company has nearly no debt, its balance sheet solid.

Concerns of prime importance are volatility in quarter-wise performance (Rs.3.72 crore loss in December 2024), high debtor days (162 days), and working capital issues. The business model of the company also raises concerns as the company is not RBI-registered, although it's seeking an NBFC license.

With its stellar growth numbers, financial health, and profound undervaluation, TFCMS may well deliver Multibagger returns if operating stability increases and gets regulatory compliances.

Ind-Swift Limited: Multibagger Penny Stock Analysis

At Rs.14.2 a share and a market cap of a mere Rs.77.8 crores, Ind-Swift Limited offers a high-risk, high-reward possibility in the pharma industry. With an unimaginably low P/E ratio of 1.21 against the industry median of 37.81, the stock clearly looks grossly undervalued purely on the basis of earnings considerations.

The firm has recorded spectacular profit growth with a 309% hike in TTM numbers, indicating a turn for the better after years of financial instability. Quarterly performance is still erratic (Rs.5.50 crore loss in December 2024), but prior quarters reflected good profits, especially June 2024 (Rs.28.24 crores).

The key financial indicators paint a mixed picture: ROCE of 13.4% shows decent operational effectiveness, but the negative book value (Rs.-122) shows serious impairment of the balance sheet due to past losses. Still, the company has been able to steady operations and register positive cash flows in recent times.

What is interesting in Ind-Swift is the possible corporate trigger – a scheduled NCLT hearing on May 29, 2025, on amalgamation, which can be a major value-unlocking catalyst. The stable promoter holding of 55.58% indicates management commitment during testing times.

Key issues are heavy debt burden (Rs.1,023 crores), adverse equity position, contingent liabilities of Rs.72.4 crores, and dependence on other income for profitability. The turnaround of the company seems tenuous with uneven quarterly performance.

For risk-taking investors looking for Multibagger returns, Ind-Swift has the potential to generate spectacular returns if its plans for debt restructuring and amalgamation materialize but needs to be positioned extremely cautiously considering its weak financial health.

South Indian Bank: Multibagger Potential Analysis

South Indian Bank, incorporated in 1929, exhibits encouraging traits though it is a penny stock at its existing price of Rs.27.8. The bank possesses sound financial fundamentals with positive trends in asset quality parameters and steady growth in all areas.

The stock is trading at a wide discount to book value (P/B of 0.72), leaving room for appreciation. It has a low P/E of 5.57 relative to the industry median of 12.14, so it's hugely undervalued relative to peers.

The most noteworthy is the bank's five-year profit growth path - a resounding 65.7% CAGR, with the latest quarter result registering a 19% growth in net profit to Rs.342.19 crores. The asset quality has been consistently improving with gross NPAs coming down from 5.9% (Mar 2022) to 3.2% (Mar 2025) and net NPAs decreasing from 2.97% to 0.92% over the same horizon.

The bank has good capital adequacy at 16.04% and good net interest margin of 3.28%. Although its CASA ratio of 31.9% can still be better, the steadily increasing deposit base (currently Rs.107,526 crores) indicates increasing customer confidence.

With better operating metrics, falling NPAs, and high undervaluation, South Indian Bank has good potential for good price appreciation in the medium term and can possibly generate Multibagger returns for long-term investors who can ignore its penny stock tag.

Attributes of Multibagger Penny Stocks

Investors considering these high-potential stocks should be mindful of their unique characteristics:

Small Market Capitalization: Typically, these businesses have minimal market presence, but great potential upside if they grow.

Illiquidity: Trades can be infrequent, which results in significant price fluctuations with even small amounts of market activity.

Speculative Nature: Pricing can be subject to heavy swings based on market sentiment, news cycles, and new trends over more established fundamentals.

Dramatic Volatility: The potential for huge gains is matched by the danger of huge losses.

Hidden Value: Several Multibagger stocks may be undervalued, offering uncommon chances for early beneficiaries.

Recognizing these features is essential since it facilitates balancing the thrill of huge returns against the gravity of the risk.

Benefits and Dangers of Multibagger Penny Stocks

Investment in such stocks is a two-edged sword. Here's a balanced overview of the benefits and intrinsic risks:

Benefits

High Return Potential: The main attraction is the possibility of exponential returns, taking tiny investments and turning them into substantial profits.

Low Entry Point: Low stock prices enable investors to get in without needing a high capital outlay.

Early Adoption Opportunity: There's the thrill of being an early adopter of a company that could go on to dominate its market later.

Risks

Price Volatility: Market fluctuations can be extreme, causing sudden losses as well as gains.

Liquidity Issues: Low trading volumes can prevent it from being easy to carry out timely buy or sell orders.

Market Manipulation: The smaller volume of such stocks at times invites attempts at speculative manipulation.

Business Uncertainty: Most are in the early stages of development, with risks that can vary from competitive pressures to regulatory issues.

Investors need to consider these factors seriously and look at using a diversified approach to prevent possible negatives.

Should You Invest in Multibagger Penny Stocks? If Yes, Use Enrich Money

For those investors willing to confront the complex world of penny stocks, sites like Enrich Money can prove revolutionary. This tool provides:

Strong Data Analysis: Get insights into historical performance, market trends, and breaking news that could affect your investments.

Real-Time Monitoring: Receive notifications and monitor stock activity to respond quickly to market changes.

Educational Materials: Enhance your analytical capabilities with professional articles, tutorials, and market commentary.

By incorporating Enrich Money into your investment practice, you will be able to successfully navigate the intricacies of the Multibagger environment and maybe even find that Holy Grail among the penny stocks.

Conclusion

The potential of Multibagger penny stocks in 2025 is as thrilling as it is daunting. With the ability to transform small investments into staggering profits, these stocks appeal to those who are willing to tread the thin line of risk and reward. Success here depends on a scientific approach to research, a proper grasp of market forces, and the judicious application of contemporary financial tools such as Enrich Money ORCA. Keep in mind that with great potential comes great risk, and careful analysis and diversification are essential cornerstones of a healthy investment strategy.

FAQ

What constitutes a Multibagger penny stock?

It's an inexpensive stock which has the ability to increase your original investment many times over if the underlying business shows strong growth.

How do I know if a penny stock can be a Multibagger?

Analyze both the fundamentals (health of finances, competitive lead, management quality) and technical signals (volumes in the market, patterns of prices) in conjunction with keeping abreast of sector-specific trends.

What are the principal risks for such investments?

The risks involve high volatility, risk of liquidity problems, susceptibility to manipulations in the markets, and the inherent risks in early-stage firms.

Would tools such as Enrich Money assist in the identification of potential penny stocks?

Yes. Tools such as Enrich Money ORCA provide essential analytics, real-time monitoring, and learning tools that can assist you in making more educated and data-driven investment choices.

Where should Multibagger penny stocks occupy place in my overall investment plan?

They should be a minor, speculative component of a diversified investment plan—only for those willing to accept high risk.

As you venture into the Multibagger penny stock world, keep in mind that persistent learning and diligent research are your strongest supporters. 2025 market opportunities are bountiful for the shrewd investor willing to walk a tightrope between caution and the excitement of exponential growth. Good luck investing, and I hope your high-potential market journey is both informative and rewarding!

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.