Top 3 NBFC Stocks to Invest in India for 2024

Introduction

In recent years, the financial sector in India has had significant growth, especially with NBFCs becoming the center of promulgating new development. NBFCs have consolidated themselves as an effective source of funds for anyone who needs funds for business or other purposes and there are many differences from the banking structure. When investors intend to invest for better returns, the NBFC seems to be a better place to invest and get high gains. This article brings you into the vibrant world of NBFCs By analyzing the proposed scheme of things, we identify the best NBFC stocks to invest in India in 2024.

What are NBFCs?

An NBFC is a company that offers banking services like offering credit, providing credit facilities, and dealing with all kinds of instruments that a bank is supposed to, but it does not have a banking license. They are governed by the Reserve Bank of India (RBI) and these are important contributors to the growth of the economy through the financial dominion of various segments of customers. The NBFCs provide services in the capacity of consumer credit, auto loans, other business loans, financial planning, leasing, hire-purchase, insurance, and advisory services in wealth management. It would be worthwhile to note that NBFCs are not similar to the traditional banks and are governed by a different set of legal frameworks and possess different capital structures and lending abilities. Over the years, NBFC sector has witnessed steady growth and the increased penetration has helped in catering to customers in areas where incumbent banks were reluctant to go or have not bothered to go. There are also new avenues for widening the customer base with new NBFC business models and product offerings.

TOP 3 NBFC Stocks in 2024

Here is the list of the best 3 NBFC stocks in India to invest in for the future:

|

NBFC Stocks |

Mkt cap |

P/E ratio |

Div yield |

|

Bajaj Finance Limited |

4.54LCr |

31.11 |

0.0049 |

|

Shriram Transport Finance Company Limited |

1.03LCr |

13.96 |

1.65% |

|

Cholamandalam Investment and Finance Company Limited |

1.21LCr |

35.13 |

0.14% |

Overview of Top 3 NBFC Stocks

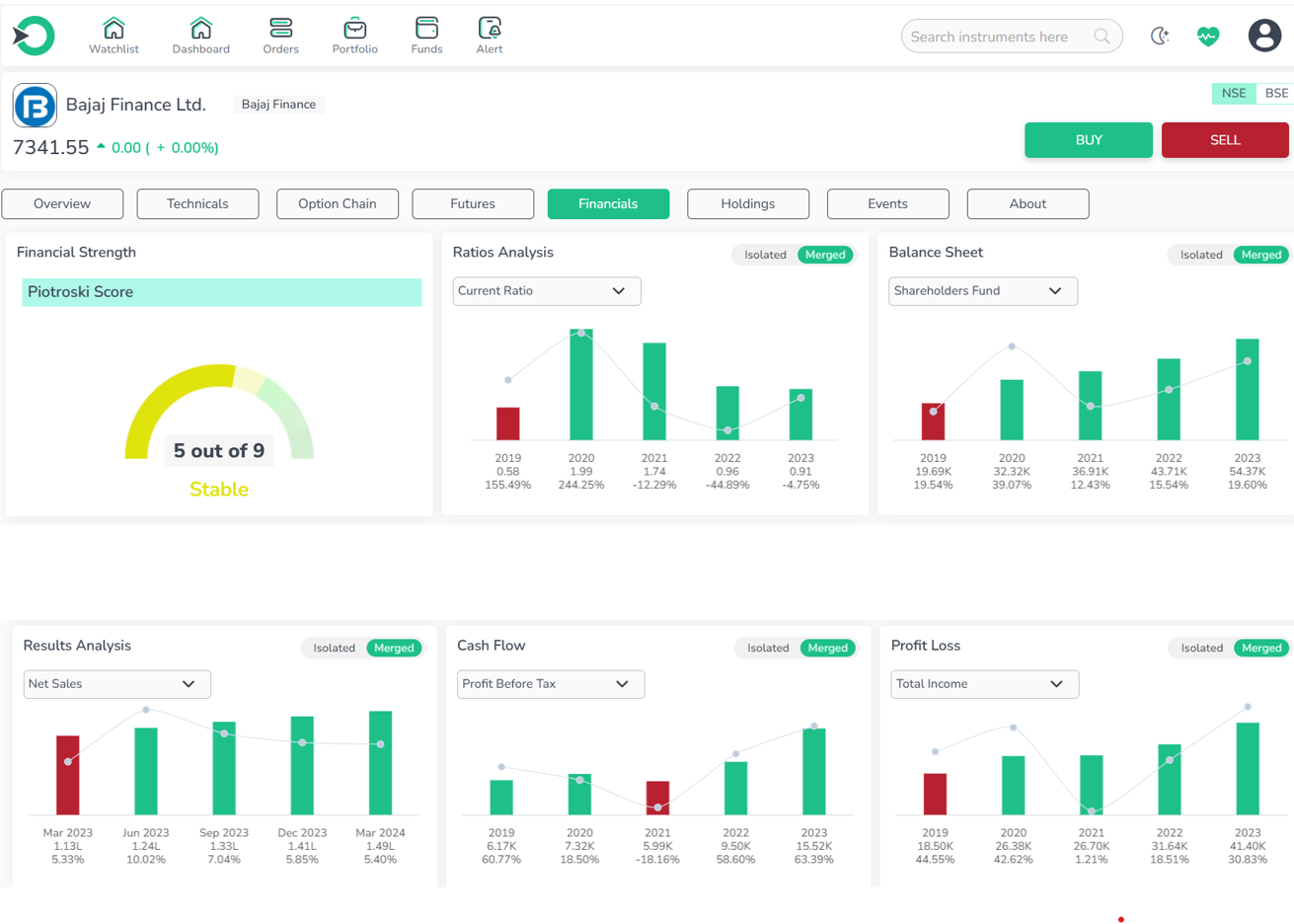

1. Bajaj Finance Limited

Bajaj Finance Ltd. (BFL), a subsidiary of Bajaj Finserv and authorized by the Reserve Bank of India (RBI), operates as a deposit-taking Non-Banking Financial Company (NBFC).It offers lending and deposit services to a diverse range of customers, including retail, SMEs, and commercial clients, with a significant presence across both urban and rural India.

-

The stock has performed poorly and is among the low performers.

-

It appears to be overvalued compared to the market average.

-

Financial growth is lagging behind the broader market.

-

Bajaj Finance Ltd. (BFL) shows average profitability, in line with industry norms.

-

The stock is overpriced but not currently in the overbought zone.

Based on the above points, despite some challenges in growth and valuation, Bajaj Finance Limited remains a top NBFC stock due to its strong market presence, diversified portfolio, and solid performance across urban and rural sectors, making it a compelling choice for long-term investment.

2. Shriram Transport Finance Company Limited

Shriram Transport Finance Company (STFC) is the primary company of the Shriram Group, celebrated for its extensive range of financial services.These encompass commercial vehicle financing, consumer finance, life and general insurance, stock broking, chit funds, and the distribution of insurance and mutual fund products.

-

The price return has been average, showing no significant excitement.

-

The stock appears overvalued compared to the market average.

-

Growth is lagging behind the market in terms of financial performance.

-

Profitability at Shriram Transport Finance Company (STFC) is average, demonstrating a balanced performance without significant deviations from industry norms.

-

The stock is currently underpriced and not in the overbought zone, indicating a good entry point.

Despite average price returns and profitability, Shriram Transport Finance Company (STFC) remains a top NBFC stock due to its prominent position in the financial sector and favorable entry point. Although currently overvalued and showing slower growth, its strong market presence and potential for future gains make it a compelling choice for investors.

3. Cholamandalam Investment and Finance Company Limited

Cholamandalam Financial Holdings Limited (CFHL), formerly TI Financial Holdings Limited, established in 1949, stands as a pivotal entity within the Murugappa Group, renowned for its extensive business diversification across India.

-

Price return has been average, lacking significant excitement.

-

The stock appears to be overvalued compared to the market average.

-

Growth is lagging behind the market in terms of financial performance.

-

Profitability is average, neither particularly impressive nor poor.

-

The stock is overpriced but is not in the overbought zone, suggesting a neutral entry point.

Despite average price returns and profitability, Cholamandalam Investment and Finance Company Limited remains a top NBFC stock. Its overvaluation and slower growth compared to the market do not diminish its standing, as it holds a solid position in the financial sector. While the stock is currently overpriced, its stable financials and market influence make it a strong choice for investors seeking a reputable NBFC.

Comparative Analysis : Bajaj Finance Ltd, Shriram Finance Ltd, and Cholamandalam Investment & Finance Company Ltd

Comparison Table: Key Metrics of NBFC stocks Over the Last 5 Years

|

Metric |

Bajaj Finance Ltd |

Shriram Finance Ltd |

Cholamandalam Investment and Finance Company Ltd |

Industry Average |

|

Annual Revenue Growth (%) |

26.55 |

17.49 |

18.71 |

14.25 |

|

Annual Net Income Growth (%) |

35.75 |

18.72 |

23.72 |

21.71 |

|

Market Share Growth (%) |

12.65 to 22.72 |

13.52 to 16.74 |

5.51 to 7.19 |

- |

|

Debt to Equity Ratio (%) |

410.07 |

475.98 |

683.1 |

384.47 |

|

Current Ratio (%) |

29.52 |

559.68 |

54.56 |

58.48 |

Insights and Comparison

-

Revenue Growth: Bajaj Finance Ltd. has shown the highest annual revenue growth rate of 26.55%, outpacing both the industry average (14.25%) and its peers.

-

Net Income Growth: Bajaj Finance Ltd. also leads in net income growth with a rate of 35.75%, significantly higher than the industry average of 21.71%.

-

Market Share Growth: Bajaj Finance Ltd. expanded its market share from 12.65% to 22.72% over the last 5 years, demonstrating robust market penetration.

-

Debt to Equity Ratio: Cholamandalam has the highest debt to equity ratio at 683.1%, well above the industry average (384.47%), indicating higher leverage.

-

Current Ratio: Shriram Finance Ltd. boasts the highest current ratio of 559.68%, reflecting strong liquidity compared to industry norms (58.48%).

In summary, while Bajaj Finance excels in revenue and net income growth as well as market share expansion, Shriram Finance showcases superior liquidity. Cholamandalam Investment and Finance Company demonstrates significant revenue and net income growth but operates with higher leverage. Each company's performance highlights its unique strengths and strategic positioning within the NBFC sector.

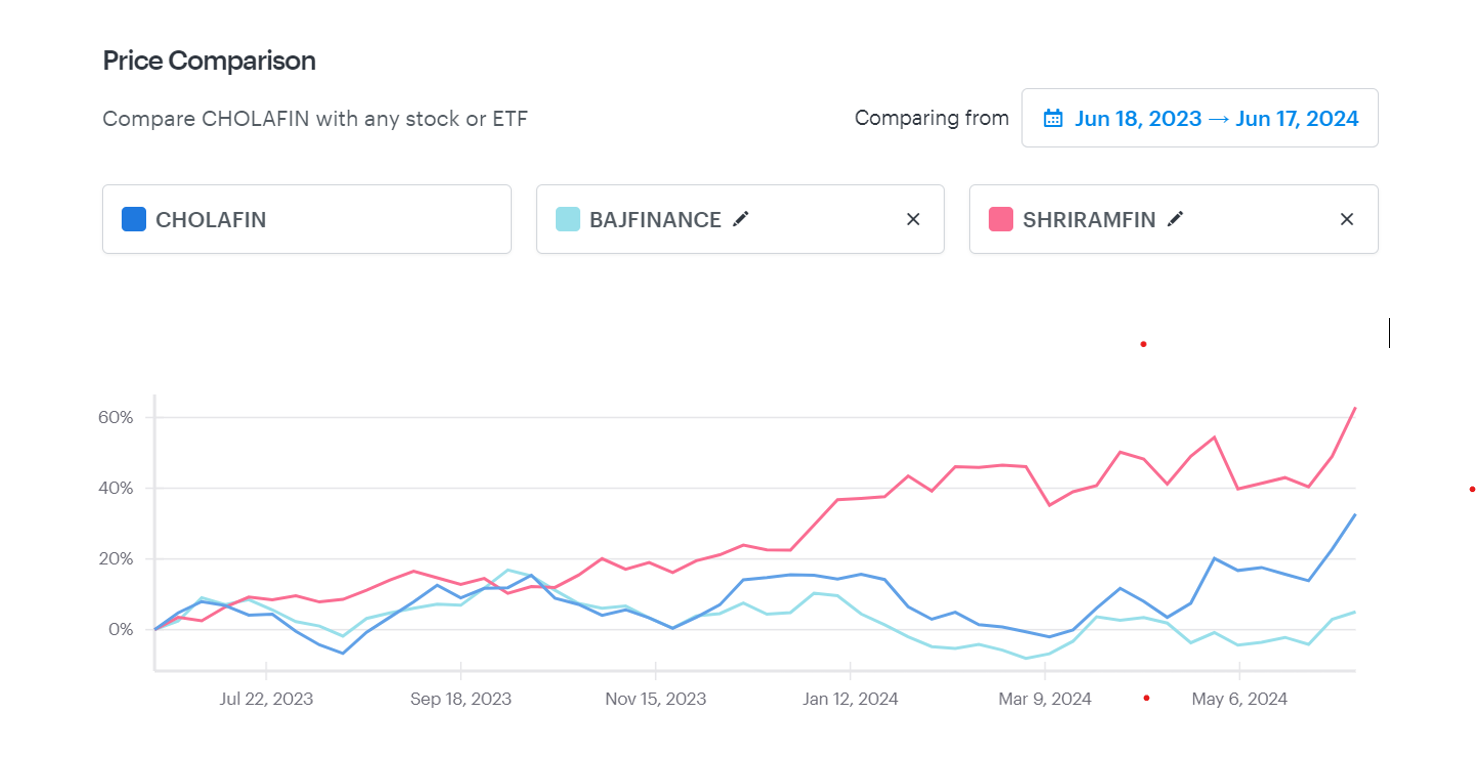

Snapshot of Price comparison of Bajaj Finance Ltd, Shriram Finance Ltd, and Cholamandalam Investment and Finance Company Ltd

How do I invest in NBFC sector stocks?

Investing in NBFC sector stocks can be done through several channels:

-

Direct Purchase: Open a demat account with a stockbroker or an online trading platform to buy shares of NBFC companies directly.

-

Mutual Funds: Invest in sector-specific mutual funds or diversified funds that include NBFC stocks for broad exposure.

-

Exchange-Traded Funds (ETFs): Buy ETFs that track the NBFC sector, providing a convenient way to invest in a basket of NBFC stocks.

Before investing, conduct thorough research on financial performance, asset quality, management, and growth potential of NBFCs. Evaluate your risk tolerance, diversify your portfolio, and align your investments with your financial goals to mitigate risks associated with the NBFC industry.

Who Should Invest in NBFC Sector Stocks?

NBFC sector stocks are best suited for investors with a moderate to high-risk tolerance and a long-term investment horizon of 3-5 years or more. These stocks are typically more volatile than traditional banking stocks due to their focus on niche lending and sensitivity to economic changes. They may not be ideal for those with low-risk tolerance or short-term financial goals. Investors should consider their financial objectives, risk appetite, and ensure portfolio diversification. Those with a strong understanding of the financial sector and a willingness to take calculated risks may find NBFC stocks an attractive addition to their investment portfolio.

Conclusion

Investors can capitalize on the burgeoning financial services sector in India by strategically selecting top-performing NBFC stocks and incorporating them into a diversified portfolio. Thoughtful research and strategic investments in these promising NBFCs offer the potential for substantial returns and sustained financial growth.

Frequently Asked Questions

-

What are the top 3 NBFC stocks to invest in India in 2024?

The top 3 NBFC stocks in India for 2024 are Bajaj Finance Ltd, Shriram Transport Finance Company Ltd, and Cholamandalam Investment and Finance Company Ltd. These companies have demonstrated strong market presence and potential for high returns in the financial services sector.

Please note: This list is provided for educational purposes and does not constitute investment advice.

-

How can I invest in NBFC stocks?

Investing in NBFC stocks involves understanding various types of NBFCs, analyzing their financial performance metrics, such as revenue growth, market capitalization, profitability, and debt levels. It's important to research how these companies operate within the financial sector.

-

Is it a favorable time to invest in NBFC stocks?

In the foreseeable future, NBFCs in India with robust business models, sufficient capitalization, effective underwriting practices, and a strong digital strategy are expected to sustain better growth and performance.

-

Are NBFC stocks potentially profitable for investors?

Yes, NBFCs operate in sectors like lending, insurance, and asset management, which can generate significant growth and profitability. Investing in well-managed NBFCs with sound risk management practices may lead to attractive investment returns over time.