Lab-Grown Diamonds: Stock Comparison & Trends in India's Jewelry Sector

India’s gems and Jewellery industry significantly supports the national economy, accounting for about 7.5% of GDP and contributing close to 14% of the country’s total merchandise exports.

This industry is an important source of employment, having increased its labor force from 5 million in 2020 to more than 8.3 million in recent times.

India continues to be a powerhouse in the diamond business, processing almost 90% of the world's diamond cutting and polishing — a tradition that reinforces its worldwide reputation.

Identified by the Indian government as a priority sector for exports, various supportive schemes have been initiated to promote international trade in this industry.

Foreign investors are allowed to invest 100% in this industry under the automatic route, which speaks volumes about India's pro-investment policies.

With the Comprehensive Economic Partnership Agreement (CEPA) signed with the UAE in March 2022, Indian Jewellery exports will increase, using duty-free access and hoping to triple trade with the region.

The Indian gems and jewelry industry is worth approximately $78.5 billion. Export numbers reached $39.14 billion in FY22, and there is an aim to achieve $70 billion within the next five years.

Recent government actions include the UAE trade agreement, revamping the SEZ Act, reducing custom duties on cut and polished diamonds (to 5% or zero), made hallmarking mandatory and introduced key reforms in gold monetization schemes and import duty structures.

An amendment under the Prevention of Money Laundering Act now requires dealers in precious metals and stones to maintain records of cash transactions over Rs.10 lakh, a move likely to promote more formalization in the sector.

The Rise of Lab-Grown Diamonds (LGDs)

Lab-grown diamonds are gaining popularity as consumers look for cheaper and more sustainable alternatives.

Ethics and Sustainability: LGDs appeal to consumers who care about ethical sourcing and sustainability, providing a cleaner and cheaper alternative to mined diamonds.

Same Physical and Chemical Properties as Natural Diamonds: These diamonds have the same physical and chemical properties as natural diamonds, with the only difference being that they are man-made.

Affordable Price Advantage: Lab-grown diamonds are almost one-tenth the cost of natural diamonds, a more affordable luxury for most buyers.

Youth-Led Demand: Gen Z and millennials are leading demand, prioritizing price and ethical sourcing yet still wanting diamond jewelry.

India's Increasing Role: India is growing as an important player in the international LGD market, with participation from players and entrepreneurs increasing.

Startup Ecosystem Leadership: India has 37 operating lab-grown diamond startups, leading the world in terms of startup numbers in this sector.

Fragmented Market: Although there is high growth, the Indian LGD market does not have a leader, and there is room for new brands and businesses to enter and establish themselves.

Unstable Pricing: Price volatility is one of the most significant challenges facing the sector, based on fluctuations in production costs and oversupply—recent drops of 25–30% demonstrate this risk.

Government Incentives: The Indian government is supporting the LGD industry with programs like the Production-Linked Incentive (PLI) scheme to ensure increased growth.

Key Companies and Players

Titan Company Ltd.

Titan, a part of the Tata group, is a well-known brand in India's Jewellery sector. The company has recently entered the lab-grown diamond segment with its brand 'Pome' by utilizing its robust retail network and customer loyalty to create traction in this new segment.

Rajesh Exports Limited

Rajesh Exports is a major player in gold refining and export businesses. Although it plays a critical role in the larger gems and Jewellery industry, it does not have much presence in the lab-grown diamond space as of now.

Kalyan Jewellers Limited

Kalyan Jewellers specializes in regionally customized Jewellery across India. Although the company is gold and traditional diamond Jewellery driven, it has recently started venturing into growing opportunities in the diamond and possibly lab-grown diamond sectors.

Vaibhav Global Limited

Vaibhav Global primarily caters to Western markets such as the U.S. and U.K. by offering affordable fashion Jewellery. While it is classified under the diamonds and gems sector, its involvement in the lab-grown diamond space remains limited at present.

Thangamayil Jewellery Limited

With operations mainly in South India, Thangamayil Jewellery has been growing its presence with new stores. It is slowly building up interest in diamond Jewellery, with potential interest in the lab-grown category as part of its diversification strategy.

Goldiam International Limited

Goldiam has established itself as a leading supplier of lab-created diamond Jewellery, particularly to large retail chains in the United States. The firm is now entering India's organized retail sector, with strong financials and good margins and minimal debt. It is one of the top contenders among LGD-focused firms and has received significant investor interest.

PC Jeweller Limited

PC Jeweller is an established Jewellery brand that sells a range of traditional and diamond Jewellery. Though it has a large market presence, it has not entered the lab-grown diamond segment in a meaningful way so far.

Renaissance Global Limited

This firm deals in designing and exporting branded Jewellery globally. It is slowly entering the lab-grown diamond segment and is known for its export-based model and innovative product lines.

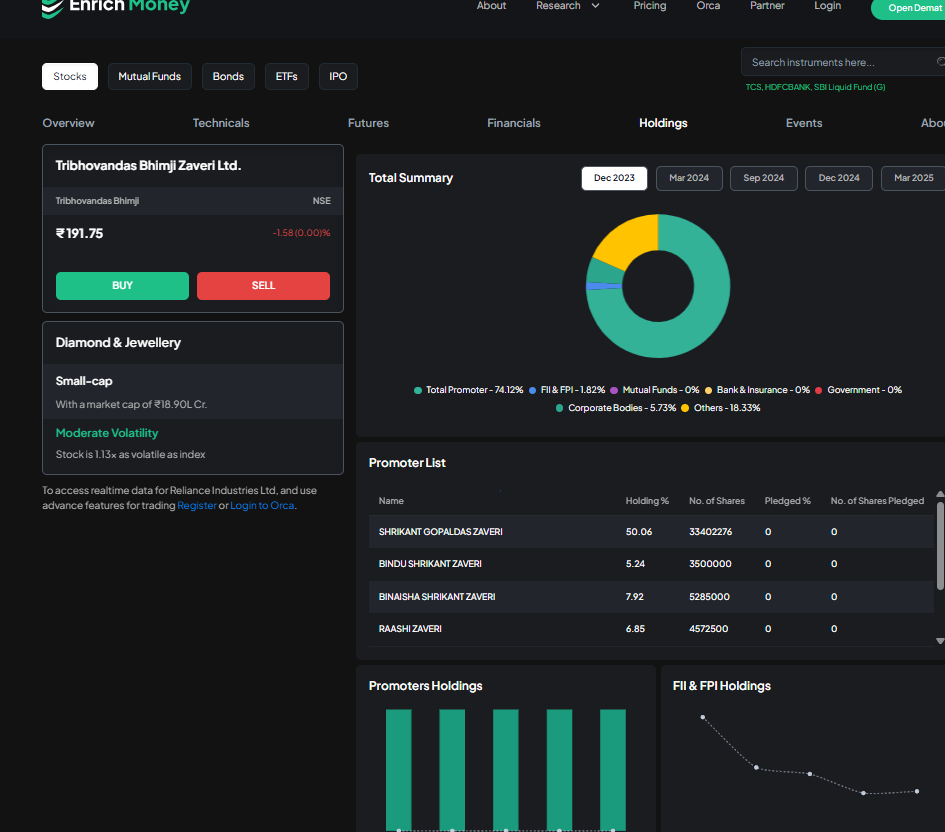

Tribhovandas Bhimji Zaveri (TBZ) Limited

TBZ is an India-based heritage jewelry brand, and it specializes mainly in gold and diamond collections. While the company has a large product range, it still has its focus on natural diamonds instead of man-made diamonds.

Radhika Jewels Limited

Radhika Jewels is a mid-cap listed company in the Indian Jewellery space. Though present in the overall gems and Jewellery industry, there are no significant developments at the moment connecting it to the lab-grown diamond space.

Trent Limited

Trent Ltd., a key player from the Tata Group, is known for its popular fashion retail chains like Westside and Zudio. It has recently ventured into the lab-grown diamond market by introducing its brand 'Pome' in its fashion retail outlets. While apparel remains its primary business, this moves signals a deliberate expansion into the Jewellery retail space.

International Gemmological Institute (India) Limited (IGI)

IGI is a significant independent organization charged with certifying diamonds and jewelry in India. It holds a leading position in the lab-grown diamond certification industry, commanding a substantial market share and serving as a key authority in ensuring product authenticity and quality standards. Supported by Blackstone, the institute is spreading its wings on a global level, although recent price corrections on LGDs have affected its performance temporarily.

Top Lab-Grown Diamond Stocks in May 2025

Top Lab Grown Diamond stocks are selected based on piotroski score of greater than 7, which indicates the financial strength of the stocks.

|

Stock Name |

Market Capitalization in INR Crores |

Close Price in Rs. |

TTM PE |

1 Year ROE |

5 Years ROE |

Net Profit Margin % |

|

296522 |

3299.3 |

90.52 |

33% |

27% |

40% |

|

|

53928 |

502.25 |

86.23 |

15% |

10% |

81% |

|

|

14753 |

329.4 |

33.8 |

32% |

50% |

25% |

|

|

5457 |

187.72 |

144.81 |

2% |

8% |

-131% |

|

|

1298 |

189.7 |

17.7 |

9% |

7% |

131% |

Key Financials

|

Stock Name |

Piotroski score |

Dividend Yield |

TTM EPS in Rs. Crores |

ROCE |

5 Years CAGR |

|

8 |

0.33% |

36.62 |

23% |

32% |

|

|

8 |

0.23% |

6.15 |

14% |

- |

|

|

7 |

0.71% |

10.16 |

43% |

44% |

|

|

8 |

0.00% |

-0.73 |

3% |

-19% |

|

|

9 |

0.88% |

11.19 |

11% |

56% |

Overview of Top Lab Grown Diamond Stocks

Titan Company Limited

Market Position: Rs.296,522 crores market cap - Unambiguous industry leader

Strengths: Industry domination, stable growth profile (32% CAGR), superior profitability ratios, superior financial health

Weaknesses: Premium valuation of 90.52 PE, priced at 30.4x book value, low dividend yield

Outlook: Even with premium valuation, Titan's market dominance, stable superior returns and superior financial health make this a core holding for long-term growth investors

Investor Profile: Best suited for growth-oriented investors comfortable with premium valuations and those not primarily focused on high dividend yields.

Kalyan Jewellers India Limited

Market Position: Rs.53,928 crores market cap - Second largest player.

Strengths: Strong market position, high Piotroski score, enhancing operational efficiency (working capital decline)

Weaknesses: High valuation with modest returns (14% ROCE), low dividend, scarce long-term performance data

Outlook: Second-largest market cap with better efficiency implies growth prospects, but premium valuations require rationale through sustained performance

Investor Fit: Ideal for growth investors seeking long-term potential and momentum investors looking to capitalize on upward stock trends, even at premium valuations.

International Gemmological Institute (India) Limited

Market Position: Rs.14,753 crores market cap - Mid-sized specialist.

Strengths: Outstanding ROCE (43%), industry-leading 5-year CAGR (44%), highest dividend yield, nearly debt-free, robust and consistent ROE (48.8% over 3 years)

Weaknesses: Working capital management erosion (78.6 to 175 days)

Outlook: Provides the optimal mix of growth, profitability and value, with its 44% CAGR and moderate valuation offering huge upside potential

Investor Fit: Growth-at-reasonable-price (GARP) investors, balanced portfolios wanting growth with a dash of income

Rajesh Exports Limited

Market Position: Rs.5,457 crores market cap - Second smallest in group

Strengths: Nearly debt-free, 0.35x book value (deep discount) trading

Weaknesses: Negative earnings, negative profit margin, negative growth trend, weak returns, no dividend despite the Piotroski score

Outlook: In spite of the favorable book value and high Piotroski score, the deterioration in fundamentals across several metrics suggests this is probably a value trap

Investor Fit: Distressed asset experts only, avoid for regular investors

Tribhovandas Bhimji Zaveri Limited

Market Position: Rs.1,298 crores market cap - smallest player in group

Strengths: Boasts the highest Piotroski score of 9 (indicating strong fundamentals), trades at the lowest PE multiple in its segment, delivers the highest dividend payout, and has achieved an impressive 56% CAGR over the last five years.

Weaknesses: Low past ROE (6.95% for 3 years), moderate ROCE (11%)

Outlook: Best Piotroski score with lowest valuations and highest 5-Year CAGR implies a great turnaround story, with the dividend acting as a cushion on the downside

Investor Fit: Ideal for value investors seeking undervalued opportunities, income investors focused on consistent dividends, and special situation investors looking to capitalize on unique market conditions or turnaround scenarios.

Comparative Ranking (Best to Worst)

1. International Gemmological Institute (India) Ltd. - Ideal combination of growth (44% CAGR), profitability (43% ROCE), and affordable valuation (33.8 PE)

2. Titan Company Ltd. - Strong market leader at a premium price with good growth and returns

3. Tribhovandas Bhimji Zaveri Ltd. -Demonstrates a strong turnaround backed by solid financial health and attractive valuation, making it a compelling choice for discerning investors.

4. Kalyan Jewellers India Ltd. - Potential growth with operational refinement, but at high valuation

5. Rajesh Exports Ltd. - Several underlying problems notwithstanding good book value

Key Takeaways

India’s diamond and gems & Jewellery industry is a key pillar of the nation’s economy, backed by robust government support and a dominant position in global exports.

Lab-grown diamonds (LGDs) are becoming a revolutionary trend, with increasing momentum because of their affordability, sustainability, and growing popularity—particularly among Millennials and Gen Z shoppers.

Although India remains the world leader in cutting and polishing diamonds, focus is quickly turning toward domestic LGD production and retail.

The landscape of LGDs in India is changing fast and no single market leader has yet emerged—setting up rich terrain for both mature names and quick-footed new players.

Diamond-related stocks have investors looking on with interest who need to weigh key considerations such as a firm's financial resilience, alignment to industry trends, retail presence, and global coverage.

Industry majors like Titan, Goldiam International, Senco Gold, Trent, and Dev Labtech are actively increasing their presence in the LGD industry.

Industry certifiers such as the International Gemological Institute (IGI) play crucial roles in authenticating quality, even though recent fluctuations in LGD prices and new product demand dynamics create operational complexities.

The industry does have risks, such as volatile LGD pricing, dynamic regulations, and supply issues in natural rough diamonds.

However, India's age-old leadership in this sector, along with rising consumer purchasing power, keeps the sector in good shape for long-term growth. With careful due diligence, one can identify sound opportunities within this sector.

For in-depth exploration of stock-specific analysis and trends in lab-created diamond investments, look at information about Enrich Money. You can also start investing by using a free Demat account and zero annual maintenance charges.

Frequently Asked Questions

What does Indian diamond stock investment analysis entail?

Investment analysis in diamond stocks entails the analysis of companies on the basis of financial stability, industry patterns, and market presence.

How speculative are diamond stocks?

Diamond stocks are extremely speculative because market fluctuations are fueled by demand and supply.

What are the important factors that should be analyzed by investors in diamond stocks?

Company fundamentals, retail networks, global presence, and exposure to lab-grown diamonds should be considered by investors.

How do lab-grown diamonds affect the industry's investment horizon?

Lab-grown diamonds offer opportunities for growth but bring in pricing, supply, and market acceptance risks.

Are Indian diamond stocks a secure investment?

Indian diamond stocks can be an investment with due diligence and risk management, but they come with market-related risks.

Reated Stock:

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.