Jewellery Penny Stocks to Watch in 2025: Hidden Gems of the Stock Market

Gold Jewellery Penny Stocks

Penny stock Jewellery companies are small-cap firms that are low-valued and belong to the Jewellery sector, offering high-risk but high-reward prospects. During 2025, parameters such as growing demand from consumers, growth in exports, and sales in the festive season may boost the performance of some of the small-cap Jewellery stocks. Investors need to scrutinize the fundamentals of the companies as well as the market conditions before investing in these risky shares.

Key Characteristics of Top Jewellery Penny Stocks

Top Jewellery penny stocks usually have high growth potential based on their low-price valuations and increasing market demand for Jewellery goods.

Increasing Market Demand: Firm consumer demand for Jewellery backs potential appreciation in stocks.

Brand Power: Popular and reliable brands tend to provide more stability.

Strong Financials: Good financials and little debt improve long-term sustainability.

Creative Product Lines: Firms with creative and trendy designs attract more customers.

Growth & Expansion Strategies: Firms that have well-defined and strategic expansion strategies are poised for increased future stock price appreciation.

Advantages of Jewellery Penny Stock Investment

Jewellery penny shares have great potential for upside as they are cheap to buy and have the chance to grow fast.

Low Price Requirement: Investors can begin with low capital, which is suitable for novices.

High Growth Opportunities: The stocks can yield big returns if the business grows well.

Diversification: Including penny stocks in your investment portfolio diversifies risk among various market segments.

Easy Market Entry: Suitable for novice investors wanting to access the stock market.

Potential Undervaluation: Certain stocks are trading at their actual value, with long-term potential.

Risks of Jewellery Penny Stock Investment

Though promising, Jewellery penny stocks involve greater risks because of market volatility and other considerations.

High Volatility: Prices can change suddenly, resulting in unpredictable returns or losses.

Low Liquidity: Thin trading volumes can make it difficult to quickly sell or purchase shares.

Lack of Transparency: Inadequate financial and operating information heightens investment risk.

Regulatory Uncertainty: Regulations in the industry can shift, affecting company performance.

Fraud Risk: Certain penny stocks can be tied to scams, and due diligence is essential.

Best Jewellery Penny Stocks NSE

Investment in Jewellery penny stocks can be made by beginning with opening a free demat and trading account with Enrich Money. Properly research the companies, study market trends, and estimate risks involved prior to making any investment.

Let’s begin with analyzing top Jewellery stocks in India.

|

Jewellery Penny Stock |

CMP Rs. |

Mar Cap Rs.Cr. |

ROE 5Yr % |

5Yrs return % |

Profit Var 5Yrs % |

EPS Var 5Yrs % |

ROE % |

ROCE % |

P/E |

|

14.37 |

120.3 |

11.85 |

27.06 |

9 |

9.7 |

10.03 |

13.2 |

14.2 |

|

|

21.61 |

2125 |

13.08 |

|

68.69 |

55.24 |

11.64 |

14.52 |

49.2 |

|

|

14.02 |

9169 |

-2.93 |

53.04 |

47.49 |

34.11 |

12.66 |

6.53 |

15.8 |

|

|

83.82 |

987.8 |

17.8 |

88.2 |

41.79 |

41.79 |

20.46 |

25.78 |

16.4 |

|

|

54 |

99.88 |

8.17 |

15.39 |

17.98 |

15.45 |

7.96 |

10.48 |

22.3 |

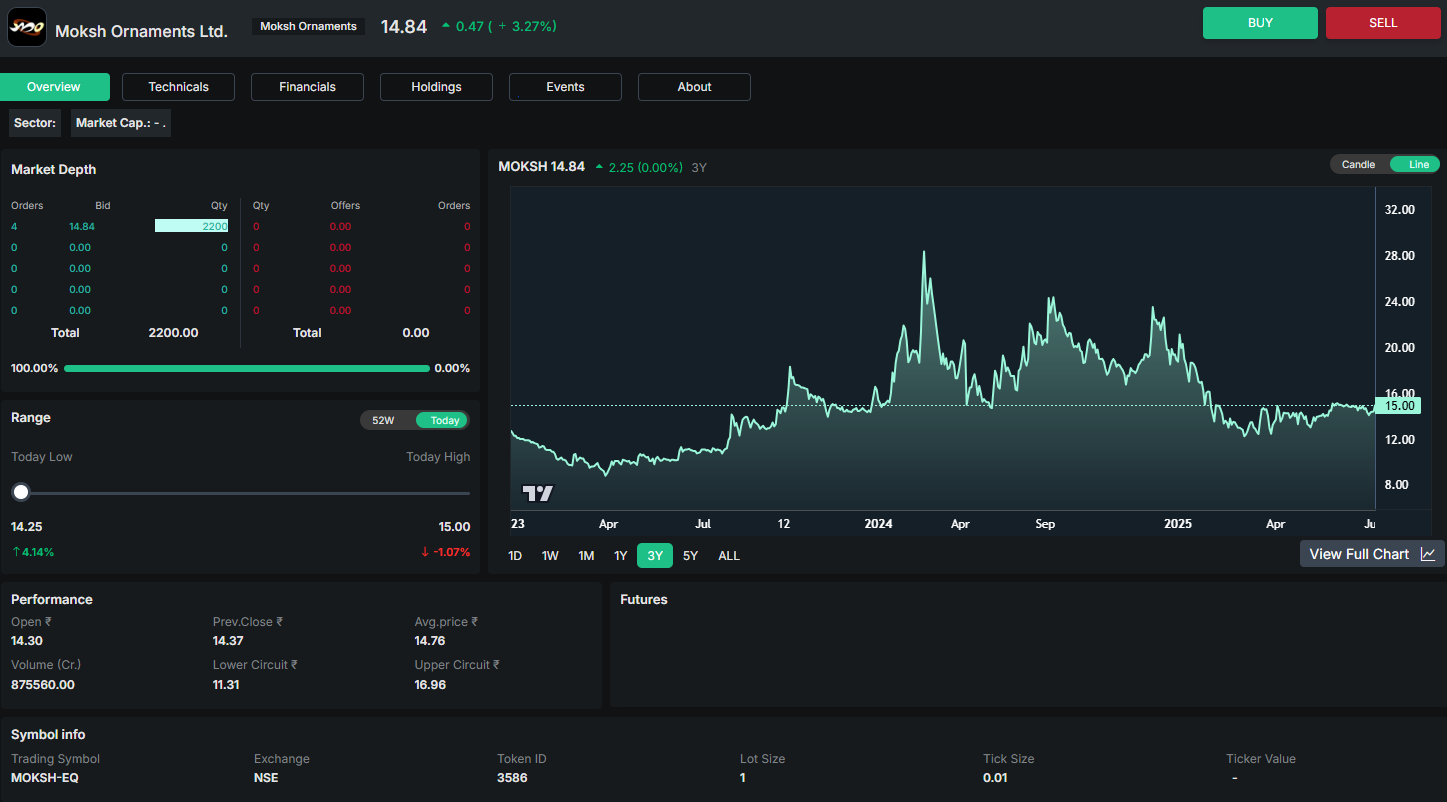

Moksh Ornaments Ltd.

Moksh Ornaments produces and retails light jewellery made of gold, targeting Mumbai jewellery markets.

Moksh Ornaments has shown consistent revenue and growth in profit compounded in the last 5 years. The capital efficiency of Moksh Ornaments is moderate. Moksh Ornaments has improved its debtor days by strengthening its balance sheet by reducing its debt. Though Moksh Ornaments has not paid a dividend , its EPS has grown steadily. Recently, the promoter holding has declined and is low which raises as a concern. Fair valuation of the stock which is trading close to its book value. Finally, Moksh Ornaments possess stable fundamentals with average growth which can be suitable for cautious investors who seek steady performers in the jewellery sector.

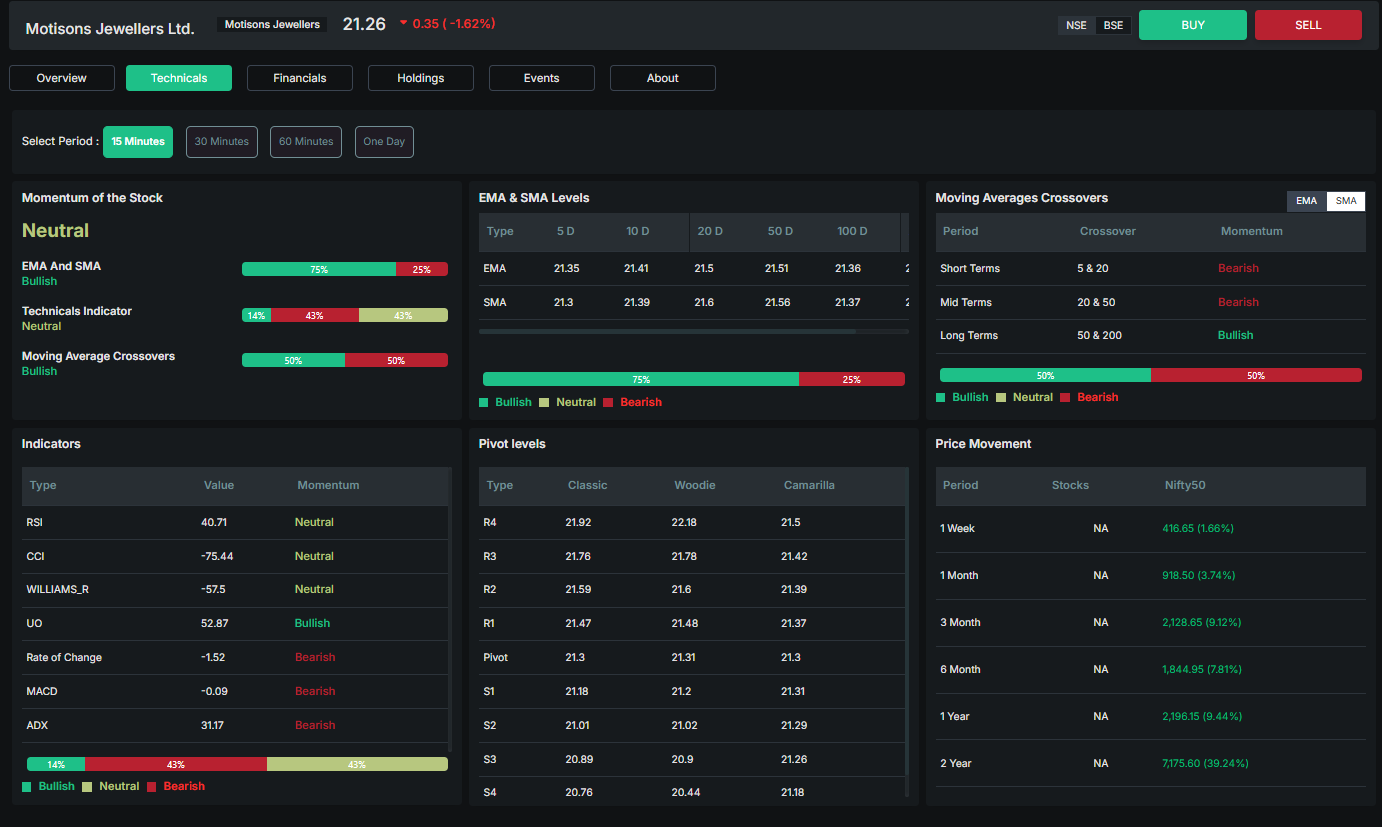

Motisons Jewellers Ltd.

Motisons Jewellers is a jewellery retail chain from Jaipur selling various collections of gold, silver, diamond, and gemstone jewellery.

Motisons Jewellers has exhibited tremendous business momentum reflected through its consistent compounded 5-year profit and EPS growth. The capital efficiency is good but less than the sector. Motisons Jewellers stocks are highly overvalued in relation to its earnings. Stock prices are sold at a premium. Finally, Motisons Jewellers possess strong business growth but the current stock price is over valued which is a risk . Investors can monitor the stock for price correction before investment.

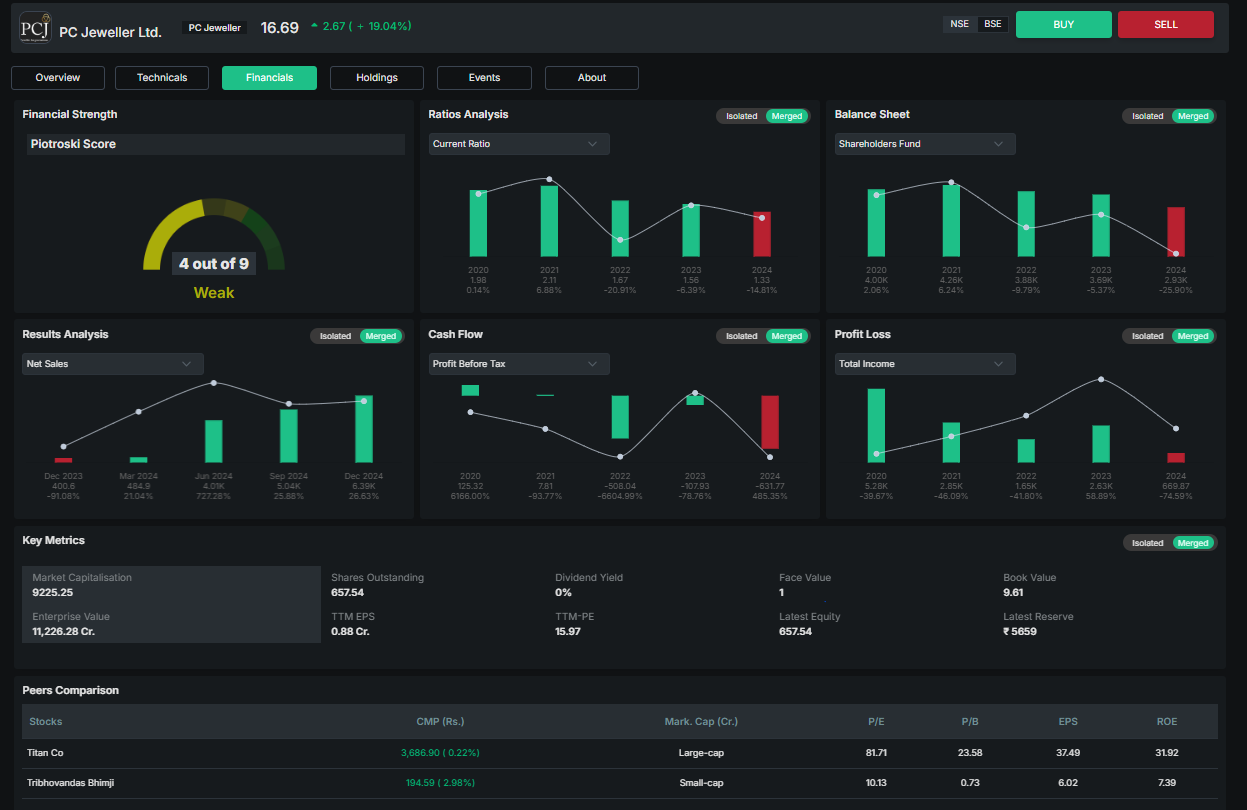

PC Jeweller Ltd.

PC Jeweller is a Delhi-based jewellery company dealing in the designing, production, and sale of diamond ornaments and gold ornaments in India.

PC Jewellers has exhibited recovery from its previous set back through its compounded 5-year return and profit growth. The capital efficiency is reasonably moderate with history of negativity and business challenges. Stock valuation indicates the overvaluation but exhibits strong book value. Recently, PC Jewellers has shown a recent uptrend in profitability and operational metrics. Finally, Past volatility and overvaluation warrants caution with recent improvements in fundamentals. Suitable for risk tolerant investors.

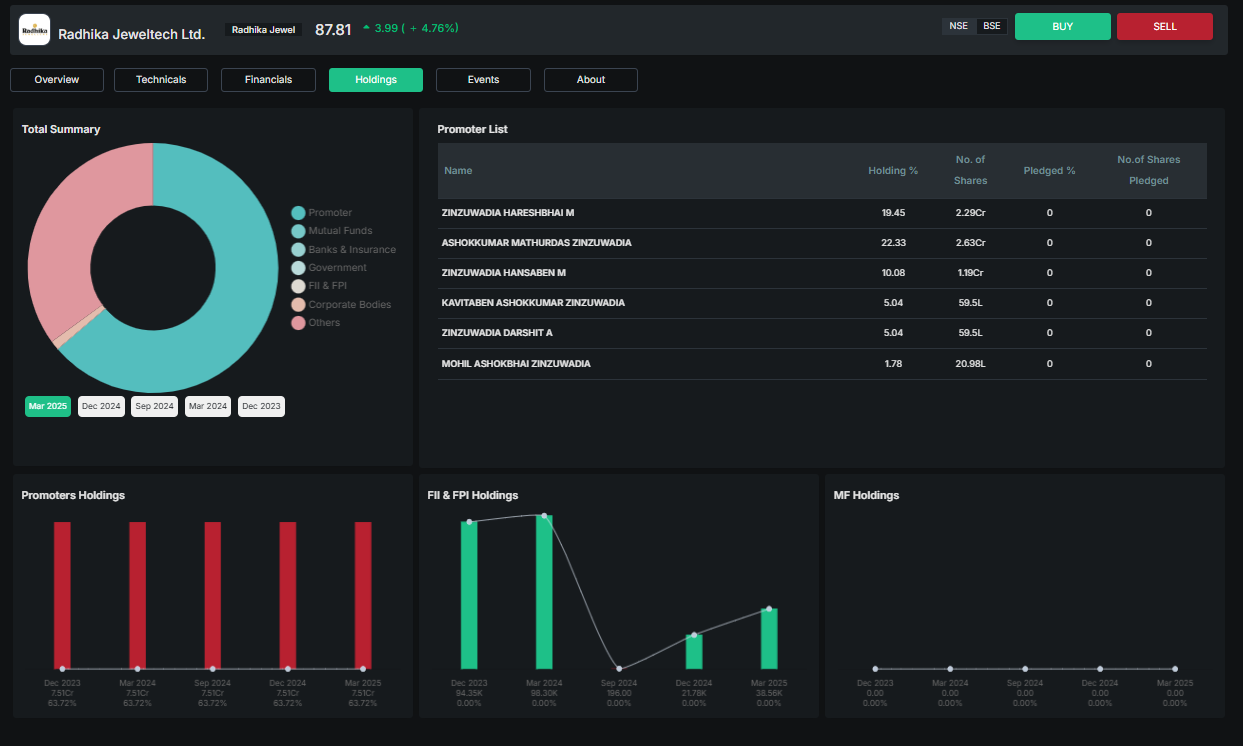

Radhika Jeweltech Ltd.

Radhika Jeweltech is a Gujrat-based jewellery retail chain dealing in traditional and modern gold and diamond patterned jewellery.

Radhika Jewel has exhibited exceptional compounded 5-year return and strong profit growth. The capital efficiency indicates superior best in class returns. The stock is moderately overvalued. Radhika Jewels has exhibited strong operational performance with consistent growth in sales and earnings. Finally, though the stock possesses risk of over valuation , Radhika Jewels possess strong fundamentals, which is attractive for long term investments at times of dips and market corrections.

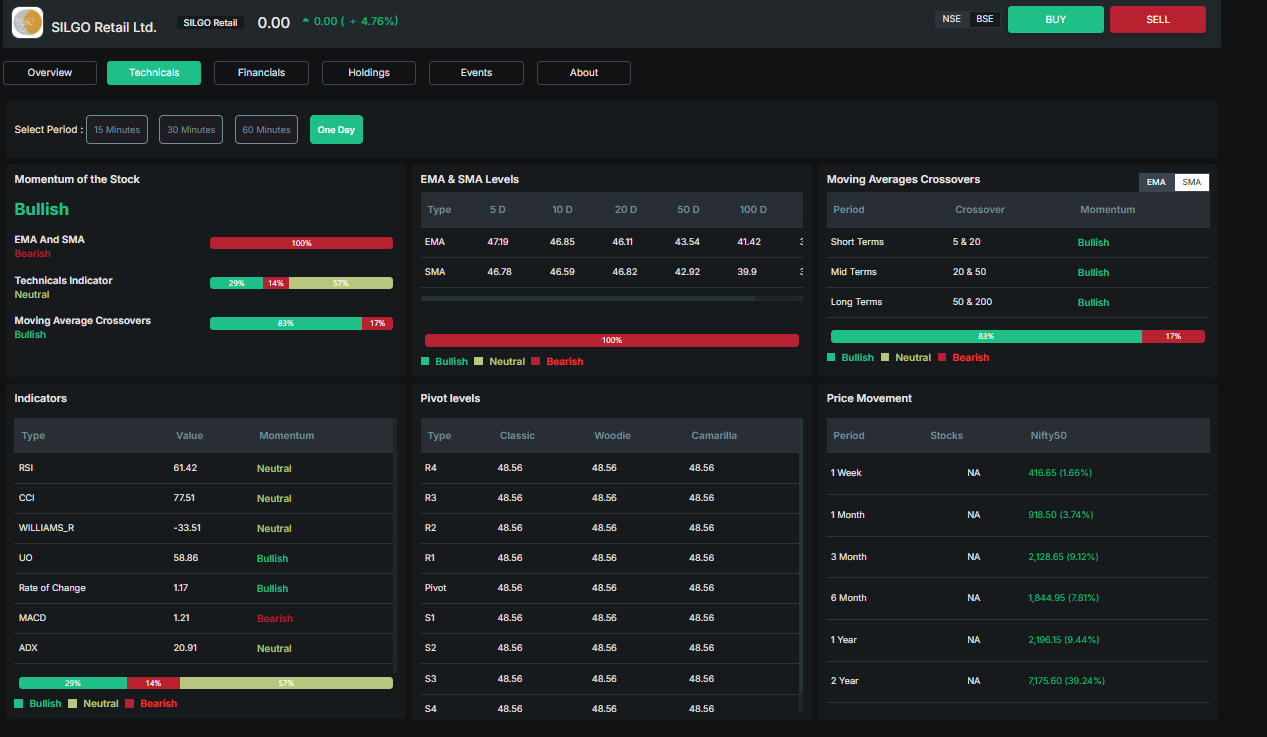

SILGO Retail Ltd.

SILGO Retail designs, produces, and markets sterling silver jewellery through its offline stores and web sites in India.

SILGO Retail has declined promoter holding and with no dividend pay out even at times of profit. The capital efficiency is at the lowest with stock overvalued. Though SILGO Retail is debt free , it has not published any returns in the last few years. Finally , SILGO Retail is stable with average fundamentals but no exemplary growth. Suitable for investors seeking low debt stocks.

Conclusion

Indian jewellery market in 2025 is a promising mix of proven leaders and growth-potential penny stocks and thus a highly active sector to invest in. The top jewellery shares in India like Titan, Kalyan Jewellers, and PC Jeweller occupy the first rank in the jewellery companies list in India and jewellery share list for long-term stability and growth. For risk-taking investors seeking greater risk and potential out-sized returns, Jewellery penny stocks India such as Motisons Jewellers, Moksh Ornaments, and PC Jeweller stand out on the jewellery stocks list with price and are tracked among jewellery penny stocks NSE. These gold Jewellery penny stocks and Jewellery penny stocks under 10 rupees offer market entry with low capital but require prudent fundamental analysis due to volatility and liquidity risk. Overall, combining the highest jewellery penny stocks with major names among the top 5 Indian jewellers can help investors diversify and capture sector expansion in 2025.

Frequently Asked Questions

Where do I get a list of jewellery shares along with their prices?

You can obtain a list of jewellery shares along with price information on Enrich Money platform.

Which jewellery penny stocks below 10 rupees are popular in India?

Some of the jewellery penny stocks below 10 rupees are PC Jeweller and regional small caps that could be found on NSE.

Are there any gold jewellery penny stocks in India that are worth tracking?

Indian gold jewellery penny stocks such as Moksh Ornaments and SILGO Retail are of interest due to their specific market niches.

How can I follow the jewellery penny stocks NSE and their current prices?

You can monitor jewellery penny stocks NSE and jewellery stocks list with price with Enrich Money

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.