Indian Tyre Industry 2024: Key Stocks and Market Trends to Watch

Tyre Industry in India

Overview:

The Indian Tyre industry consists of 41 companies with an industry turnover of USD 11 billion in FY 2022-2023 and export of USD 2.9 billion in FY 2022-2023.

The Indian tyre industry is driven by various factors like increasing vehicle production, increasing demand for tyre replacement and expansion of infrastructure projects. Also, the ongoing recovery of the automobile sector, demand for original equipment manufacturers and replacement markets are supporting the Indian Tyre industry.

Trends and Developments of Indian Tyre Industry in 2024:

-

The post covid recovery of the automobile industry with the increase in production of electric vehicles, is boosting the demand for tyres.

-

As vehicle usage increases, the need and demand for replacement tyres also increases.

-

The quality and competitive pricing of Indian tyre manufacturers have increased the demand for India made tyres in the international market, thus growth in tyre exports.

-

In 2024, due to the fluctuation in price of tyre raw materials like natural rubber and crude oil, have proportionately increased the tyre production costs. The tyre manufacturers are framing strategies to manage the cost effectively.

-

Tyre manufacturers are investing in R&D in order to develop high-performance, fuel-efficient tyres addressing the need for the EV segment.

-

The Indian tyre industry is forecasted to grow at a CAGR of 6 % to 8% over the next few years.

Tyre Manufacturing Companies Stocks in India

The rapid expansion of the Indian automotive industry has driven up demand for high-quality tyres, creating a competitive market with numerous companies. This article highlights top tyre manufacturing company stocks in India for potential investment. It also analyses three key tyre stocks. For in-depth insights into these stocks' strong fundamentals, investors can use the Enrich Money Orca app, which provides valuable information for making informed investment decisions in India's Tyre manufacturing market.

Let’s analyze the three tyre stocks from the above list.

Unlock your financial potential with Enrich Money's advanced digital investment platform Orca . Start your journey to wealth with a free demat trading account, powered by Enrich Money's expertise in innovative wealth management technology

Intraday Price Comparative Analysis

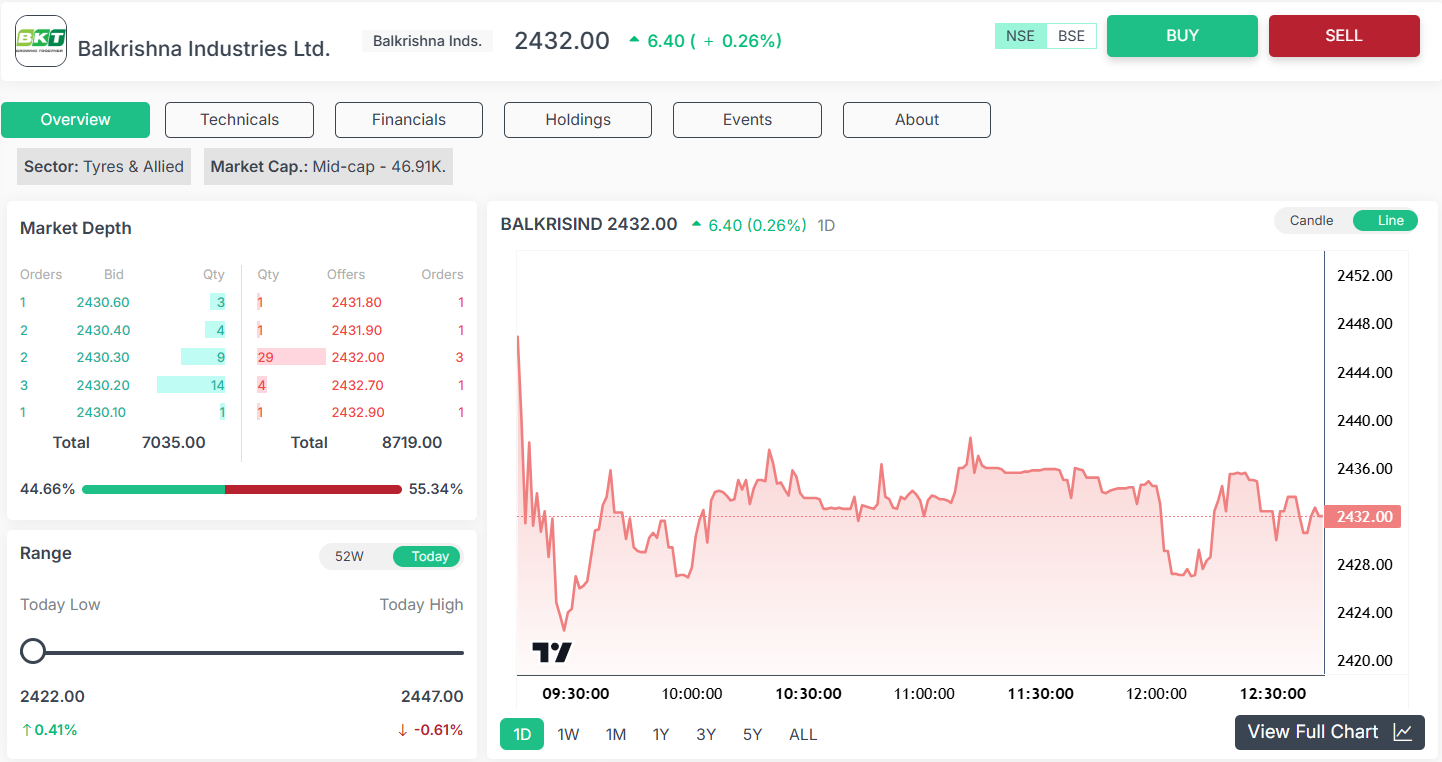

Balkrishna Industries Limited

Balkrishna Industries Limited , a leading tyre manufacturer in India which manufactures specialized tyres to be used in areas of agriculture, construction, and industrial applications. The company exports its tyres to over 160 countries across the globe. The company manufactures tyres which are known for its high-quality and durability. The company focuses on innovation and sustainability, continually investing in R&D to enhance its product offerings.

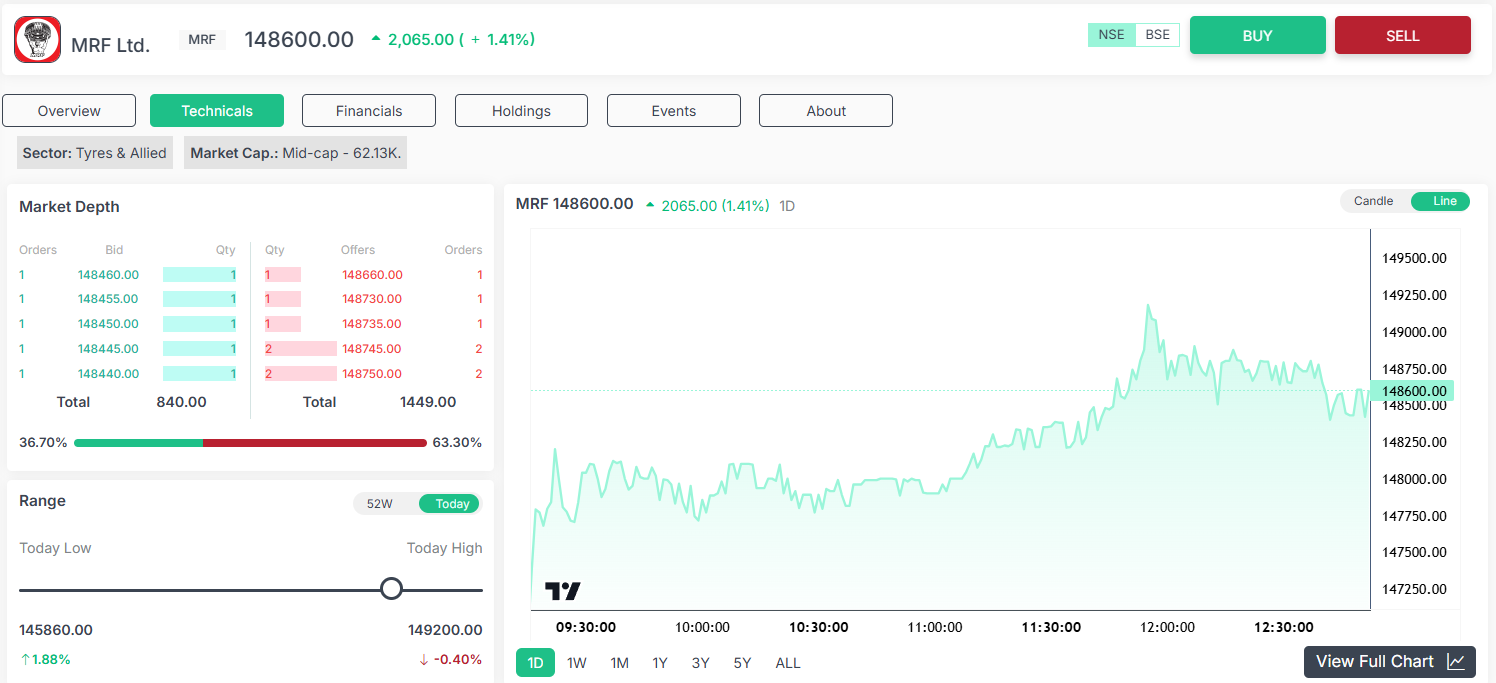

MRF Limited

MRF (Madras Rubber Factory) , largest tyre manufacturer in India with global presence. The company started its operation in 1946 manufacturing tyres for vehicles like cars, trucks, and motorcycles. The company is known for its quality, innovation, and strong brand presence. The company has diversified its business operations to paints, toys and motorsports proving its excellence across various businesses.

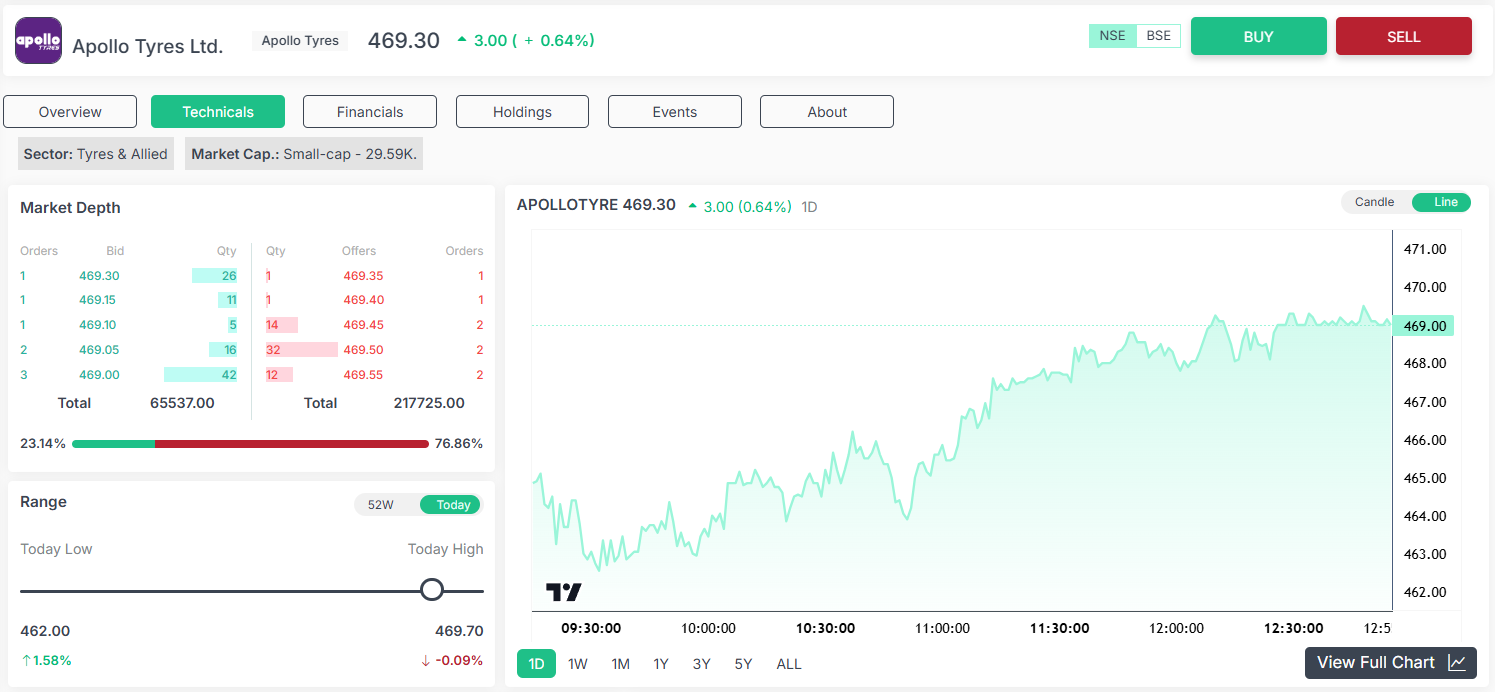

Apollo Tyres Limited

Apollo Tyres, a leading tyre manufacturer offering specialized tyres for passenger cars, commercial vehicles, and two-wheelers. The company started its operations in 1972, with its presence in India, Europe and various other regions. The company known for its innovation, durability and strong brand presence. The company has invested in R&D to produce eco friendly tyres.

The intraday price analysis of the three tyre company stocks reveals distinct market sentiments for each. Balkrishna Industries is trading near its day high, indicating strong buying interest and positive momentum, suggesting that investors are confident in the stock's performance. On the other hand, MRF Limited and Apollo Tyres are both trading near their day lows, which could indicate selling pressure or a lack of buying support. This might reflect caution among investors or a reaction to broader market conditions or company-specific news. Overall, Balkrishna Industries is currently showing more strength compared to MRF Limited and Apollo Tyres.

Chart Analysis

Balkrishna Industries Limited

The Bearish Heikin Ashi Pattern with high volume is observed on daily and weekly charts. The Bullish Continuation Heikin Ashi Pattern is observed on monthly charts.

MRF Limited

Bullish Heikin Ashi Pattern with a bullish tick from red to green is observed on daily charts. The Bullish Initiation Heikin Ashi Pattern is observed on weekly charts. The Bullish Heikin Ashi Pattern with high volume is observed on monthly charts.

Apollo Tyres Limited

The Bullish Continuation Heikin Ashi Pattern is observed on daily charts. The Bullish Initiation Heikin Ashi Pattern is observed on weekly charts. Spinning Top Continuation Heikin Ashi pattern is observed on monthly charts.

The chart analysis of three leading tyre companies presents varied trends across different timeframes, reflecting their market momentum.

For Balkrishna Industries, the daily and weekly charts display a Bearish Heikin Ashi Pattern with high volume, indicating potential short-term downward pressure. However, on the monthly chart, a Bullish Continuation Heikin Ashi Pattern suggests a long-term upward trend, indicating that despite short-term volatility, the stock may continue its overall bullish trajectory.

In the case of MRF Limited, the daily chart reveals a Bullish Heikin Ashi Pattern with a positive shift from red to green, suggesting the beginning of an upward move. The weekly chart further strengthens this outlook with a Bullish Initiation Heikin Ashi Pattern, while the monthly chart shows a Bullish Heikin Ashi Pattern with high volume, indicating strong bullish momentum across all timeframes.

For Apollo Tyres Limited, the daily chart shows a Bullish Continuation Heikin Ashi Pattern, suggesting ongoing strength in the short term. The weekly chart also reflects a Bullish Initiation Heikin Ashi Pattern, indicating the start of a potential upward trend. However, the monthly chart presents a Spinning Top Continuation Heikin Ashi Pattern, indicating some indecision or consolidation, but with a likelihood of continuing the prior trend.

Overall, while all three stocks exhibit bullish tendencies, Balkrishna Industries shows short-term caution, MRF Limited demonstrates strong consistent bullishness, and Apollo Tyres reflects steady upward momentum with some long-term consolidation.

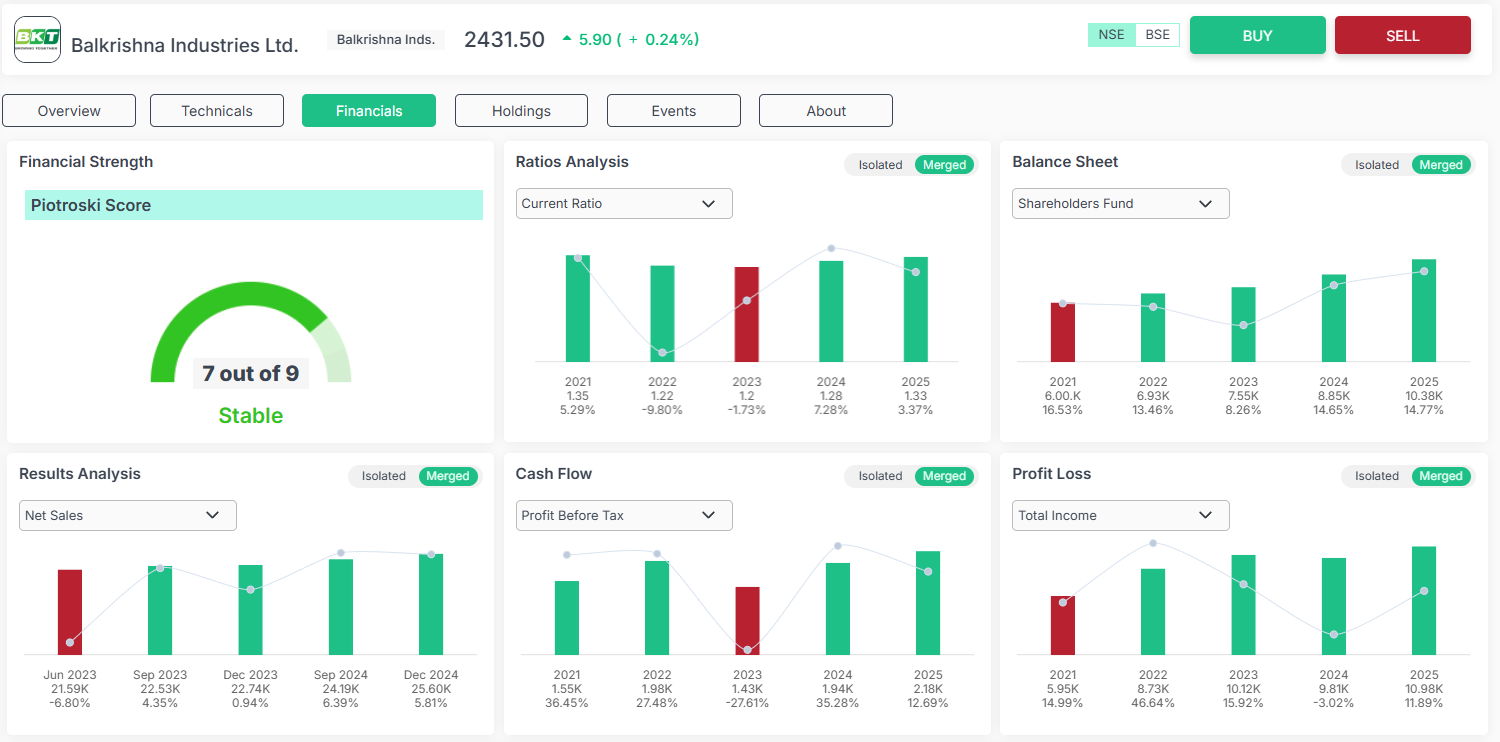

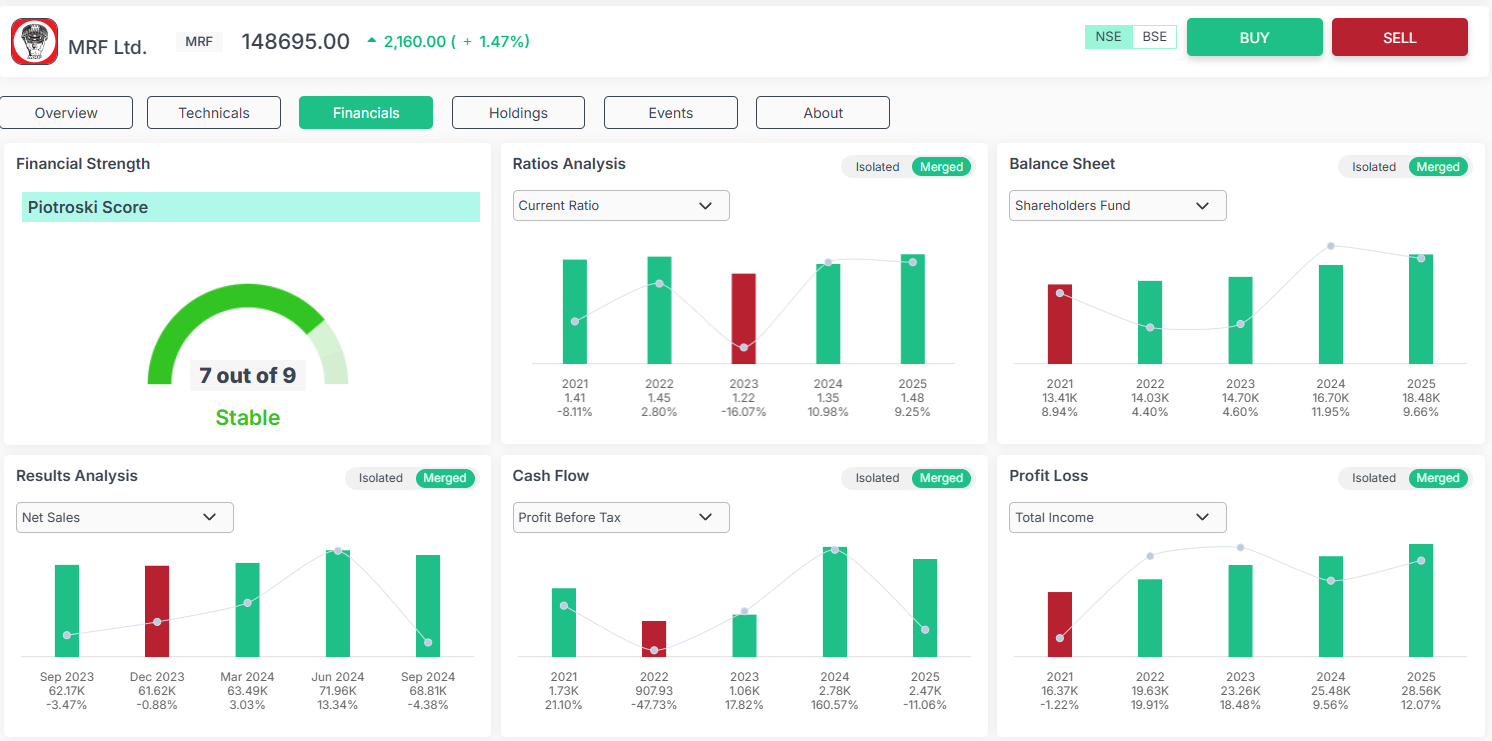

Fundamental Analysis

Balkrishna Industries Limited

Valuation: The company shows a strong book value growth over the past three years, indicating sound financial health. However, the high price-to-book ratio suggests that the stock may be overpriced, reflecting market optimism.

Profitability: Balkrishna Industries has demonstrated solid profitability, with key metrics like net profit, EBITDA, EPS, RoCE, and RoE all on an upward trajectory. Despite this, the dividend and earnings yield remain disappointingly low, which might be a concern for income-focused investors.

Growth: The company has shown consistent growth in total and quarterly sales, as well as in total assets, indicating robust operational performance.

Stability: Balkrishna Industries enjoys good financial stability, which adds to its appeal as a reliable investment.

MRF Limited

Valuation: MRF appears to be underpriced, with its book value increasing steadily over the last three years. This undervaluation may present a buying opportunity for value investors.

Profitability: The company’s profitability is satisfactory, with stable net profit, EBITDA, RoCE, and RoE. However, like Balkrishna, MRF’s dividend and earnings yield are low, which might limit its attractiveness to yield-seeking investors.

Growth: Although MRF’s annual sales and total assets have grown in recent years, the overall year-on-year growth is only average, suggesting modest expansion.

Stability: MRF’s financial stability is underscored by its declining debt levels, which is a positive sign for long-term sustainability and revenue generation.

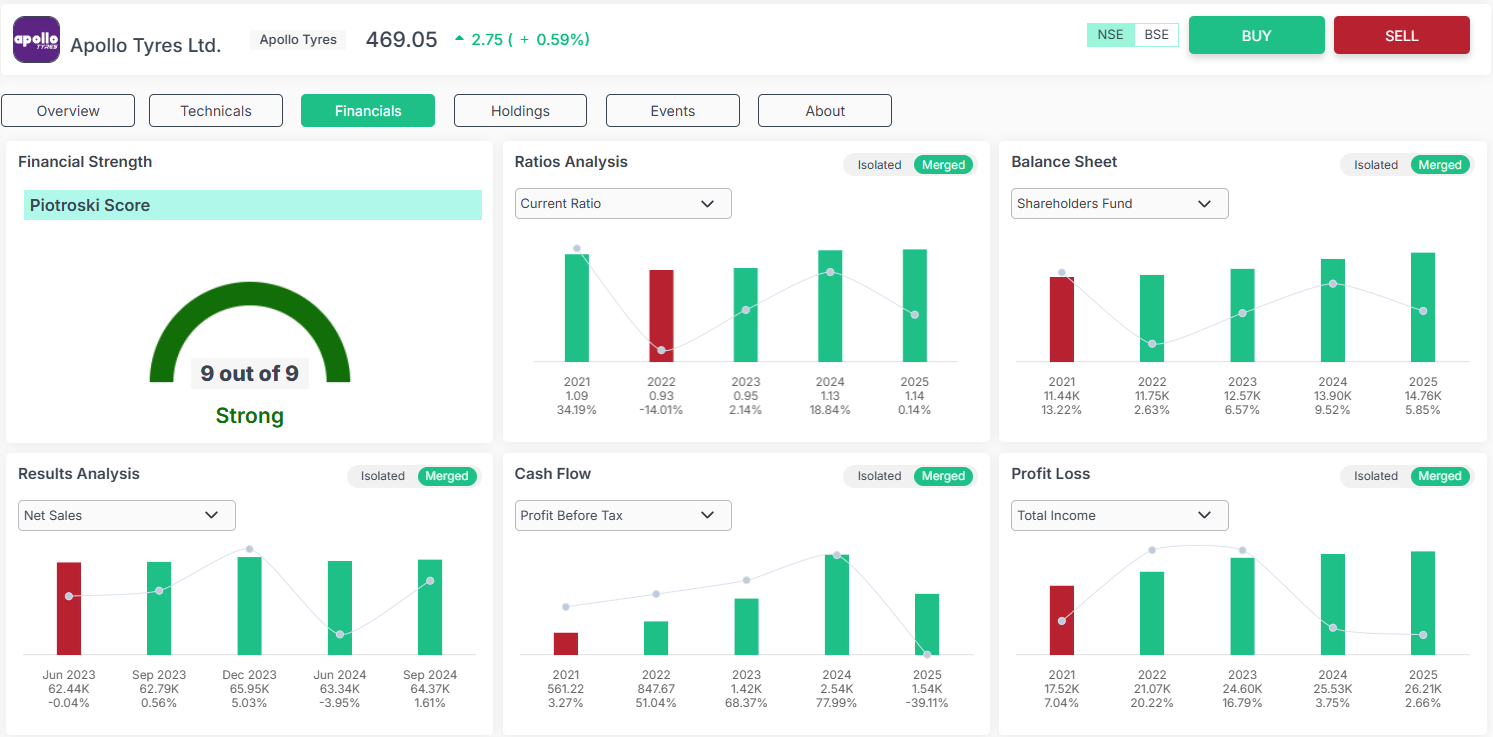

Apollo Tyres Limited

Valuation: Apollo Tyres is currently undervalued, with its book value on the rise, making it an appealing option for investors seeking undervalued stocks with growth potential.

Profitability: The company’s profitability metrics, such as net profit, EBITDA, and RoE, are improving, indicating healthy operational performance. However, the decline in EPS and the low earnings yield could be a concern for some investors.

Growth: Apollo Tyres has shown positive growth in net margins and annual sales, reflecting its ability to scale and expand its market presence.

Stability: The company’s decreasing debt-to-equity ratio, coupled with rising revenue, suggests a strong financial position and stability, which is crucial for long-term growth.

Thus, Balkrishna Industries stands out for its strong profitability and stability but may be overpriced. MRF offers potential value due to its under-pricing but shows average growth. Apollo Tyres presents a mix of undervaluation and solid growth prospects, with a focus on improving financial stability. Investors should consider these factors based on their individual investment goals and risk tolerance.

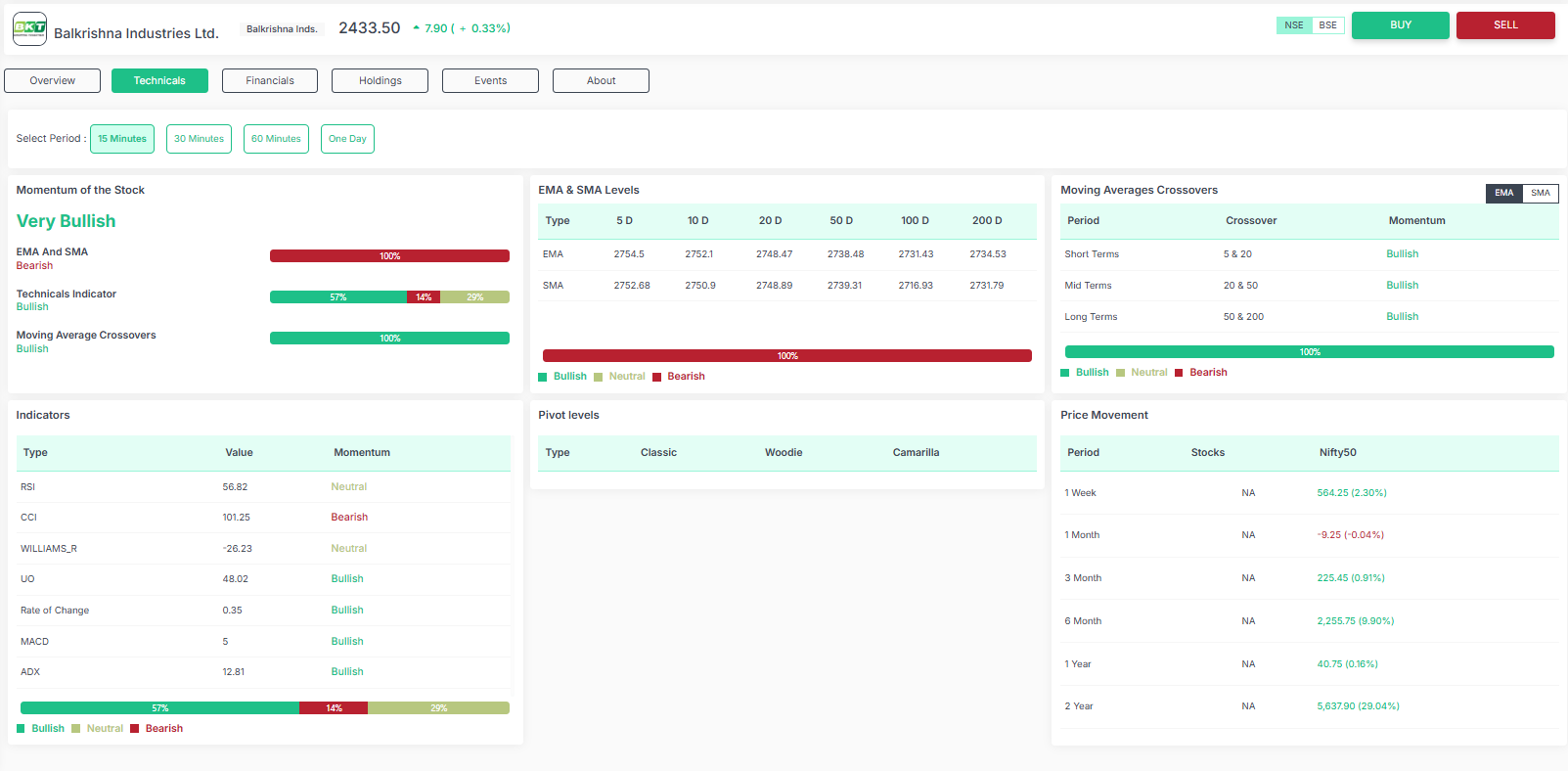

Technical Analysis

Unlock powerful stock insights with the Orca app. Dive into detailed technical and fundamental analysis at your fingertips. Download today and elevate your investment strategy

Balkrishna Industries Limited

Based on the moving averages, the Balkrishna Industries stock exhibits bullish signals. Technical indicators are neutral indicating continuity in the pattern. Moving average crossovers exhibit bullish signals.

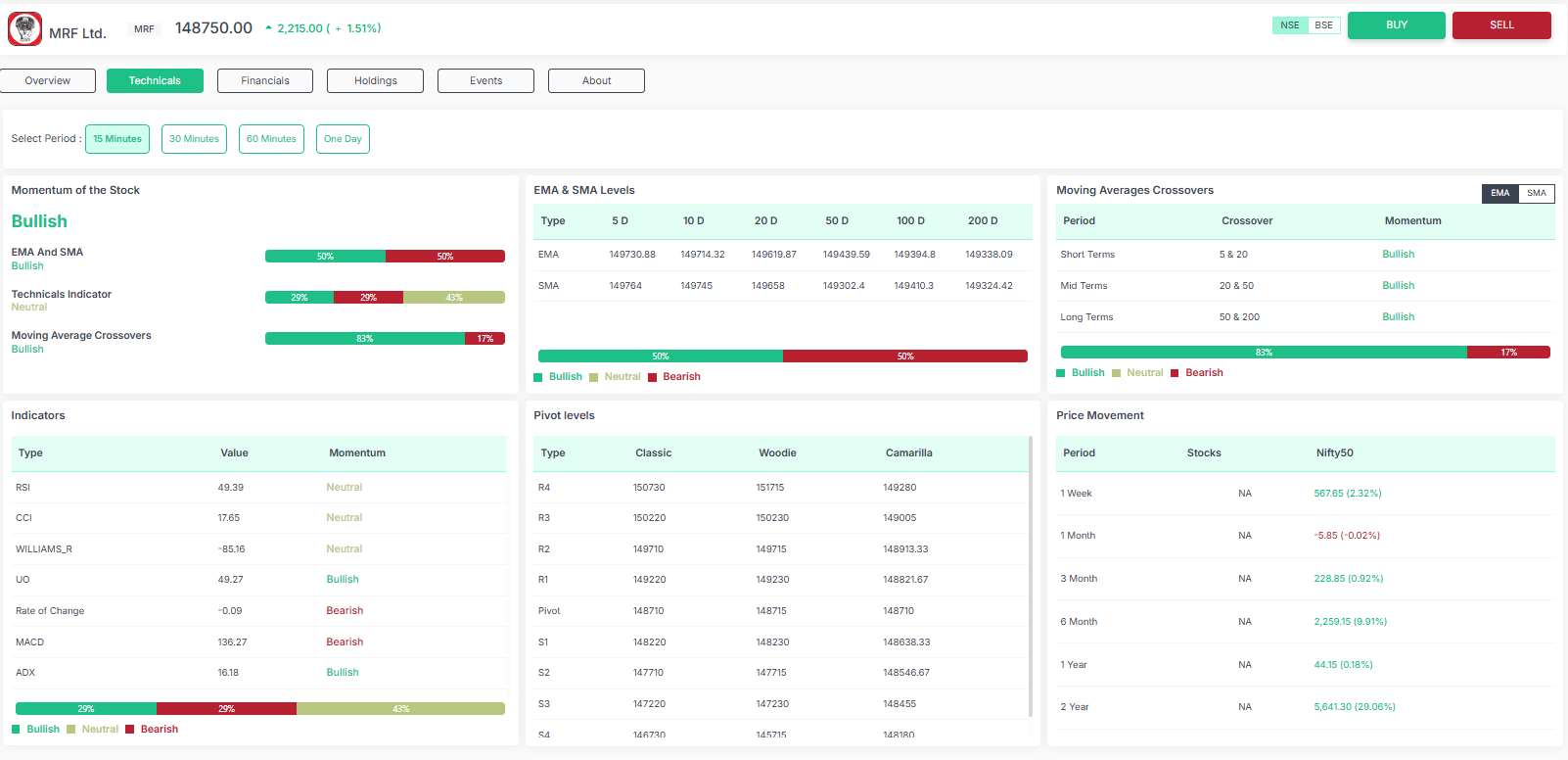

MRF Limited

Based on the moving averages, the MRF Limited stock exhibits bearish signals. Technical indicators are neutral indicating continuity in the pattern. Moving average crossovers exhibit bullish signals.

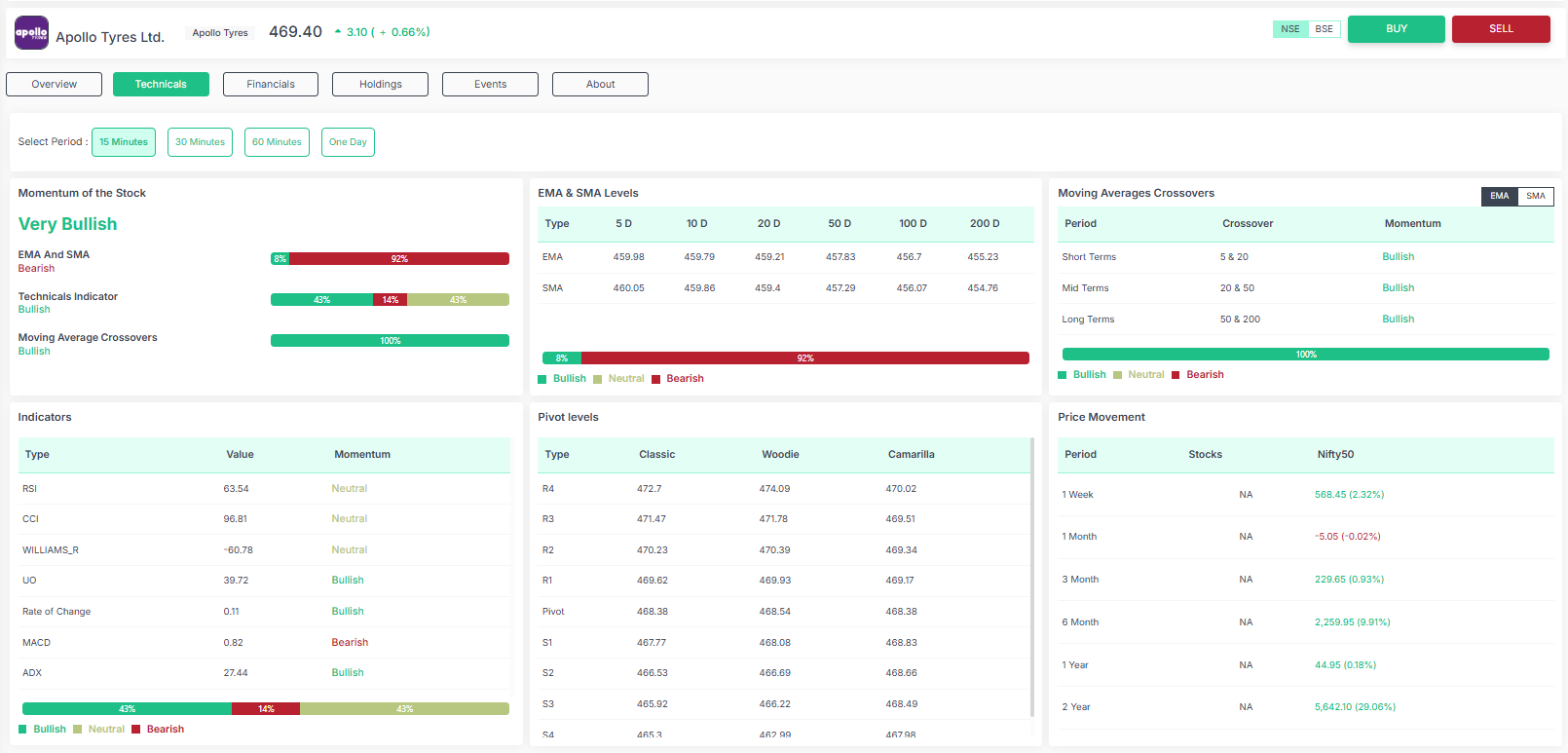

Apollo Tyres Limited

Based on the moving averages, the Apollo Tyres Limited stock exhibits bullish signals. Technical indicators are neutral indicating continuity in the pattern. Moving average crossovers exhibit bearish signals.

The technical analysis of three major tyre company stocks—Apollo Tyres Limited, MRF Limited, and Balkrishna Industries—reveals varying trends and potential market movements.

Apollo Tyres Limited shows bullish signals based on its moving averages, suggesting that the stock might continue to rise in the near term. However, the neutral technical indicators imply that the current trend could persist without significant change, while the bearish moving average crossovers may signal a potential reversal or slowdown in the upward momentum.

MRF Limited presents a contrasting scenario, with moving averages indicating bearish signals, which could suggest a potential decline or weakness in the stock's performance. Despite this, the moving average crossovers show bullish signals, hinting at a possible recovery or upward movement. The neutral technical indicators here also suggest that the stock might continue in its current pattern without any major shifts.

Balkrishna Industries appears to be the most promising among the three, with both moving averages and moving average crossovers indicating bullish signals. This suggests that the stock may continue its upward trajectory. The neutral technical indicators reinforce the idea that the current trend is likely to continue, providing a stable outlook for investors.

Conclusion

The Enrich Money Orca app provides investors with detailed insights into stock momentum trends. For well-informed decisions, it’s advisable to use both technical and fundamental analysis tools for a thorough evaluation

Frequently Asked Questions

What factors are considered in a comparative analysis of tyre manufacturing companies?

Key factors include valuation, profitability, growth trends, and financial stability, offering insights into each company's market position.

How does valuation impact the comparison of tyre companies?

Valuation metrics like price-to-book ratio and market capitalization help determine if a stock is over or undervalued compared to its peers.

Why is profitability important in comparing tyre companies?

Profitability, measured by metrics like EBITDA, net profit, and RoE, indicates a company's ability to generate returns and sustain growth.

What role does growth play in comparative analysis?

Growth trends in sales, assets, and margins reveal each company's capacity to expand and capture market share over time.

How does financial stability affect the comparison of tyre companies?

Stability, reflected in debt levels and cash flow management, is crucial for assessing a company's long-term viability and risk exposure.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.