Indian Air Conditioner Industry Q1 FY2026 Start: Key Players & Market Outlook

Air Conditioner Industry Overview

The Indian air conditioner industry had a challenging FY2026 start, mainly because of unseasonal rains and a late arrival of summer, which resulted in lower demand for room air conditioners . Industry volumes declined by about 25-34% year-on-year, resulting in decline in revenues for market leaders Voltas, Blue Star, and Havells. Though there has been trouble, the companies have kept their operations stable and are hopeful about bouncing back during the next festive season.

The overall air conditioner market remained muted by reason of weather-related disruptions, though 10-15% revenue growth in FY26 is still expected as demand later in the year is driven by new energy efficiency regulations and festival buying.

The Indian AC industry is expected to grow at a compound rate of 12-16% with support from growth in smaller cities and growth in disposable incomes.

In short, though Q1 was weak on account of climatic conditions, large players were resilient and are positioned well for expansion as market conditions consolidate during the rest of FY2026

Recent Performance

Indian air conditioner industry growth slowed to expectations in 2025, mainly because of unseasonal rains and cooler temperatures that disrupted buying behavior during peak summer seasons. However, the major players such as Blue Star and Voltas reduced their overall annual growth estimates to about 10-15% from earlier projections of 25-30%. The early optimism in the first half of February and March resulted in bigger inventory builds, but erratic weather prompted buyers to back away in April and May. Industry players are still optimistic of a turnaround towards the latter part of the year, especially in the festive season and with new energy efficiency standards spurring in-season buying.

Challenges

The sector is subjected to recurrent challenges like uncertain weather conditions affecting seasonal revenues and supply chain shortages, such as shortages of important components like compressors and raw copper material. Local production of some of the major components has yet to keep up with demands, triggering dependency on imports, mostly from China. Supply bottlenecks as well as certification delays continue to be operational challenges for businesses.

Investment Potential

From an investment perspective, the air conditioner industry has good long-term growth prospects. The residential market can grow at about a 15.6% CAGR during 2025-2033 and reach close to $19.6 billion in 2033, and commercial sales are likely to grow even more rapidly. Industry giants like Voltas and Blue Star have large stakes and keep innovating with energy-saving and smart technology products. It is also driven by growing disposable incomes and rising penetration in tier 2 and tier 3 cities.

Government Initiatives

Government policies are becoming a key driver of the sector's growth path. Schemes such as the "AC swap" program intend to offer incentives to consumers to replace old, inefficient units with new 5-star rated ones on the basis of rebates and trade-in incentives. The government also plans to standardize temperature levels between 20°C and 28°C to regulate energy use during peak hours, in synchronization with larger energy conservation objectives.

Future Outlook

Looking ahead, industry experts expect the Indian air conditioner market to double in size within the next four years, driven by hotter summers, urbanization, and technological advancements. The sector is predicted to maintain a CAGR between 12% and 16%, supported by expanding domestic manufacturing capabilities and increased adoption of energy-efficient and connected AC systems. Despite short-term obstacles, the market remains poised for substantial growth and attractive investment opportunities.

Company Overview

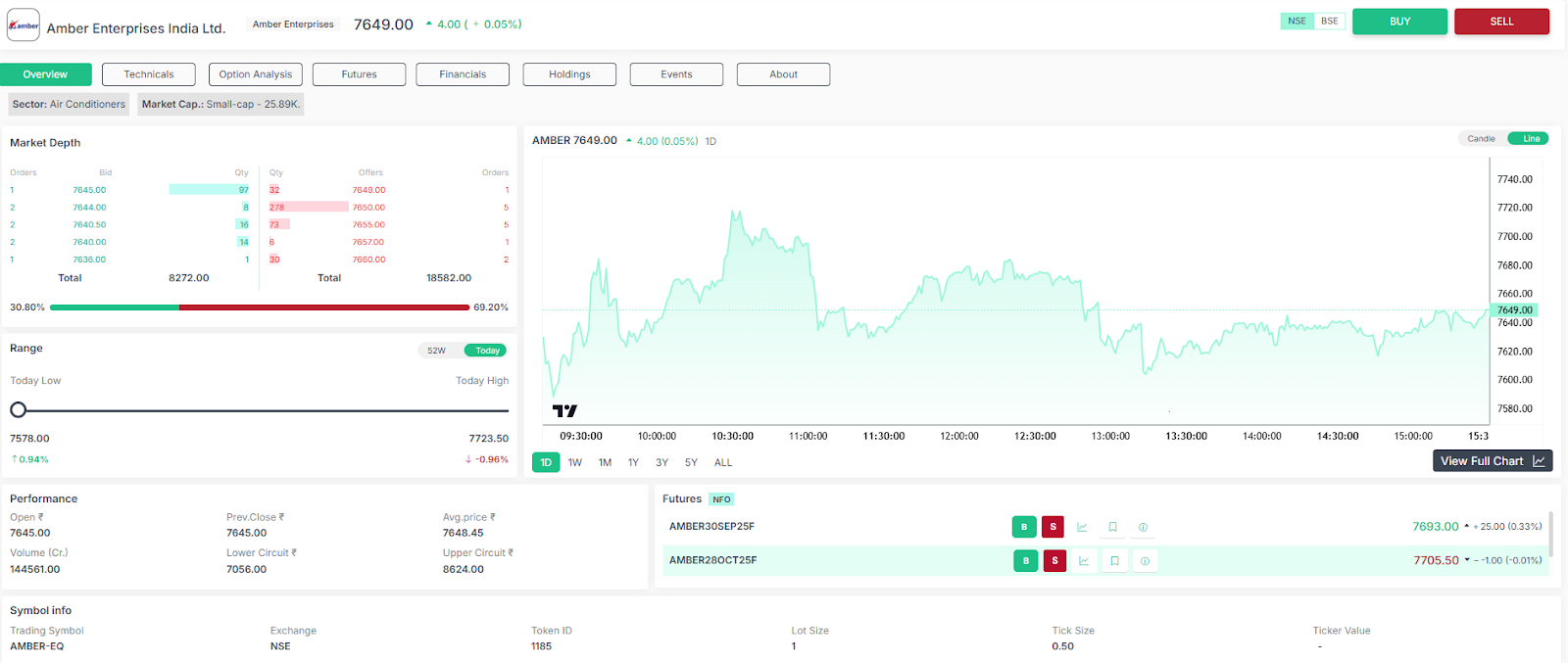

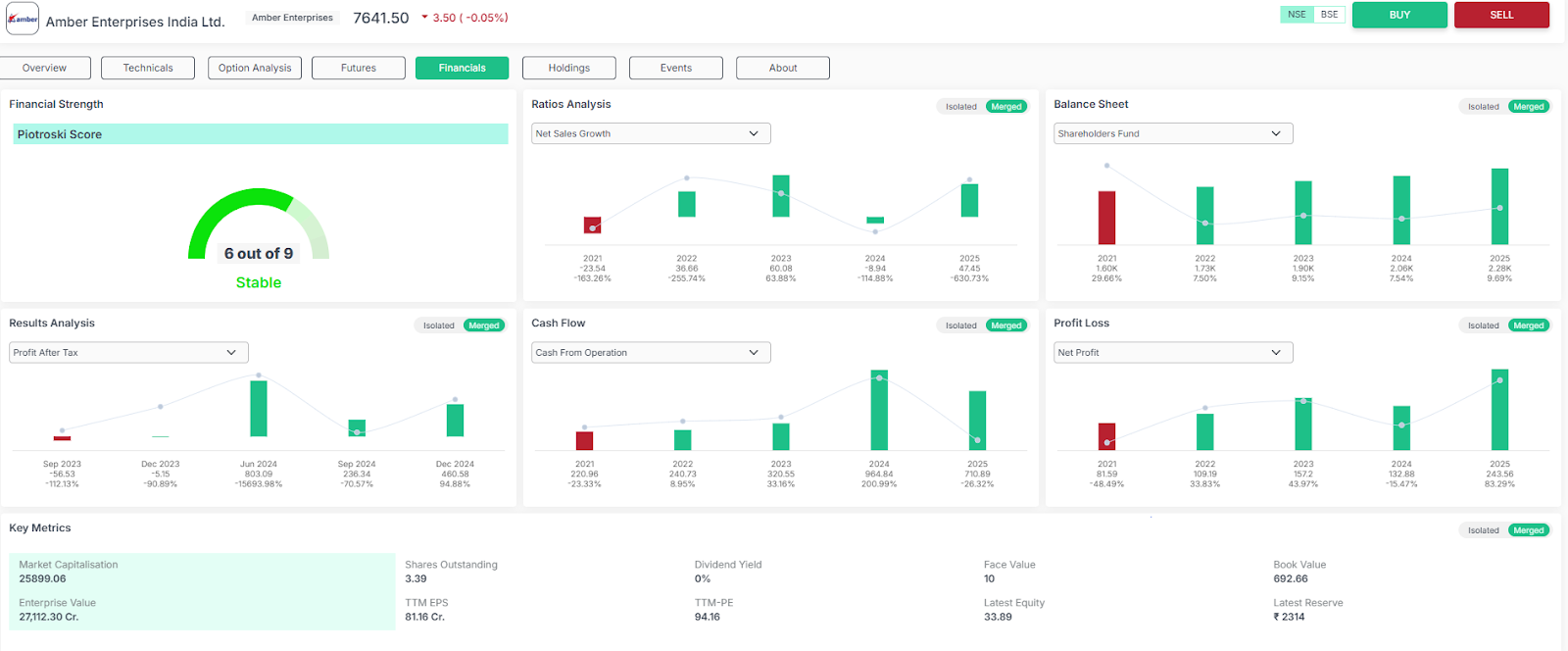

Amber Enterprises India Ltd

Amber Enterprises is a leading manufacturer and supplier in the air conditioning segment, having a market share of around a 23.6% room air conditioner market in India. Founded in 1956, the firm shines as an OEM/ODM partner, delivering complete HVAC solutions and manufacturing major components like heat exchangers, copper tubing, and plastic components. It has several manufacturing units around the country, aided by strong R&D that fuel innovation and sustainability. Apart from consumer durables, Amber also caters to industries such as electronics and railway subsystems, thus being a diversified B2B solution provider with focus on quality and efficiency.

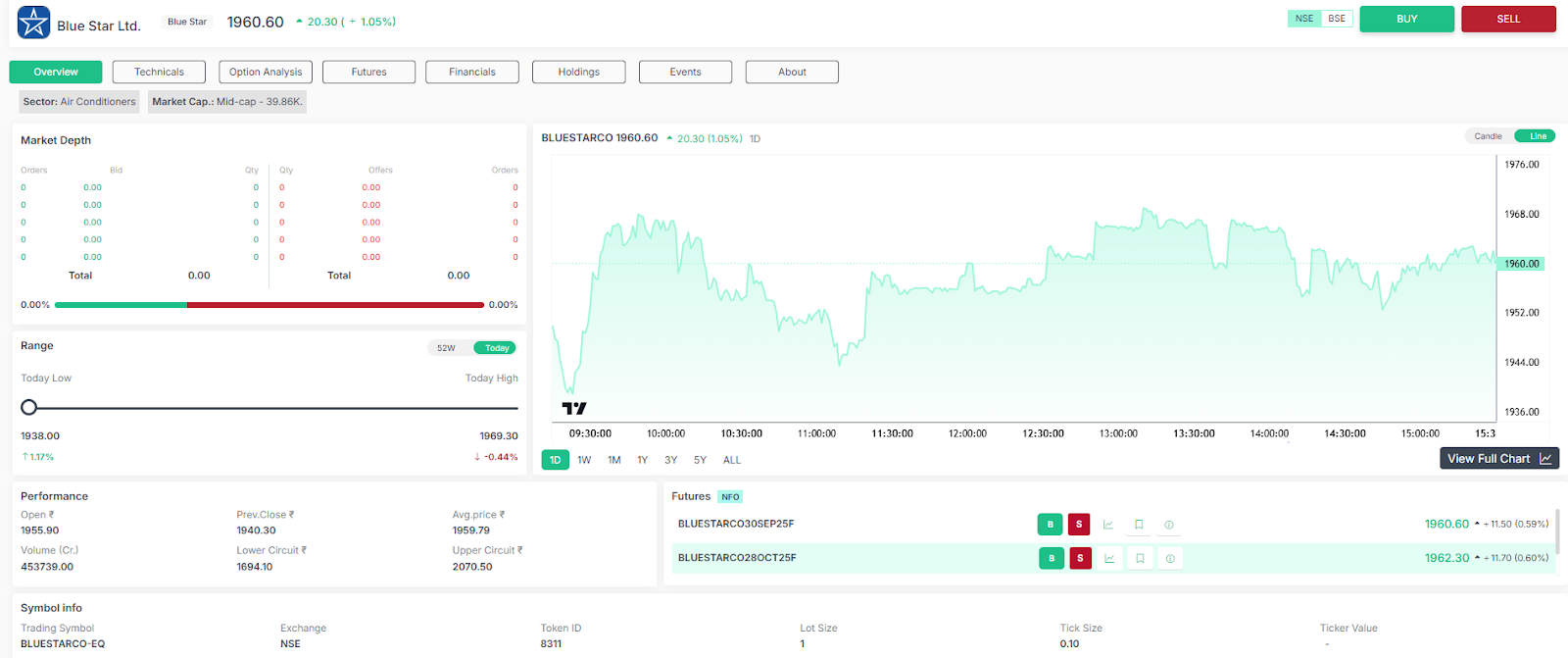

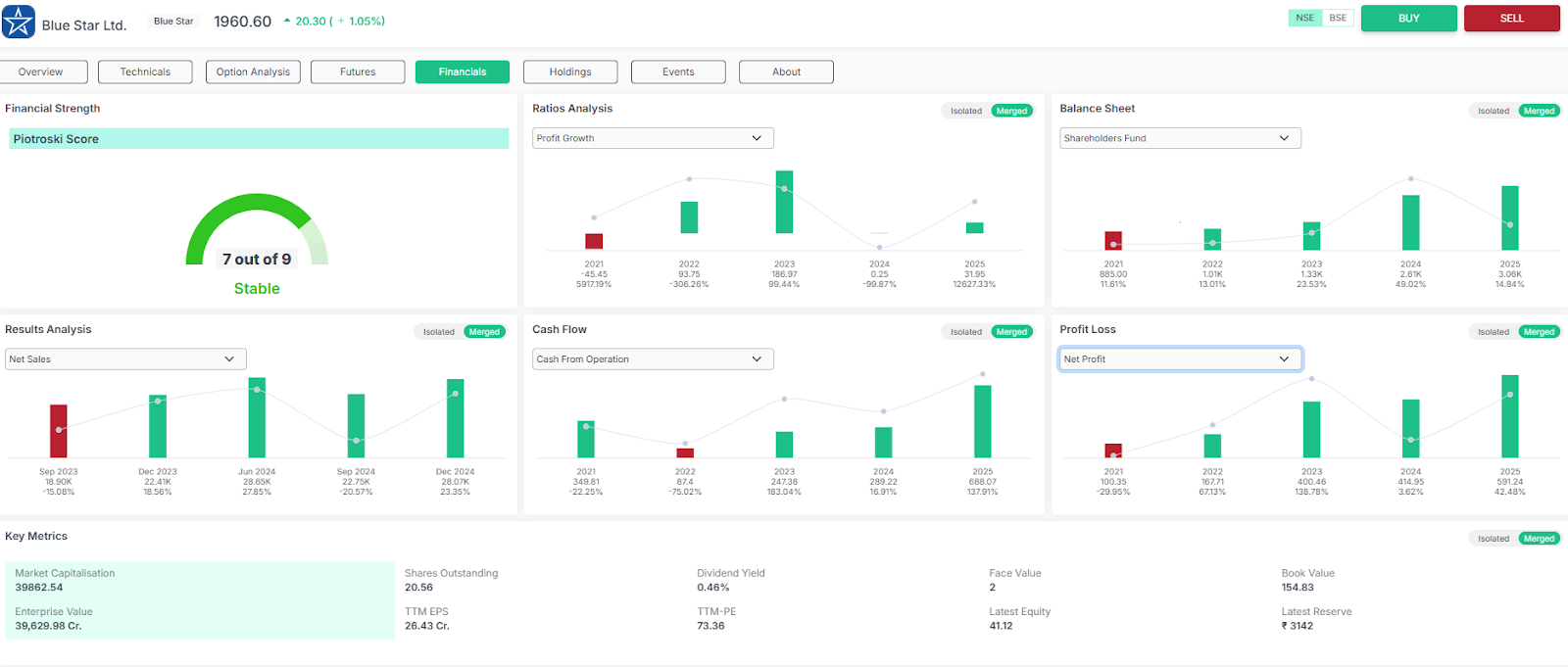

Blue Star Ltd

Blue Star is a well-established Indian cooling industry player with more than eight decades of expertise. Headquartered in Mumbai, it provides a complete lineup of air conditioners and commercial refrigeration products, as well as mechanical, electrical, plumbing, and firefighting contracting solutions. The company's manufacturing capacity extends across a series of plants, serving residential, commercial, and industrial clients with solutions ranging from chillers to VRFs and water coolers. Blue Star also offers integrated facility management and EPC services with a strong retail and service footprint across the country.

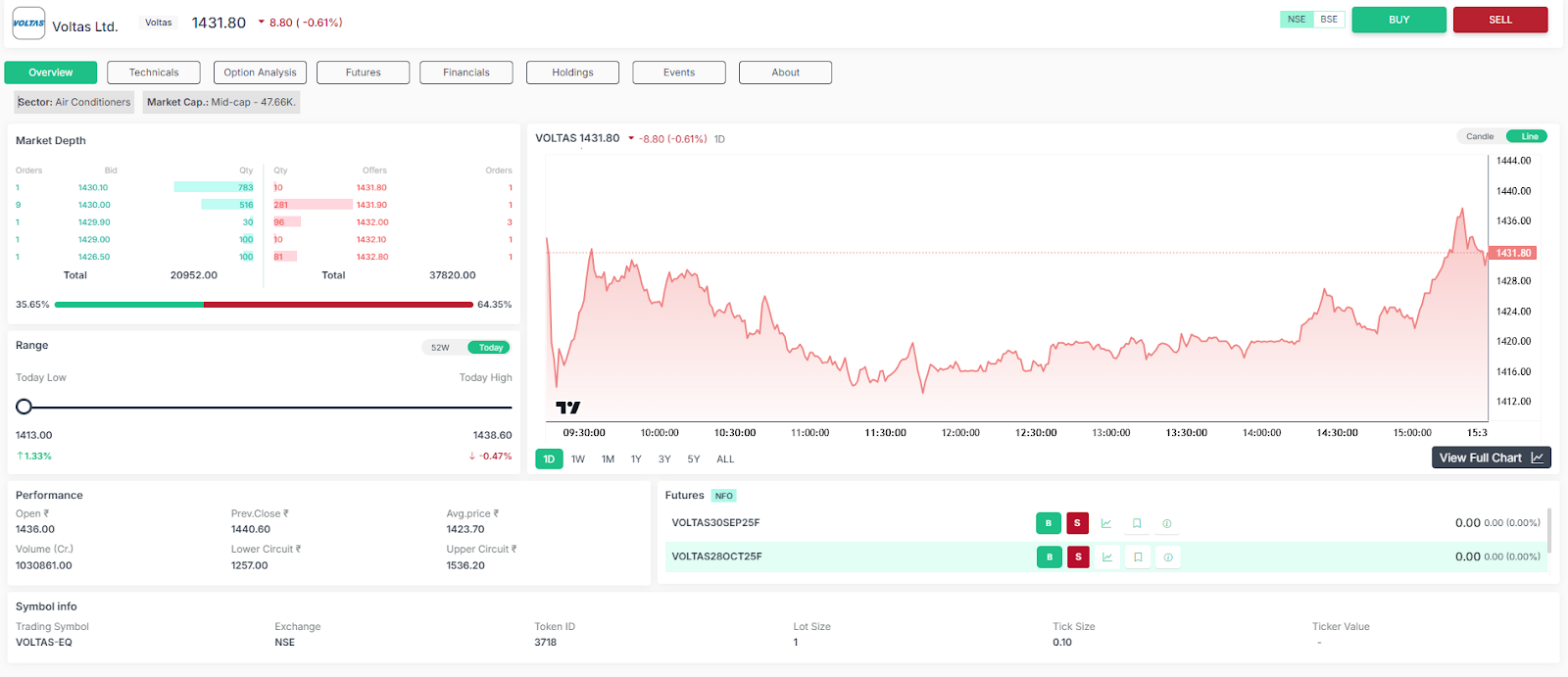

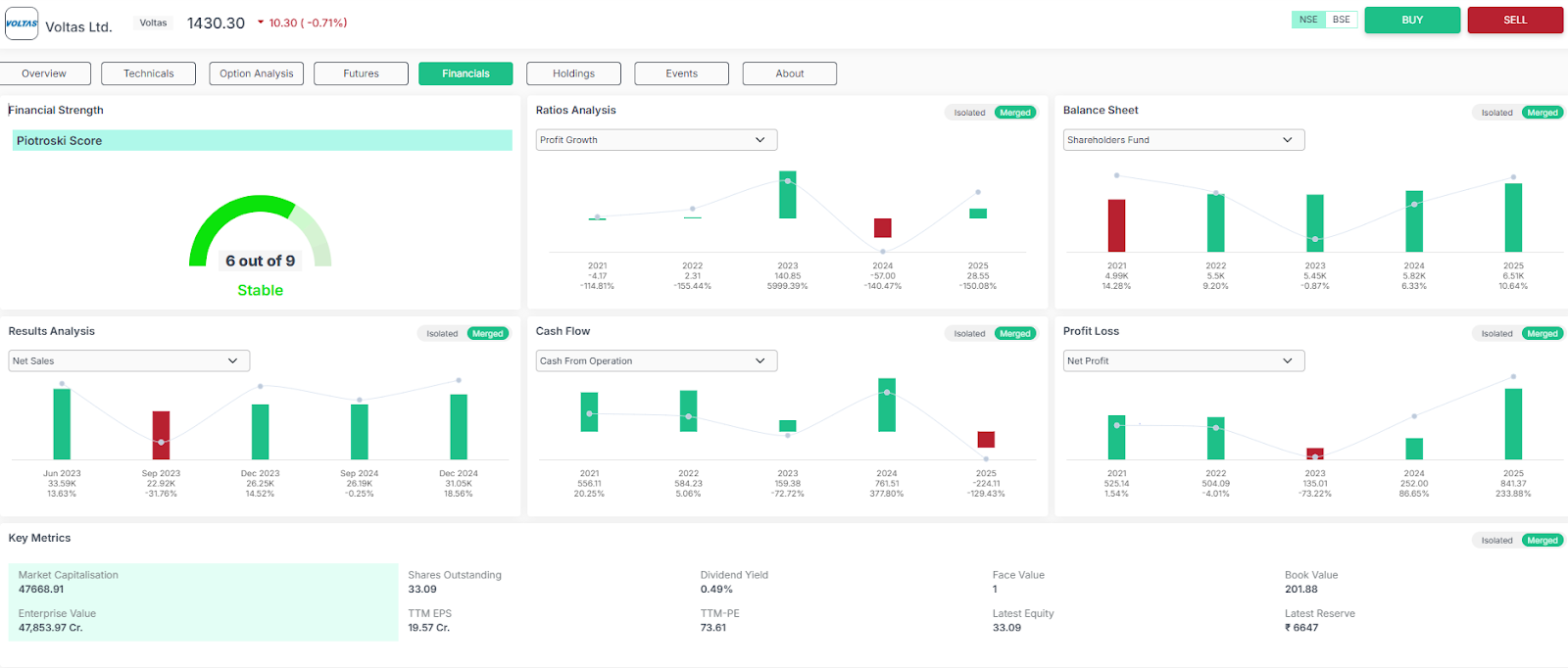

Voltas Ltd

Voltas, which is a Tata Group firm established in 1954, is India's number one air conditioning brand and a leader in engineering and infrastructure solutions. The company offers a wide range of cooling products such as residential air conditioners, commercial refrigeration, and air coolers. Voltas also undertakes big engineering projects across the world with the help of advanced technology like DC inverter systems. Through its joint venture, Voltas Beko, the company ventures into home appliances, bolstered by a wide network of services and a well-established market share leadership in India.

Q1 FY26 Key Metrics Comparison: Amber Enterprises Limited, Blue Star Limited and Voltas Limited

Here is the key metrics comparison for Q1 FY2026 of Amber Industries, Blue Star and Voltas Limited

|

Metrics |

Voltas |

Blue Star |

Amber Enterprises |

|

P/E |

73.27 |

75.43 |

94.18 |

|

Div Yield % |

0.49 |

0.46 |

0 |

|

ROCE % |

17.64 |

26.2 |

14.49 |

|

1Yr return % |

-20.45 |

15.24 |

71.6 |

|

Debt / Equity |

0.14 |

0.12 |

0.9 |

|

EV / EBITDA |

44.33 |

44.58 |

31.11 |

|

3Yrs return % |

14.03 |

52.61 |

50.27 |

|

ROE 3Yr % |

7.67 |

21.48 |

9 |

|

ROE % |

13.47 |

20.62 |

11.28 |

|

Profit growth % |

41.73 |

6.73 |

72.33 |

|

PAT 12M Rs.Cr. |

647.6 |

534.1 |

275.06 |

|

PAT Qtr Rs.Cr. |

140.46; 57.98% (YoY) |

120.96; 28.36% (YoY) |

103.87; 43.6% (YoY) |

|

Qtr Profit Variation |

-57.98% (YoY) |

-28.36% (YoY) |

43.53% (YoY) |

|

Sales Qtr Rs.Cr. |

3938.58 |

2982.25 |

3449.13 |

|

Revenue Rs. Cr. |

3939; 19.96% (YoY) |

2982; 4.1% (YoY) |

3449 ; 43.6% (YoY) |

Amber Enterprises India Ltd

Amber showed excellent growth with sales increasing to Rs.3,449.13 crore, up more than 43% compared to the previous year. Amber is growing on the back of higher demand for air conditioning parts and diversified product offerings in consumer and B2B segments.

Net profit jumped 43.53% to Rs.103.87 crore due to operating efficiency, higher scale, and strong demand.

Margins at EBITDA levels were healthy at a level of 7.4%, with an EBITDA of Rs.263 crore reflecting higher profitability and better cost control.

The debt-to-equity ratio is higher at 0.9, resulting from consistent investment in increasing capacities and infrastructures.

Amber's stock has been the top performer among its peers with a 1-year return of 71.6% and strong investor faith in its growth path.

The P/E ratio is the highest at 94.18, which shows premium valuation proportionate to its high earnings growth and growth prospects.

Blue Star Ltd

Blue Star reported Rs.2,982.25 crore revenue, which grew modestly by 4.1% YoY, underpinned by robust commercial projects and maintenance orders even though the air conditioner segment contracted.

Quarter profit fell by 28.36% to Rs.120.96 crore indicating margin constraint and reduced volume realization in its core cooling products.

EBITDA fell by 16%, with the EBITDA margin of approximately 6.7%, indicating the effect of increasing costs over the growth in revenues.

Owing to a low debt-to-equity ratio of 0.12, Blue Star remains financially sound and well-placed for investments in the future.

Blue Star stock returned 15.24% in the past year on the back of diversified business segments other than consumer durables.

Blue Star has a P/E multiple of 75.43, comparable to its sector peers, demonstrating robust market hopes for long-term growth.

Voltas Ltd

Voltas had sales of Rs.3,938.58 crore, down by close to 20% year-on-year on account of subdued demand in the RAC business on account of unseasonal weather hampering the summer sales season.

The net profit of the company in the quarter declined sharply by 57.98% to Rs.140.46 crore, signalling pressures on margins and slower volumes.

EBITDA margin also declined sharply affecting operating profits, though quarter-end EBITDA specific numbers were not emphasized, the EV/EBITDA multiple is high at 44.33, reflecting premium valuation in spite of recent drop in profit.

Voltas has a low debt-to-equity ratio of 0.14, reflecting strong financial health in the face of challenging market conditions.

Voltas share price has declined more than 20% in the last year reflecting investor skepticism about recent results and the softness in demand in the industry.

The P/E ratio is 73.27, reflecting high expectations from the market despite the recent quarterly failure.

Investment Insights:

Amber Enterprises posted solid operational and financial performance, ahead of revenue and profit growth in Q1 FY26, driven by expansion of capacity and market demand.

Blue Star posted subdued revenue growth but was under pressure on profitability as the RAC business reported margin decline.

Voltas had a difficult quarter with sharp falls in revenue and profits due to weak demand scenarios and industry headwinds.

All three firms demonstrate healthy financials with manageable debt, although Amber is more leveraged as a result of investments in expansion.

Valuation multiples are high throughout the industry looking ahead reflecting strong long-term growth expectations in spite of short-term troubles with quarterly earnings.

Final Thoughts

The Indian AC market experienced a challenging Q1 FY26 on account of unseasonal rains and off-season summer, suppressing demand and hurting revenue for the likes of Voltas and Blue Star. Amber Enterprises defied trends to deliver robust growth. Companies remain hopeful for revival aided by energy regulations and festive season demand despite near-term challenges. Enrich Money captures this resilient prospective outlook and growth opportunity in the space.

Frequently Asked Questions

Which firm reported maximum revenue growth in Q1 FY26?

Amber Enterprises had the maximum revenue growth of 43.6% year-on-year at Rs.3,449 crore.

What was Voltas' performance in Q1 FY26 compared to last year?

Voltas registered a 19.96% fall in revenue at Rs.3,938 crore and a 57.98% fall in net profit at Rs.140 crore.

What was Blue Star's net profit trend in Q1 FY26?

Blue Star's net profit fell 28.36% to Rs.121 crore even as revenue rose modestly by 4.1%.

Which firm recorded the highest profit growth in Q1 FY26?

Amber Enterprises recorded the highest profit growth, with net profit rising 43.53% year-on-year to Rs.104 crore.

What were the EBITDA margin trends of these firms in Q1 FY26?

Amber Enterprises had a healthy EBITDA margin of 7.4%, whereas Blue Star and Voltas witnessed compression in margin because of increasing costs.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.