How Global Tensions Influence the Performance of the Indian Stock Market in 2024

Introduction

In the intricate web of global economics, the reverberations of geopolitical tensions and international events are felt keenly within the corridors of the stock market. These external forces wield significant influence, shaping market sentiment, investor behavior, and ultimately, the trajectory of stock prices. Understanding the nuances of how these global dynamics impact the stock market is paramount for investors seeking to navigate through uncertainty and capitalize on opportunities. In this article, we delve into the profound "impact on stock market" of geopolitical tensions in 2024, with a particular focus on how these forces shape the landscape of the Indian stock market.

Global Tensions Impacting Indian Stock Market:

The year 2024 has witnessed a surge in geopolitical tensions, trade disputes, and energy security concerns, all of which have reverberated across financial markets worldwide. Let's delve into the key global tensions impacting the Indian stock market:

Geopolitical Conflicts:

Tensions in regions like the Middle East, South Asia, and Eastern Europe have led to increased market volatility and investor uncertainty. Conflicts in Gaza and heightened hostilities involving Iran and Pakistan inject unpredictability into the global landscape, impacting investor sentiment in the Indian stock market.

Israel-Hamas conflict

The Israel-Hamas conflict could lead to higher insurance premiums and shipping expenses for Indian merchandise exporters. Bilateral services trade between India and Israel amounts to approximately USD 1.3 billion. Nevertheless, the impact is likely to stay constrained unless the conflict undergoes significant escalation. The overall effect on India-Israel trade, covering both merchandise and services, hinges on the duration and intensity of the conflict.

The Israel-Hamas conflict presents multifaceted challenges for India, impacting trade, investor sentiment, infrastructure projects, and the stock market. Nonetheless, for investors with a long-term outlook, this upheaval also represents a chance to invest in high-quality stocks.While uncertainties persist, India’s adaptability and resilience remain key assets in navigating these challenges, including the impact on the stock market.

Trade Disputes and Tariffs:

Trade tensions between major economies, disrupt global trade flows and economic growth prospects. Tariffs and trade restrictions disrupt supply chains and increase costs for businesses, impacting sectors reliant on international trade in the Indian stock market.

Bilateral services trade between India and Israel totals around USD 1.3 billion. Yet, the impact on stock market may be minimal unless the conflict escalates notably. The broader effect on India-Israel trade, covering both goods and services, hinges on the duration and severity of the conflict.

Energy Security Concerns:

Geopolitical tensions in oil-producing regions influence global energy markets and oil prices, directly impacting India's energy security and economic stability. Any disruption in oil supply or spike in oil prices due to geopolitical tensions affects sectors sensitive to oil prices in the Indian stock market.

US NYMEX oil began the year around $80 a barrel in 2023 but declined to $64 levels by May. There was a brief rally in October, coinciding with the Israel-Hamas conflict and reports of declining US inventories, but all gains were wiped out by the end of the year.

Oil prices will continue to be influenced by demand-supply dynamics in 2024. Given the current fundamentals, there are limited prospects for a significant price surge unless there is a major escalation of tensions in the Middle East, which could have a negative impact on the global oil supply chain, impacting the stock market. While the shortfall in output from OPEC-plus countries is being offset by increased US production, unexpected production cuts or supply disruptions due to escalating tensions in the Middle East will be pivotal for the market.

Regarding prices, considering various factors, US WTI futures may fluctuate within the range of $64-98 a barrel. Additionally, in the domestic market, apart from international prices, volatility in the Indian rupee will also influence the price outlook, impacting the stock market's performance.

Soft Versus Hard Landing of the US Economy

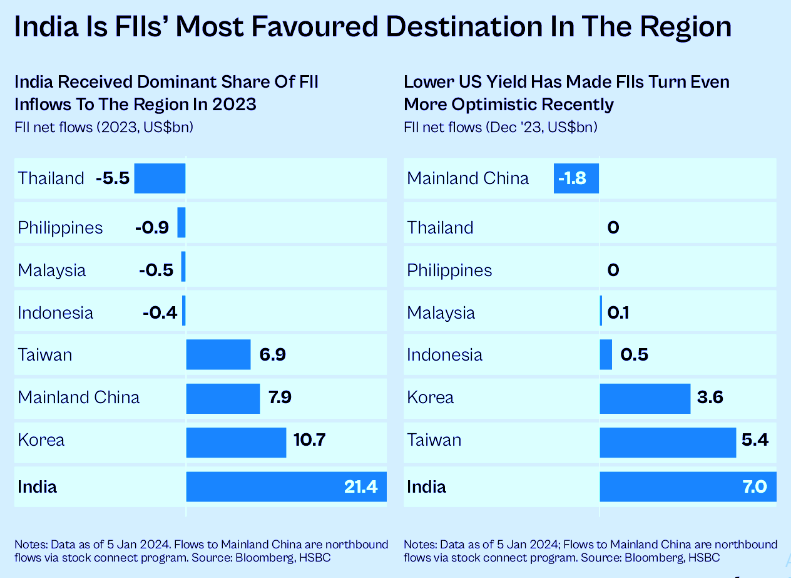

the US Federal Reserve's potential rate cuts could have implications for the Indian stock market. If the Fed cuts interest rates, it may lead to increased Foreign Institutional Investor (FII) flows into emerging markets like India. This influx of foreign investment could positively impact the Indian stock market by boosting investor sentiment and driving up stock prices.

Additionally, the expectation of a soft landing for the US economy, meaning a gradual slowdown without a recession, could further bolster investor confidence in emerging markets, including India. As a result, Indian equities may experience upward momentum as global investors seek opportunities in markets perceived to have stronger growth prospects.

Overall, the content implies that developments in the US economy and monetary policy could indirectly influence the performance of the Indian stock market through changes in FII flows and investor sentiment.

Valuation Concerns Impact on Stock Market Persist

Currently, Indian market valuations are soaring, with the Nifty 50 trading at 22.6 times its one-year forward earnings, well above the five-year average of 21.6 times. This trend is also observed in small and mid-cap companies, which are commanding even higher valuations. Despite historical trends of trading at a premium due to superior fundamentals, concerns over high valuations linger, impacting the stock market.

Goldman Sachs notes that India's relative P/E premium, at about 76 per cent, is steep compared to the five-year average of 50 per cent. While valuations are expected to moderate as earnings catch up, shifts in the macro environment, such as an earlier-than-expected Fed easing cycle and improved global risk appetite, justify a higher target multiple.

Despite these concerns, India's strong fundamentals and positive sentiment position it well amid a weak global growth scenario. Foreign portfolio flows, particularly through systematic investment plans (SIP), have helped stabilize markets. Furthermore, with FPI ownership of Indian equities currently at 17.6 per cent, below the ten-year average of 19 per cent, there's room for more foreign inflows.

Conclusion

In summary, global tensions exert a profound impact on the Indian stock market. From geopolitical conflicts to trade disputes and shifts in the US economy, these external factors shape investor sentiment and market performance. Despite the challenges they bring, they also present opportunities for savvy investors. Navigating through these complexities requires a deep understanding of global dynamics and their direct impact on the stock market. Investors are encouraged to have confidence in India's long-term story, despite potential bouts of volatility. Any market correction could present buying opportunities in Indian equities.Additionally, taking advantage of free demat and trading account services can facilitate investment in the Indian market.

Frequently Asked Questions

-

Which Global Markets Influence the Indian Market?

The Indian market is significantly influenced by the performance of the US market. For example, concerns about a potential recession in the US often lead to preparations for volatility in Indian markets. Additionally, the strength of the US dollar serves as a crucial global economic indicator with implications for Indian market trends.

-

What Global Markets Influence Bank Nifty?

Bank Nifty's performance is influenced by various global markets, with a significant dependency on the US financial markets. Movements in key US indices like the S&P 500 and Dow Jones Industrial Average can greatly impact Bank Nifty, reflecting broader trends in global financial markets. Additionally, changes in major economies such as those in Europe and Asia, along with shifts in global interest rates and monetary policies, also contribute to shaping the performance of Bank Nifty.

-

Which Indexes impact on the Indian Stock Market?

The Indian stock market is impacted by two prominent indexes: the Sensex and the Nifty.

-

What is the impact of the stock market on the Indian economy?

The stock market, particularly during bull markets when prices rise, boosts consumer and company confidence. This confidence leads to increased spending and investment, ultimately driving up the country's GDP. In short, a thriving stock market tends to correlate with a growing Indian economy.

-

Which Country's Stock Market Influences Nifty?

The Singapore Stock Exchange plays a significant role in India's stock market. The SGX Nifty helps predict and track the behavior of the Indian Nifty, making it an important indicator for the Indian stock market.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.