2024's Best Fintech Stocks to Invest In India

Overview

Fintech stocks represent firms within the financial technology sector. This sector focuses on leveraging technology to enhance and revolutionize financial services, disrupting traditional banking and finance practices. These companies integrate conventional financial operations with cutting-edge technologies such as AI, blockchain, data analytics, and mobile applications. Their objective is to enhance the efficiency, accessibility, and affordability of financial services.

India , emerging as the fastest-growing financial technology (FinTech) market globally, with its market size projected to uptrend from USD 50 billion in 2021 to an estimated USD 150 billion by 2025 and an impressive USD 2.1 trillion by 2030. This exponential growth is fuelled by the rapid adoption of digital financial services across the country, driven by factors such as increasing smartphone penetration, expanding internet connectivity, and government initiatives promoting digital payments and financial inclusion.

The FinTech sector encompasses various market segments, including Payments, Digital Lending, Wealth Technology, Insurance Technology, and more. Each segment presents unique opportunities for investors looking to capitalize on India's FinTech revolution. In this guide, we will explore some of the top FinTech stocks poised for growth in 2024, highlighting their key strengths and potential for investors.

Best Fintech Stocks to Invest In India Latest Updates 2024

Computer Age Management Services Limited (CAMS):

Leadership Changes: On December 16, 2024, Natarajan Srinivasan resigned as Director.

Financial Investment: On December 27, 2024, CAMS Financial Information Services Pvt. Ltd. announced plans to raise INR 80 million in funding from CAMS.

Central Depository Services (India) Limited:

Q3 FY2025 Results: Posted a 21.11% growth in net profit at Rs.130.10 crore and a 29.67% increase in sales to Rs.278.11 crore.

Intellect Design Arena Limited:

Strategic Partnerships: Formed partnerships with HCL Technologies and Wipro to accelerate financial services' digital transformation through the eMACH.ai platform.

eMACH.ai Launch in Sri Lanka: Launched eMACH.ai, with 329 microservices and more than 1,757 APIs, to transform Sri Lanka's banking sector.

Bengaluru Office: Launched a new office for eMACH.ai.

Indian Bank Deal: Signed a five-year agreement worth Rs.80 crore to deploy eMACH.ai-powered Cash Management System.

Infibeam Avenues Ltd.:

Grew globally by taking a 20% stake in US-based XDuce.

Entered into a Rs.2,000 crore MoU with Gujarat Government to create an AI Hub.

Acquired a 49% stake in Pirimid Fintech and majority stake in Rediff.com.

KFin Technologies Ltd.:

Posted a 45.5% jump in net profit at Rs.89.32 crore for the September 2024 quarter.

Financial Technology Industry Landscape

India stands as the second-largest nation in terms of financial technology deal volume, capturing a 14% share of international investments. In 2022, Indian financial technology startup companies secured the second-highest funding globally, raising approximately USD 5.65 billion.

The digital lending segment in India witnessed remarkable growth, reaching USD 270 billion in 2022 and surging to USD 350 billion in 2023. India currently holds the second position in the Asia Pacific region and ranks third globally in terms of the largest insurance market.

Key Statistics:

-

The number of digital transactions in FY 2022-23 totalled 13 crores.

-

Digital payment transactions through the Unified Payments Interface (UPI) amounted to Rs. 139 lakh crores in FY 2022-23.

-

A total of 17 Fintech Unicorns emerged in FY 2022-23.

-

Fintech funding in India amounted to USD 34 billion between 2014 and 2022.

-

Since its inception in 2016, UPI transactions have surpassed 10 billion.

-

The highest-ever UPI transaction volume was recorded at 12.2 billion in January 2024.

-

In 2022, digital payments saw a substantial increase, with transactions and value rising by 76% and 91%, respectively.

Forecast of Indian Financial Technology Market

The Indian financial technology industry's major segments are projected to achieve the following milestones by 2030:

-

The Payments segment is expected to reach a transaction volume of USD 100 trillion and generate USD 50 billion in revenue.

-

The Insurance Technology segment is forecasted to grow to USD 88.4 billion, establishing itself as the fastest-growing insurance market worldwide.

-

The Wealth Technology segment is anticipated to reach USD 237 billion by 2030.

Top 5 Fintech Stock to Invest in 2024

|

Fintech Shares |

Market Capitalization |

Fintech share price India |

Price to Book Ratio |

Dividend Yield % |

|

Rs. 15310 crores |

Rs.3110.60 |

19.23 |

1.64% |

|

|

Rs. 20984 crores |

Rs. 2008.10 |

16.27 |

0.950% |

|

|

Rs. 13630 crores |

Rs. 996.40 |

6.58 |

0.220% |

|

|

Rs. 9890 crores |

Rs. 35.50 |

3.06 |

0.140% |

|

|

Rs. 10685 crores |

Rs. 625.35 |

12.01 |

0% |

Computer Age Management Services Ltd.

Computer Age Management Services Limited share price has increased by 2.14 % today. This fintech stocks in India has delivered a 1-year return of 43.95%. The traded share volume of fintech stocks in India was 1.3 million. The EPS value of the stock in the recent quarter was Rs. 18. The price to book ratio suggests that stock is overpriced. The book value of the stock has increased drastically in the past three years. The fintech stocks in India has declared a dividend of Rs.37.8 for FY 2023.

The corporate earnings have provided excessive returns . During the last twelve months, RoE has reported to be 41.77%. and Net margin was 30.20%. The overall profit of the company has been in uptrend in the last five quarters.

There is a steady increase in the overall sales in the last three years. The fintech stocks in India have good stability with the company paying its debt for the last three years and will be debt free in future.

The MACD signal indicates bullish crossover. The technical indicators signal neutral and waiting for a new trend to emerge. The SMA and EMA levels are exhibiting strong bullish signals.

Central Depository Services (India) Ltd.

Central Depository Services Limited share price has increased by 6.70 % today. This fintech stocks in India has delivered a 1-year return of 101.40%. The traded share volume of fintech stocks in India was 8.1 million. The EPS value of the stock on YoY basis is 11.32%. The price to book ratio suggests that stock is overpriced. The book value of the stock has increased drastically in the past three years. The fintech stocks in India has declared a dividend of Rs.16 for FY 2023.

The corporate earnings have provided excessive returns . During the last twelve months, RoE has reported to be 29.71%. and excellent Net margin was 49.49%. The RoE, RoA, RoCE are in uptrend in the last three years.

There is a steady increase in the overall sales in the last three years. The fintech stocks in India have reported a stable cash ratio of 3.26.

The MACD signal indicates that strong bullish crossover. The technical indicators signal mild bearish to neutral and indicating for overbought level . The SMA and EMA levels are exhibiting strong bullish signals.

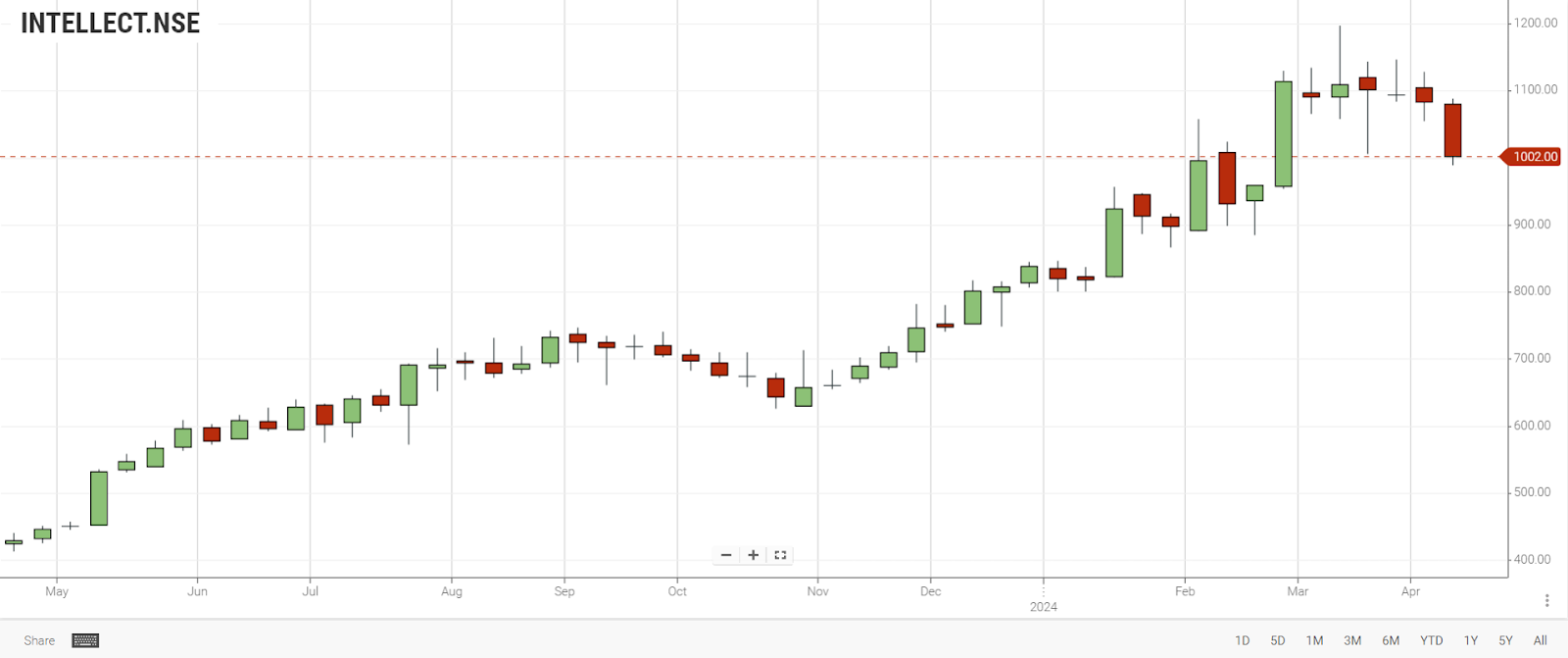

Intellect Design Arena Ltd.

Intellect Design Arena Limited share price has decreased by 1.10 % today. This fintech stocks in India has delivered a 1-year return of 129.34%. The traded share volume of fintech stocks in India was 0.7 million. The EPS value of the stock is in uptrend on a QoQ basis. The price to book ratio suggests that stock is highly overpriced. The book value of the stock has increased drastically in the past three years. The fintech stocks in India has declared a dividend of Rs.2.5 for FY 2023.

The fintech stocks in India has reported strong returns with RoCE of 12.98, RoE of 16.25% and Net Margin of 13.1% . There is an overwhelming increase in the total sales in the last three years. But the fintech share has less liquidity.

The MACD signal indicates bullish positive line crossover. The technical indicators signal mild bearish to mild bullish and indicate for overbought level but do not possess enough downward momentum. The SMA and EMA levels are exhibiting strong bearish signals.

Infibeam Avenues Ltd.

Infibeam Avenues Limited share price has decreased by 1.96 % today. This fintech stocks in India has delivered a 1-year return of 154.26%. The traded share volume of fintech stocks in India was 27.9 million. The EPS value of the stock is in uptrend on YoY basis. The price to book ratio of 64.37 suggests that stock is overpriced. The fintech stocks in India has declared a dividend of Rs.0 for FY 2023.

The fintech stocks in India have reported poor returns with RoE and RoA in downtrend in the last three years. But the fintech stocks in India have reported an uptrend in net profits and EBITDA.

There is an overwhelming increase in the total sales in the last three years. But the fintech share has less liquidity.

The MACD signal indicates a bearish crossover. The SMA and EMA levels are exhibiting bearish signals.

KFin Technologies Ltd.

KFIN Technologies Limited share price has decreased by 0.94% today. This fintech stocks in India has delivered a 1-year return of 115.29%. The traded share volume of fintech stocks in India was 0.2 million. The price to book ratio of 11.90 suggests that stock is overpriced. The fintech stocks in India has declared a dividend of Rs.0 for FY 2023.

The fintech stocks in India have reported excess return over corporate earnings. Over the last one year, the company has reported strong returns with RoE of 25.65%. The fintech stocks in India have reported increased profits on QoQ basis. There is an overwhelming increase in the total sales in the last three years. The fintech stocks in India has reduced its debt burden

The MACD signal indicates bullish crossover. The SMA and EMA levels are exhibiting strong bearish signals.

Key Considerations Before Investing in Fintech Stocks

-

Regulatory Compliance: Fintech companies must adhere to stringent regulations set by government bodies such as SEBI and NSE. It's essential to ensure that the company complies with these regulations to avoid potential setbacks.

-

Historical Performance Analysis: Evaluate how the company has performed in various market conditions and economic climates. Understanding the factors that have influenced its revenue and the risks it has faced can provide valuable insights.

-

Financial Stability Assessment: Assess the financial health of the company by analyzing metrics such as revenue growth, profit margins, and return on equity. This can help you gauge the company's ability to weather financial challenges.

-

Market Trend Monitoring: Keep an eye on market trends that may impact fintech stocks. Compare the company's performance with its competitors to identify growth opportunities and potential risks.

-

Management Evaluation: Evaluate the management team's experience, strategic vision, and risk management strategies. A competent management team is crucial for navigating the complexities of the fintech industry and driving growth.

Conclusion

Fintech investments in India can be a rewarding opportunity, given the country's rapid growth in the financial technology sector. Avail the best trading app India for beginners from Enrich Money to invest in the best fintech stocks in India . With the market size projected to reach USD 150 billion by 2025 and USD 2.1 trillion by 2030, there is significant potential for growth. However, it is crucial for investors to conduct thorough research and due diligence before making investment decisions. Understanding the regulatory environment, analyzing historical performance, assessing financial health, monitoring market trends, and evaluating the management team are key factors to consider. By carefully considering these aspects, investors can navigate the dynamic fintech landscape and identify promising investment opportunities in 2024.

Frequently Asked Questions

What Are The best FinTech Companies in India on NSE in 2024?

Best Fintech stocks #1: Computer Age Management Services Ltd.

Best Fintech stocks #2: Central Depository Services (India) Ltd.

Best Fintech stocks #3: Intellect Design Arena Ltd.

Best Fintech stocks #4: Infibeam Avenues Ltd.

Best Fintech stocks #5: KFin Technologies Ltd.

How should one determine the value of fintech shares?

When investing in stocks, it's crucial to analyze a company's financial data to assess its true value. A simpler approach involves examining financial ratios such as the price-to-earnings ratio and price-to-book value ratio to gauge a company's performance.

How can I track the financial technology stock price in India?

You can track the stock price of financial technology (fintech) companies in India by using stock market apps like Orca or visit Enrich Money.

What are the potential risks of investing in fintech stocks?

Investing in fintech stocks carries several risks, including regulatory risks (changes in regulations impacting the company's operations), competitive risks (increased competition leading to loss of market share), technological risks (disruption due to new technologies), and market risks (volatility in stock prices). It's important for investors to carefully assess these risks before investing in fintech stocks.

What factors can impact the stock price of fintech companies?

The stock price of fintech companies can be influenced by various factors, including market trends, financial performance, regulatory changes, competition, and broader economic conditions. Additionally, company-specific news, such as product launches, partnerships, or acquisitions, can also impact stock prices.

Related Stocks

HDFC Asset Management Company Ltd.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.