Analysis of Budget 2024-2025: Key Implications and Strategic Insights

On 23rd July,2024, Union Finance Minister of India , Mrs. Nirmala Sitharaman presented the Indian Union Budget for the financial year 2024 -2025. In this union budget, several strategic initiatives have been introduced with the objective of enhancing economic growth, employment opportunities, and ensuring sustainable development. This union budget is announced with the ambition of ‘Viksit Bharat’ a roadmap towards ‘Developed India '.The budget is focussed on four major castes namely , The poor, the woman, the youth and the farmers. The union budget is framed with four major themes namely, employment, skilling, MSME and middle class. Let’s analyse the key features of this union budget 2024-25 and its potential implications.

Agricultural Initiatives

Transforming Agricultural Research

The budget stresses on a complete review and research on agriculture in order to improve its productivity and develop a wide variety of climate resistant crops.

National Cooperation Policy

The budget will be introducing a national cooperation policy to improve , systemize and develop the cooperative sector.

Atmanirbharta for Oil Seeds

The budget focuses on domestic production of oilseeds like mustard, groundnut, sesame, soybean, and sunflower . India’s objective is to reduce the nations dependency on imports of oilseeds and work on self-reliability of oil seed production.

Vegetable Production and Supply Chain

The budget aims to promote Farmer Producer Organizations (FPOs), cooperatives and start ups which work on the collection, storage and marketing of vegetables through its supply chain management.

Release of New Varieties

The Indian government has planned to introduce 109 varieties of climate resistant , high yielding crops and 32 varieties of field and horticulture crops.

Implications

These agricultural initiatives aim to increase high yielding of crops which are climate resistant. Also, to streamline the supply chain of vegetables to help small scale farmers, increase domestic oilseed production. Introduce new crop varieties to help farmers and for the purpose of food security.

Employment Initiatives

Analysis of PM’s Scheme on Employment Linked Incentive Package

Scheme A: Support for New Entrants

This scheme provides one month wage subsidy of up to Rs.15000 in three installments for new entrants in all formal sectors. It is forecasted that around 210 lakh youths will benefit through this scheme.

Scheme B: Job Creation in Manufacturing

This scheme offers incentives for EPFO contributing first time employees in manufacturing sector. Through this scheme both the employer and employee will benefit through EPFO contribution over first four years. It is forecasted that this scheme will benefit around 30 lakh new employees in manufacturing sector.

Scheme C: First Time Employees

Through this scheme, the EPFO contributions of first-time employees will be reimbursed up to Rs.3000 per month for two years . It is forecasted that this scheme will create around 50 lakh new jobs .

Scheme D: Skilling Programme

Under this scheme, over 20 lakh youth will be trained over a period of five years. Over 1000 industrial training institutes will be established.

Other Employment Initiatives

Government will launch new hostels and creches to support women workforces.

Loans will be sanctioned for up to Rs. 7.5 lakhs with government guarantee for students which is expected to benefit around 25000 students.

For student education loans for domestic higher education institutions for up to Rs. 10 lakhs will be available as direct e Vouchers , which would benefit around 1 lakh students at 3% annual interest subvention.

Implications

These schemes would eventually reduce unemployment of the youth community and improve the job market. However, the success of the scheme depends upon its effective implementation in formal and manufacturing sectors and its monitoring.

While the other employment initiatives, will increase women participation and retention in jobs . The loan initiatives will increase the number of students to join higher education. The skill trading program will enhance the skills of the youths in the country.

Inclusive Human Resource Development and Social Justice

Economic Opportunities in Eastern States

Purvodaya: Vikas Bhi Virasat Bhi

This plan aims to generate opportunities in states of Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh to increase their developments.

Industrial Development

The government has planned for an industrial node at Gaya within the Amritsar-Kolkata Industrial Corridor at a budget of Rs. 3 lakh crores.

Support for Women and Girls

For women and girls-oriented schemes, the government has allocated more than Rs. 3 lakh crores.

Tribal Community Development

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

The scheme aims at improving the socio-economic conditions of the tribal community which is expected to benefit around 5 crore tribal peoples.

Expansion of Financial Services

India Post Payment Bank Branches

India will launch more than 100 branches in the northeast region for Indian Post Payment Bank.

Infrastructure and Irrigation Projects

Andhra Pradesh Reorganization Act

The Central government will provide financial support of Rs.15000 crore to Andhra Pradesh to complete its Polavaram Irrigation Project and Kopparthy node on the Visakhapatnam-Chennai Industrial Corridor and the Orvakal node on the Hyderabad-Bengaluru Industrial Corridor.

Implications

The above initiatives will improve the economic conditions of eastern India, Andhra Pradesh, women and tribal communities.

Manufacturing & Services

For MSME’s

The government has enhanced a new model for assessment under the credit guarantee scheme. The mudra loan limit has increased to. Rs.20 lakhs for the ‘Tarun’ category. Also, the government will support MSME units for food irradiation and safety testing.

Infrastructure Development:

The budget has proposed to set up 12 new parks under the National Industrial Corridor Development Programme and also to facilitate dormitory-style accommodation for industrial workers through PPP mode.

Critical Minerals Mission:

The government will aim to produce critical minerals within the country and also to recycle them.

Insolvency Resolution:

The budget proposed to improve and establish additional tribunals to pass resolutions regarding insolvency quickly.

Internship Opportunities:

The government will make initiatives to provide Internships for 1 crore youth in 500 top companies over 5 years with allowances and CSR funding.

Implications

The government initiatives will improve MSMEs, boost infrastructure and also improve company readiness among youth to stabilize the economy.

4. Urban Development

Stamp Duty:

Stamp duties for property purchased by women will be reduced.

Street Markets:

Increase the weekly street foods hubs to 100 in selected cities.

Transit Oriented Development (TOD):

Improve connectivity and reduce congestion in selected 14 large cities with its population more than 30 lakh by implementing TOD plans.

Water Management:

In selected 100 large cities, projects related to water supply, sewage treatment, and solid waste management will be promoted.

Housing Needs:

Implement PM Awas Yojana Urban 2.0 ( at an investment of Rs.10 lakh crore provide housing for urban poor and middle class)

Implications

These initiatives will promote gender equality , enhance street markets and TOP plans in large cities. Investments in water management and housing will improve the livelihood of urban and middle-class people.

Energy Security

Nuclear Energy:

Establish small reactors under PPP. Enhance R&D in small reactors and nuclear technology to improve energy security

Energy Audit:

The plan is to provide financial assistance to micro and small industries to transform into clean energy sources. Launch 60 – 100 clusters for energy audits.

Pumped Storage Policy:

Facilitate electricity storage and integrate renewable energy sources to ensure a constant energy supply.

AUSC Thermal Power Plants:

NTPC and BHEL will enter into a joint venture to establish a 800 MW commercial plant .

PM Surya Ghar Muft Bijli Yojana:

This scheme will provide free electricity up to 300 units per month to 1 crore houses.

Implications

The energy security initiatives by the government will improve energy production through nuclear energy sources and saving of electricity through storage solutions. The new proposed AUSC power plant will increase electricity production. The Free electricity scheme will reduce the energy costs of houses with access to energy.

Infrastructure

Infrastructure Development:

The budget has allocated around Rs.11 lakh crore for infrastructure projects. It has also allocated Rs.1.5 lakh crore to states for interest free loans.

PMGSY Phase IV:

Set up of Phase IV of PMGSY to ensure all-weather connectivity to 25,000 rural habitations.

Irrigation and Flood Mitigation:

Allocated Rs. 11,500 crores for Kosi-Mechi intra-state link and other schemes. Financial assistance for Himachal Pradesh, and flood management support for Assam, Sikkim, and Uttarakhand.

Tourism Development:

Development of Vishnupad and Mahabodhi Temple Corridors, development of Rajgir and Nalanda and Odisha.

Implications

The substantial infrastructure funding will improve connectivity and resource allocation. Enhanced irrigation and flood management will address regional challenges and support resilience. Tourism initiatives will boost cultural and heritage sites, driving economic growth and enhancing national tourism appeal. These measures collectively aim to promote balanced regional development and economic prosperity.

Innovation, Research & Development

The budget has proposed ‘Anusandhan National Research Fund’ for scientific research by funding Rs.1 lakh crore . For space research, the government has set up a joint venture fund of Rs.1000 crore .

Implications

Enhance private sector innovation and growth of space research.

Next Generation Reforms

-

Introduction to Bhu-Aadhaar number for lands. Survey of map subdivisions, linking of land records with farmers registries. Digitization of all land records through GIS and cadastral mapping and also to establish land registry system

-

Allocate funds for climate adaptation and mitigation

-

Streamline FDI process and promote the use of Indian Rupee as currency for overseas investments.

-

NPS Vatsalya scheme for minors through fund contribution by parents and guardians.

-

Enhanced data governance and management.

-

Enhancement of New Pension Scheme (NPS):

Implications

The above next generation reforms will digitize land management and streamline FDIs. NPS Vatsalya and NPS will improve financial security. Data governance will help in decision making.

Tax Proposals

Major Changes in Custom Duty

-

Exempted three more cancer medicines – affordable medicines

-

Decreased the Basic Customs Duty (BCD) to 15% for mobile phones, PCBA based mobiles and chargers – beneficial for mobile industry

-

Decreased custom duty on gold and silver to 6% and platinum to 6.4% - beneficial for the jewellery industry.

-

Decreased BCD for shrimp and fish foods to 5% - improves global competition in marine industry.

-

Exempted solar cells and panels related to capital goods – beneficial for solar energy transition.

-

Full exemption on 25 critical minerals – beneficial for strategic sectors.

Direct Tax Proposals

The Indian government’s main objective is to reduce the compliance burden, enhance entrepreneurial spirit and provide relief from tax to Indian citizens.

Rationalization of Capital Gain

-

Short-term Gains on financial assets will be taxed at the rate of 20%.

-

The objective is to create a uniform taxation structure , simplifying the taxation on short term capital gains.

-

Long-term Gains on financial and non-financial assets will be taxed at a rate of 12.5%.

-

The objective is to encourage long term investments which will lead to a stable investment environment.

-

The Exemption Limit for capital gains on financial assets is increased to Rs.1.25 lakh per year.

-

The increase in exemption limit is an added tax relief for investors . Also, it will promote more savings and investment by investors.

Employment & Investment

-

Abolishment of Angel tax will encourage investors to invest in more startups which in turn encourage innovation and entrepreneurship.

Tourism

-

The tax levied on domestic cruise operations are simplified in order to boost the cruise tourism sector . This simplification will reduce the administrative, financial and operational burdens.

Foreign Mining

-

The harbour rates for foreign mining companies are reduced in order to make India an attractive destination for foreign mining investments.

Foreign Companies

-

The corporate tax rates for foreign companies have decreased to 35% from 40%. This reduction will attract more foreign investments .

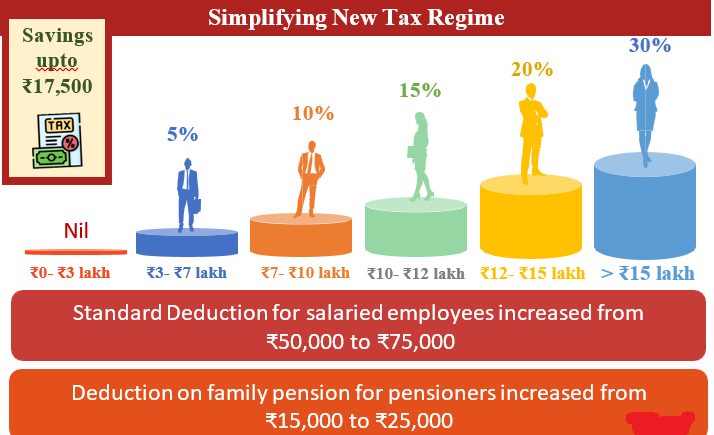

New Tax Regime

Source : (www.indiabudget.gov.in)

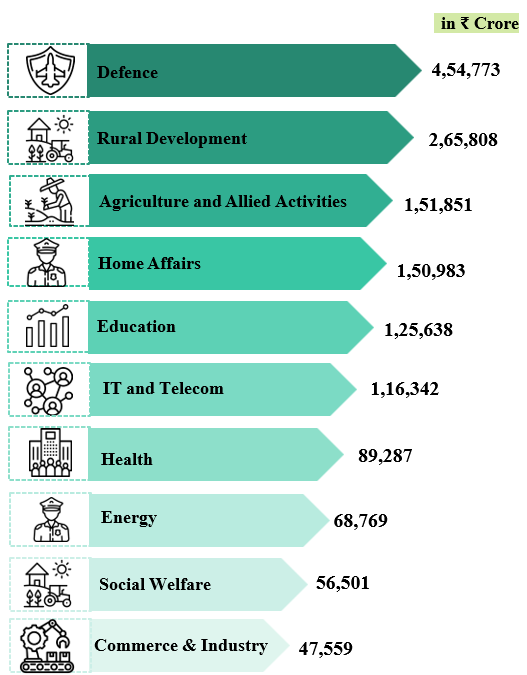

Major Expenditures of India

Source : (www.indiabudget.gov.in)

Effect on Stock Market

The union budget 2024-2025 focuses on employment of the youth, women empowerment, economic growth of the middle class and economic backward class , infrastructure and sustainable development. It is likely to have a mixed effect on the Indian stock market as the infrastructural focus is not uniform throughout India. The boost in the agricultural sector, MSME, infrastructure and energy will have positive impacts on stock markets . The measures to abolish angel tax and decrease in corporate tax will boost FDI and investments. Rationalization of capital gains may affect short term trading activities but encourage long term investments. Overall. The union budget aims to develop a stable and growing economy which helps India to achieve its aim of ‘Viksit Barath’, which potentially leads to increased investors confidence and market stability.

Frequently Asked Questions

What are the key focuses of the 2024-2025 Union Budget?

The budget emphasizes employment generation, women's empowerment, support for the middle class, and infrastructure development. It aims for economic growth and sustainable development with targeted initiatives for various sectors.

How will the budget affect the agricultural sector?

The budget introduces measures to enhance agricultural productivity through climate-resistant crop varieties and improved supply chains. It also focuses on reducing dependency on imported oilseeds by boosting domestic production.

What changes in tax policy are proposed in the budget?

The budget includes rationalization of capital gains tax, with short-term gains taxed at 20% and long-term gains at 12.5%. The abolition of angel tax and reduction in corporate tax rates are aimed at encouraging investment and entrepreneurship.

How will the budget impact employment opportunities?

The budget proposes various schemes to create jobs, including wage subsidies for new entrants and incentives for manufacturing sector employment. It also includes a skilling program and support for women in the workforce.

What are the implications of the budget for the stock market?

The budget's focus on infrastructure, MSME support, and energy sector developments is likely to positively impact the stock market. However, changes in capital gains tax and tax policies could influence trading patterns and investor confidence.

Disclaimer: This blog is dedicated exclusively for educational purposes. Please note that the securities and investments mentioned here are provided for informative purposes only and should not be construed as recommendations. Kindly ensure thorough research prior to making any investment decisions. Participation in the securities market carries inherent risks, and it's important to carefully review all associated documents before committing to investments. Please be aware that the attainment of investment objectives is not guaranteed. It's important to note that the past performance of securities and instruments does not reliably predict future performance.